Could We See $100 Oil In 2023?

Summary & Key Takeaways

The oil market looks to be taking a bullish turn.

Indicators of the physical market such as inventories and the futures term structure suggest the market is tight, while numerous supply and demand forecasts suggest deficits in the coming quarters.

These and other bullish factors at play could lead to a meaningful rally in oil throughout the second of the year.

Oil bulls rejoice

Goods things finally appear to be happening for energy bulls. After languishing in mediocrity over the first half of 2023, oil prices now appear to be recovering and could well be setting up for another leg higher. WTI has rallied to roughly $80/bbl in July after trading around the mid-to-high $60s for much of the year, undoing a lot of technical damage in the process.

As it stands, the fundamental outlook for the market appears quite constructive for the second half of 2023, and, should these bullish factors remain in place, a rally to $90/bbl or even as high as $100 is not out of the question.

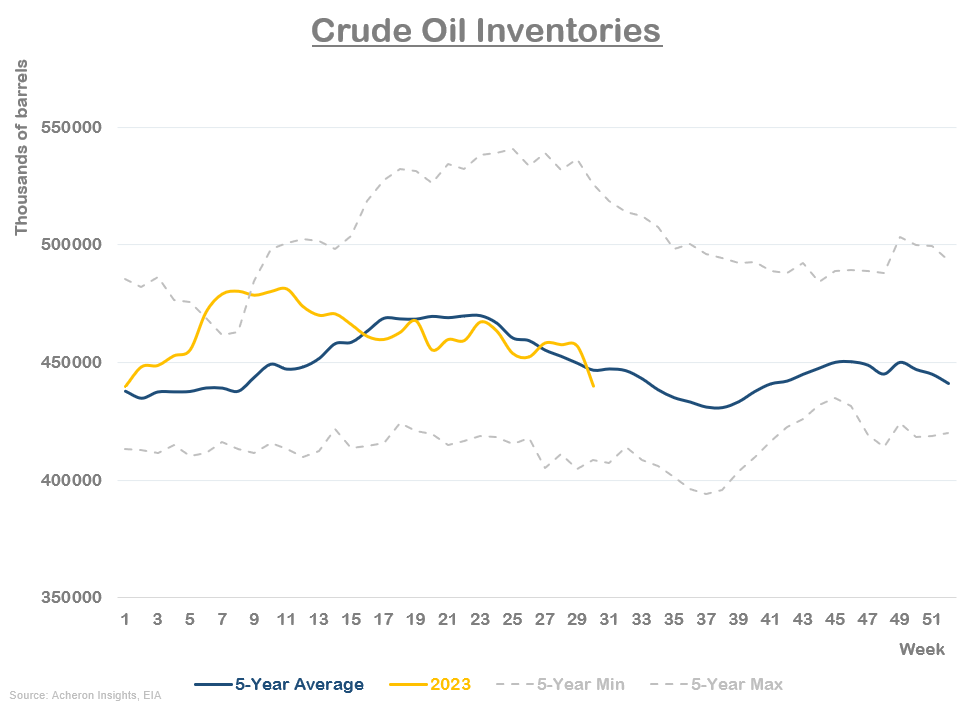

Inventories have turned bullish

Starting with the physical market, crude oil inventories have flirted with both builds and draws for much of the year - giving little fundamental signal in the process. But now, things could well be changing. After API’s reported inventory draw of 15.4 million barrels for the final week of July, the EIA has since confirmed this bullish outcome, with their estimates coming in at 17 million barrels, significantly outpacing estimates.

This was the largest weekly drawdown of US crude oil inventories since the data was first recorded in 1982. And, as we can see below, not only does this appear bullish on an absolute basis, but also on a seasonally adjusted basis.

For crude oil, analysing inventory changes and inventory levels provides a decent real time proxy for the supply and demand dynamics within the market. Should this record drawdown be a sign of things to come, this bullish turn in inventories should continue to support prices for the months ahead.

Term structure remains in backwardation

In similar fashion to changes in inventory levels, the shape of the crude oil futures curve provides valuable insight to the ongoings within the physical market.

Although the actual prices of the various futures contracts are themselves not useful predictors of future prices, the shape of the futures term structure does provide valuable information into the underlying fundamentals of the oil market, and is another excellent indicator of the status of the physical market. Generally:

Backwardation implies there is a supply deficit as market participants are willing to pay a premium for instant delivery, despite the associated delivery and storage costs. As a result, any deficit will need to be met via drawing down inventories.

Again, similar to inventories, the term structure has provided mixed signals for much of the year as it has flirted with backwardation and contango.

As it stands, the curve now resides in firm backwardation across the board, though not the same degree as was seen during 2021 and early 2022. Nonetheless, this remains a bullish outcome for now as the market looks to be becoming increasingly tighter as we enter the second half of 2023.

Prompt and longer-dated time spreads are also confirming this dynamic. Both are sitting firmly in backwardation and confirming the recent move higher in WTI.

Meanwhile, US crack spreads for refined products such as diesel, jet fuel and gasoline have all also moved higher in-line with the recent rally in crude, thus confirming the tightness in the market as indicated by the backwardated term structure. Crack spreads measure the difference between the price refiners purchase crude and the price they sell the various refined products

Short-squeeze underway

From a positioning perspective, everyone and their dog has been either short or bearish oil for quite some time now, so there has been (and remains still) plenty of scope for a sustained positioning driven squeeze higher.

Indeed, the managed money component of the futures market (i.e. hedge funds and CTAs), recently had their smallest exposure to oil in almost a decade as recently as early July. And, while their buying activity has fuelled much of the rally thus far, there remains plenty of scope for speculators to drive prices higher still.

Likewise, total speculative positioning as a percentage of open interest remains close to favourable contrarian levels despite the recent rally.

From surplus to deficit

In terms of the supply and demand outlook for oil, it appears we could see deficits return to the market throughout the second half of the year (if they are not already present). Though I view their forecasts with a grain of salt, the EIA’s projections suggest global demand will exceed production by 0.98 mm b/pd deficit in Q3 followed by an additional shortfall of 0.38 mm b/pd in Q4.

Similar projections are being made by commodity analysts at Standard Chartered, who predict “that a seasonal increase in demand combined with producer output restraint will create large supply deficits over the coming months”, suggesting a “supply deficit of 2.81 million barrels per day in August; 2.43 mm b/d in September and more than 2 mm b/d in November and December. The analysts have also projected that global inventories will fall by 310 thousand b/d by end-2023 and another 94 thousand b/d in the first quarter of 2024 thus keeping oil markets backwardated and pushing oil prices higher.” Likewise, the IEA have also recently revised upward their demand forecasts, and now predict a 1.7 mm b/d shortfall through 2H23.

While demand overall still lags its pre-COVID trend, it has recently hit an all-time high. As reported by Bloomberg’s Javier Blas, “expressed in barrels a day, the fresh record high in global oil consumption totals about 102.5 million, likely hit in the last few weeks in July and above the 102.3 million of August 2019.” Whether we like it or not, it continues to look increasingly apparent renewable energy sources such as wind and solar lack the efficacy, efficiency and base load capacity to replace fossil fuels, so it stands to reason peak oil demand is still likely decades away.

On the supply side, Saudi Arabia have confirmed they will extend voluntary production cuts through September, this puts the cumulative effects of Saudi’s total production cuts over the past year or so at around 3 mm b/d, meaning their overall production is now around 9 mm b/d, below their estimated maximum of 12 mm b/d. Meanwhile, Russia have also suggested they plan to cut exports by 300,000 b/d by next month, after already agreeing to reduce exports by 500,000 b/d in August.

It seems increasingly the case Saudi Arabia have now positioned themselves as the worlds swing producer of crude oil given the lack of investment in US shale of lat. This is likely a dynamic the Saudi’s will continue to leverage in the short-term, as they have hinted that current cuts could be extended or even deepened. While Saudi Arabia’s production cuts are largely responsible for the supply shortfall, we are likely to see throughout the second half of 2023, such supply shortages - coupled with reasonably strong demand - suggest the market will remain tight at least through the next quarter.

Market technicals

From a technical perspective, the picture has improved dramatically this past month. WTI looks to have broken out of tis downward ascending wedge pattern that has been slowly developing over the last year, whilst also breaking through key moving averages. As it stands, the ~$82 level looks to be key resistance for now, and whether or not we can break through this level will be very informative as to how sustainable any potential 2H23 rally can be.

From a seasonality perspective, the outlook remains favourable for the next quarter.

A cautiously bullish outlook

On the whole, the outlook for the oil market over the second half of 2023 looks quite bullish. Market technicals, trend and seasonality look to be taking a turn for the better, while fundamental indicators of the physical market such as the term structure, inventories and crack spreads also look to be learning toward the bullish side of the equation.

Ultimately, there appears plenty of scope for higher prices in the coming months. But, while I remain very bullish oil over the long-term and expect to see prices reach mid-triple digits at some point in the future, I am skeptical that this will occur in 2023.

Indeed, there is a number of factors at play which could put a ceiling on prices in the medium-term. For one, as discussed earlier, much of the supply shortages seen in the market today are a result of Saudi’s numerous production cuts. Should prices spike to the $90-$100/bbl level, it seems likely they will once again ramp up production to take advantage of these higher prices. What’s more, while Chinese oil consumption has disappointed this year, we have seen the Chinese work to significantly increase their commercial and strategic stockpiles in recent months, and history suggests they could release these barrels onto the market should prices rise sufficiently. And finally, while the economy remains robust for now, the outlook for economic growth continues to appear subpar, which may or may not impact demand in late 2023 to early 2024. Either way, the second half of the year looks to be an existing one for energy bulls.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.