Asset Allocation Outlook For 2023

Where should investors be looking for the year ahead?

With so much conjecture regarding whether we are heading into recession or whether the bottom for stocks is in, it is important every so often to take a step back and assess one’s exposure to the asset class universe. In this article I will attempt to present a broad guide for each major asset class - stocks, bonds, commodities and precious metals - and how investors should be looking to allocate to each over the next six to 12 months.

Stocks

As I have been pointing out for some time now, although I see reasons why the stock market could still move higher over the coming months, I find it difficult to justify buying into the broad equity markets with any kind of buy-and-hold approach over the next six to nine months.

Indeed, when assessing whether it may be an appropriate time to do exactly that, I try to view the outlook for the market through the lens of a number of differing market drivers. These include market internals (which incorporate things like trend, momentum, breadth, pro-cyclical leadership and the movements of high yield spreads and credit), positioning and sentiment, financial and monetary conditions, as well as leading indicators of the business and liquidity cycles, among others. When all are broadly signalling neutral to positive readings, history suggests being long equities and risk assets over a six to 12 month time frame generally pays. As has been the case since late 2021, my leading indicator dashboard has been suggesting an underweight exposure to equities, with the liquidity and growth cycles as well as financial and monetary conditions remaining material headwinds for stocks at present. On the other hand, sentiment and positioning have been flirting with neutral to positive readings for most of the past six months, and remain so today.

Another input I use in determining my asset allocation to equities is a simple growth matrix; comparing where we are currently in the business cycle - using the ISM Manufacturing PMI as a proxy - to where the cycle is heading. Again, history suggests the best times to be overweight the broad stock market and risk assets alike is when growth has bottomed and is accelerating. Unfortunately, the leading indicators of growth do not suggest the PMI is likely to bottom until at least the second half of 2023.

Have markets priced this in? Perhaps. But that is not a bet I am willing to make at this stage. I would rather invest with the growth and liquidity cycles and tailwinds, not headwinds.

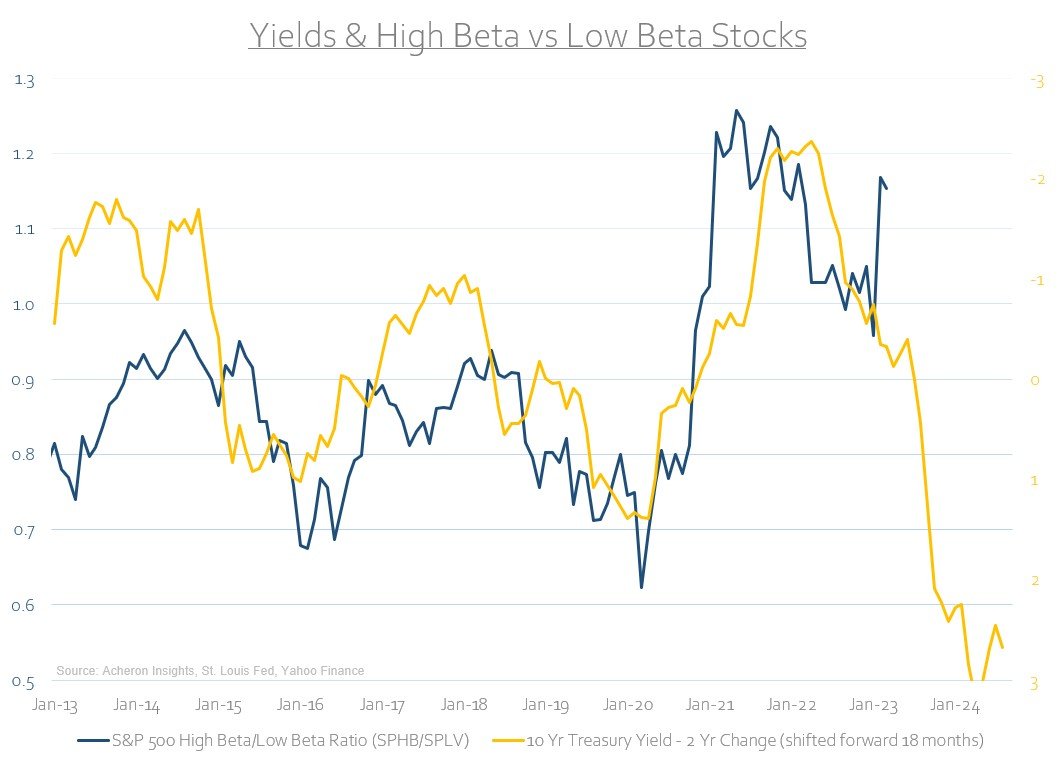

What is clear however, is when yields are where they are currently the nature of market leadership and performance is likely to be much different for the foreseeable future (think years). Remember, there is now an alternative to stocks. But more important, there is a vastly reduced need for institutions to reach down the risk curve for additional yield.

Pension funds and institutions don’t need the illiquidity premium or short-vol premium to meet their desired return targets when T-Bills and money market funds are offering in excess of 4.5%. It should thus not be surprising to see why higher yields have a material impact on the future performance of high-beta assets.

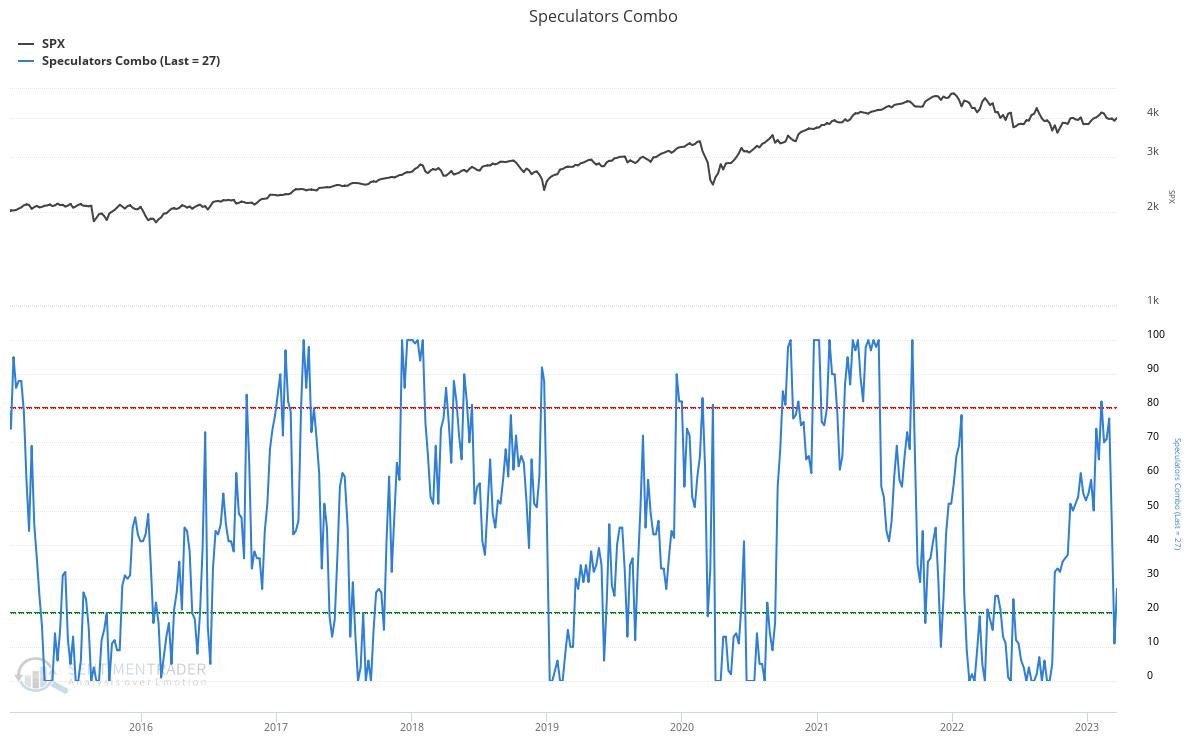

However, these dynamics bear little for the market direction over the short-term. In fact, my bias is still that stocks go higher before they go lower. Bearing primary responsibility for this thesis are the positioning dynamics within the stock market. Simply put, there remains too much bearishness. Nearly everyone and their dog is still largely short, particularly after the fear induced by SVB and Signature Bank in recent weeks.

Not only is this the case within the futures market per the above, but CTA’s (i.e. trend followers) as the most short stocks they have been in over half a decade according to Goldman Sachs. Meanwhile, my model that estimates vol targeting funds exposure (this model uses the greater of 30 day and 90 day realised volatility, and is based on a similar model developed my Nomura) suggests that although they have increased their long exposure materially over the past few months as realised volatility has come down , there remains plenty of scope for vol targeting funds - which control material flows - to increase equity exposure should stocks continue rally into mid-year and realised volatility subsequently fall.

Source: Goldman Sachs

So long as positioning is biased to the short-side the pain trade will be stocks higher, and doesn’t the market love to inflict maximum pain to the consensus. The fact that seasonality has turned incrementally positive for the next couple of months will only add fuel to the fire. And yes, seasonality does matter - even for stocks.

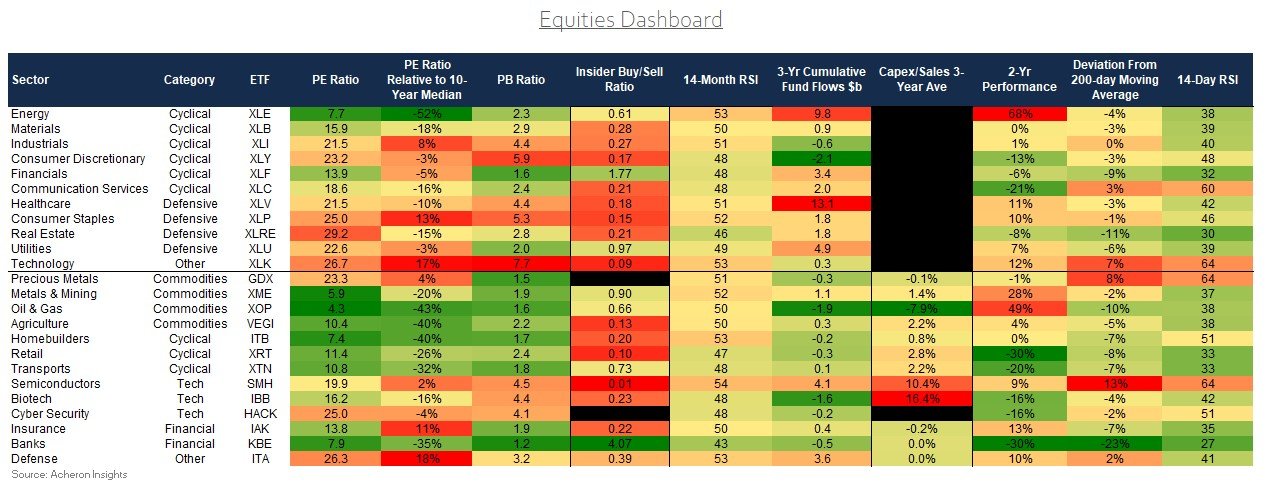

Putting my tactical and cyclical outlook for the broad stock indices aside, any good fundamental analyst will always argue there is some value to be had within the market. Indeed, for long-term investors looking for a place to park capital, there are a number of sectors within the stock market that are seemingly offering a favourable risk/reward.

For me, this remains the energy sector. Although the outlook for oil prices may only be so-so over the next few months, the value in energy related equities remains. They are cheap, nearing oversold territory and now have very little speculative positioning therein, while the long-term fundamentals for the sector (i.e. the capital cycle and structural supply constraints) remain positive. The fact corporate insiders are again slowly becoming net-buyers is a positive.

Fixed Interest

Regular readers of mine will be well aware I have been signalling the potential for a tactical opportunity to be long bonds for some time now. While short-duration fixed interest of any kind is perhaps the best investment out there at present, the opportunity to add duration risk is seemingly getting closer and closer by the day. While not a timing tool, my Fixed Interest Quadrant continues to flag an overweight position to duration is fundamentally sound.

Indeed, from a business cycle perspective, interest rates continue to look mispriced.

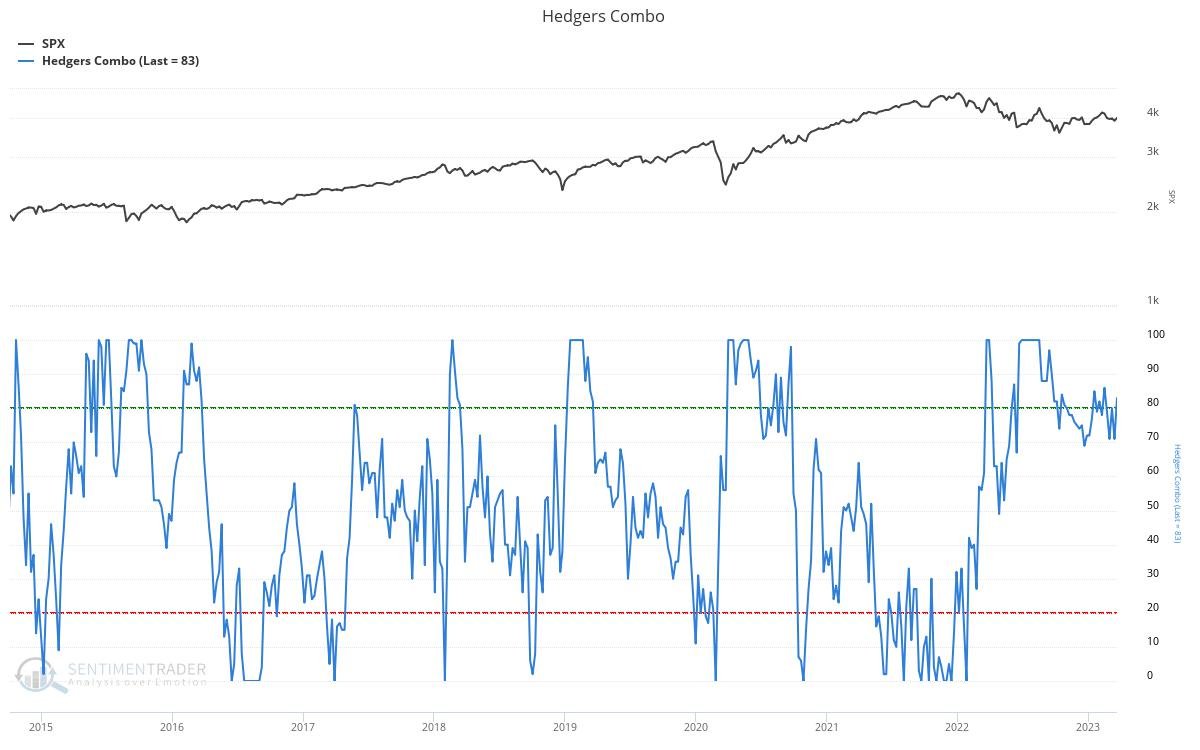

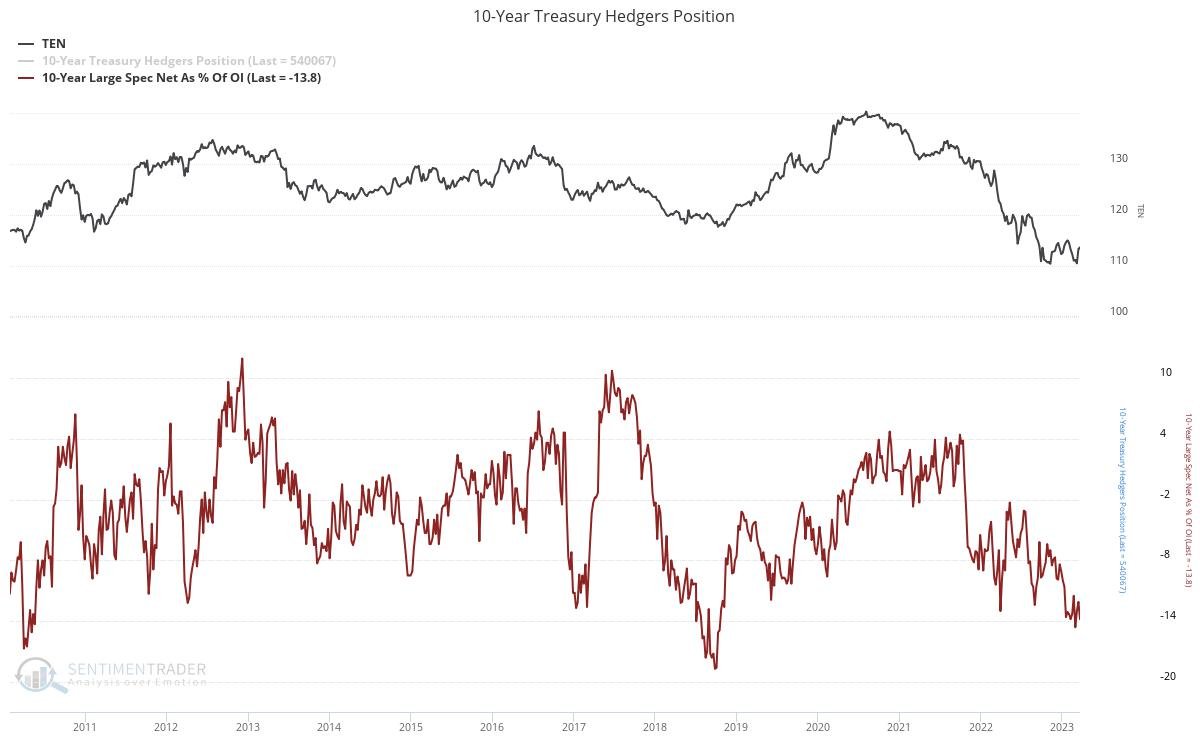

While positioning overall is mightily bearish. There is plenty of fuel for a move in bonds at some stage this year.

As the market and economy transitions from inflation risks to growth risks over the coming months, the fundamentals for the long-bond trade will only gain steam. However, we may not be there yet.

From a technical perspective, the 10-year Treasury yield is sitting at important support at the 3.4% level, which also coincides with the 200-day moving average. Given the importance of this level and that we have just triggered a daily DeMark 9 sequential buy signal, another bounce higher in yield may be on the cards before we move lower.

Seasonality seemingly confirms this notion, with the historical performance of long-term Treasuries during Q2 generally producing only so-so returns.

The catalyst of the move in bonds will of course be the stickiness of inflation, tightness in the labour market and robustness of growth over the next few months. I believe all will be heading lower at some point this year, but whether this is a Q2, Q3 or even Q4 even will likely determine the timeliness of any potential bond rally. There are of course plenty of structural headwinds for bonds, and we are likely only at the beginning of a secular bear market, these dynamics will likely limit the upside of any potential bond rally, at least relative to what we have become accustomed to in recent decades.

Regardless of the magnitude of any potential bond rally, it remains likely that bonds are set to outperform stocks for the year ahead.

One area of the fixed income market I am certain spells trouble is the credit markets. As we have seen with the banking stress over the past couple of weeks, the effects of tightening monetary and financial conditions are only beginning to be felt. The lags of monetary policy are long and variable, but they are seemingly now arriving. Credit spreads could blow out in 2023.

A potential deterioration of the credit cycle is a worrisome trend worth monitoring. Higher credit spreads equal higher volatility.

Commodities

Unlike stocks which have performed admirably over the past six months or so, commodities have continued to correct lower following the early 2022 peak. So much so, they are as a group looking to be nearing an attractive contrarian buying opportunity for long-term investors who believe in the real asset story.

Indeed, from a technical perspective, the Goldman Sachs Commodity Index has retracted to its long-term support area around $500-$550, which also coincides with the 200-week moving average for the index, while the magnitude of this correction looks to be nearing similar levels which have marked previous long-term bottoms.

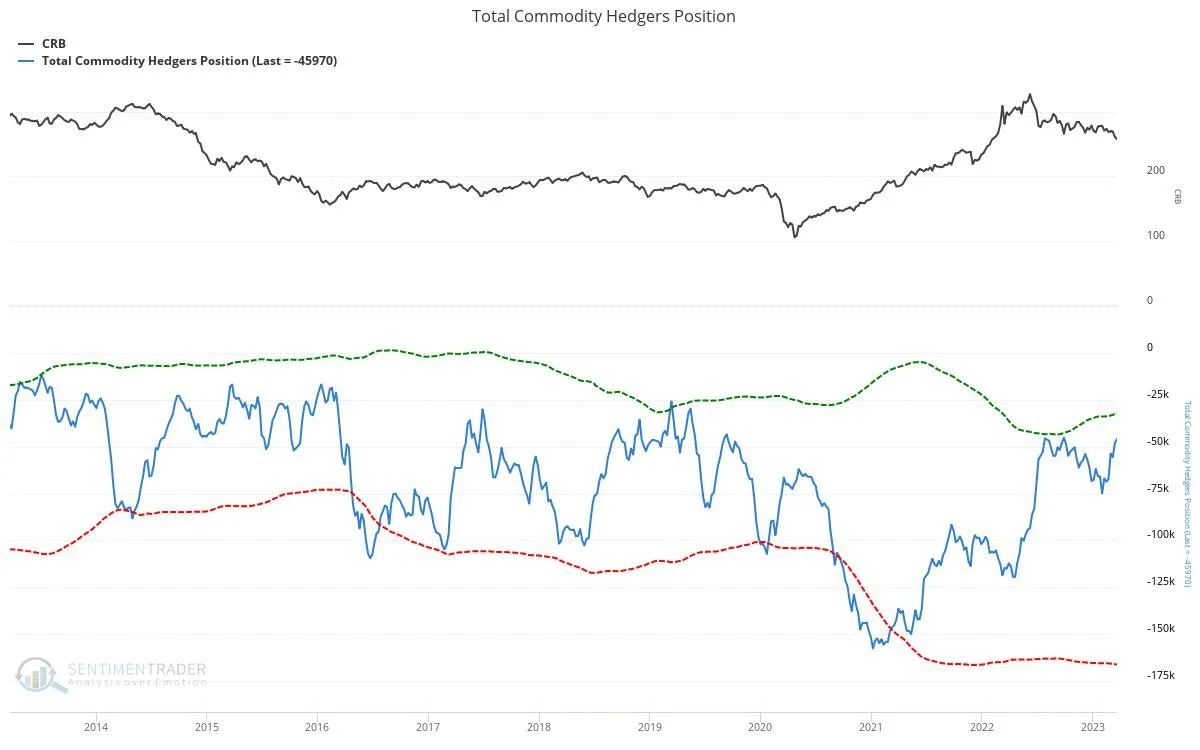

Meanwhile, overall positioning toward commodities is now reaching extreme bearish levels. As we can see below, the total commodity hedgers positioning (i.e. the smart money), is nearing its most bullish levels in half a decade.

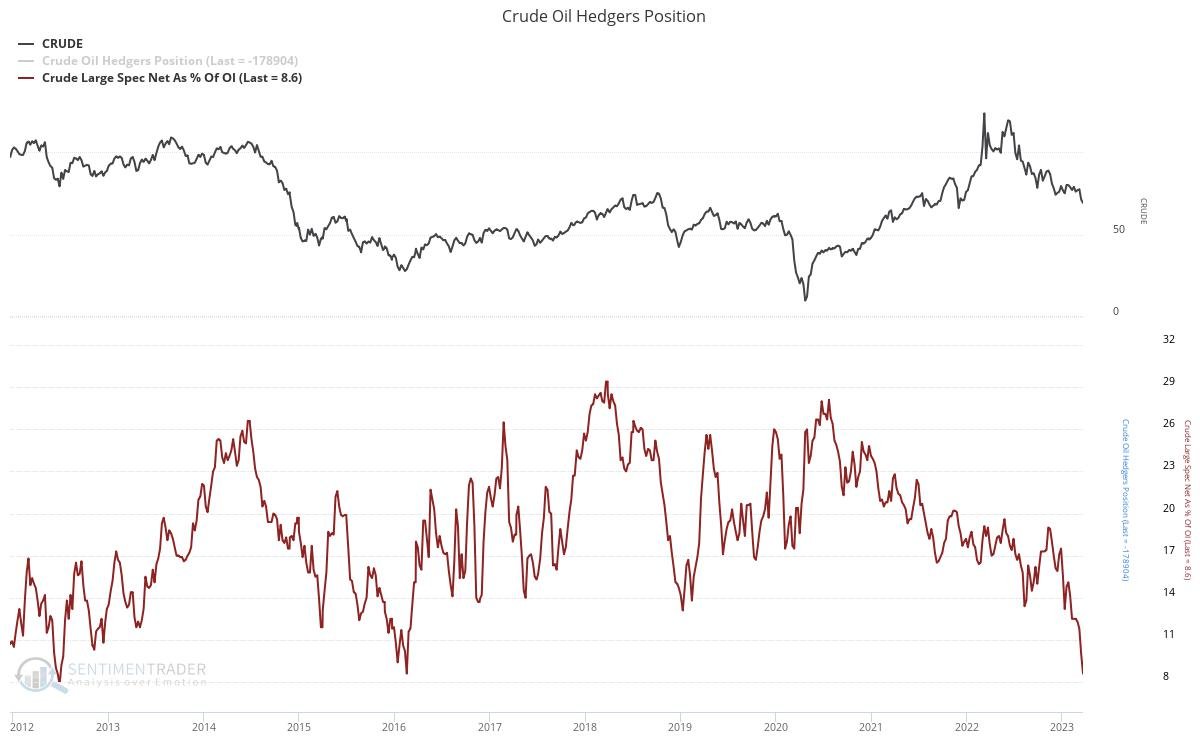

Nowhere is this more prevalent than in the energy space. Speculative positioning for crude oil is now firmly the most bearish since early 2016. Given the structural tailwinds in the sector and how this recent correction has largely been driven by the unwinding of speculative and leveraged long positions, there is now plenty of fuel to send oil prices - and thus energy related equities - much higher should the bull market resume. We may not be there yet, but the signs are slowly suggesting this is a market ready to explode to the upside in the not-too-distant future.

Digging deeper into the commodity complex, it is also seemingly apparent that various agricultural commodities may be reaching washout levels, with wheat being the most apparent.

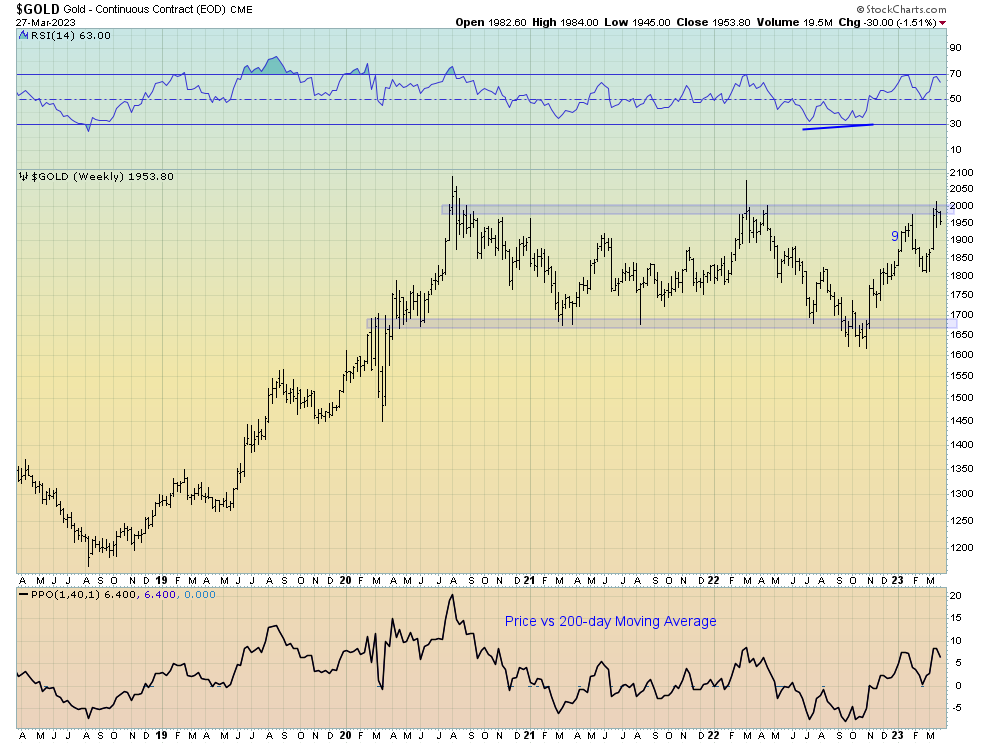

In terms of precious metals, they of course have been a major beneficiary of the banking crisis over recent weeks, as calls for an imminent dovish pivot in monetary policy have returned. Although I am bullish the sector, we may be reaching some kind of short-term top in precious metals. Not only has gold seemingly been rejected at the important $2,000 resistance level, but it is looking relatively overbought on a short-term basis. What’s more, I can’t help but think the Fed has one last hawkish surprise left in them before this hiking cycle is done and dusted.

Any meaningful correction in precious metals however would likely prove an excellent buying opportunity for long-term investors. Indeed, I do believe the next few years will see the outperformance of real assets relative to financial assets. Precious metals, energy and commodities should all benefit handsomely.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.