The Bull Case For Bonds Revisited

Summary & Key Takeaways

The leading indicators of growth and inflation both continue to suggest a bond rally is a distinct probability during 2023.

Sentiment and positioning are at levels indicative of excellent long-term contrarian buying opportunities.

Regardless of your secular outlook for interest rates, bonds look to be a far more compelling cyclical investment compared to stocks.

With a tight labour market, robust economy and China reopening all dynamics which may cause this business cycle to play out slower than expected, some patience is still warranted for those bullish bonds.

The fundamentals favour a cyclical rally in bonds

When assessing the forward-looking indicators of the growth and liquidity cycles, it is the bond market that appears most disconnected from where these leading indicators suggest we are heading. Though the factors driving yields higher over the past 18 months have been significant, we are slowly beginning to see signs of a more favourable environment for bonds as 2023 progresses. The bond trade continues to loom as a source of potential profits amid a market full of uncertainty.

Based on the business cycle alone (which is of course not the only factor that drives yields), one could surmise that long-term Treasury yields should fall at least two to three percentage points from current levels, such is their divergence from the indicators of the economic cycle.

And, given the outlook for the business cycle suggests a recession is on the cards for the second half of 2023, it seems likely yields will eventually follow growth lower, at least to some extent. Typical leading indicators of yields such as the diffusion index of various OECD Composite Leading Indicators (which measures the number of OECD countries with rising LEI’s) and the NAHB Housing Index are very much confirming this message.

As are a number of measures of market internals which tend to correlate well with yields. Firstly, the copper-to-gold ratio peaked in the latter stages of 2023 and seemingly suggests that yields may have overshot to the upside.

The same can be said of the relative performance of consumer discretionary stocks versus consumer staples stocks.

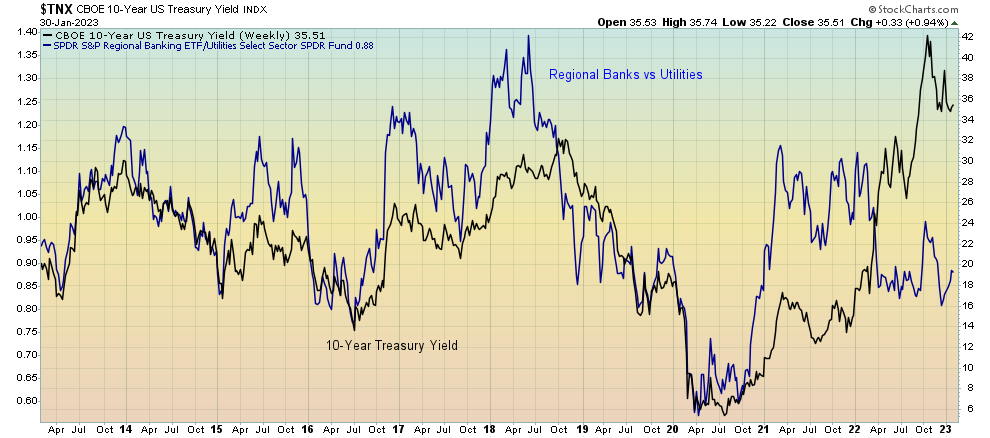

And the relative performance of regional banking stocks versus utility stocks.

Stan Druckenmiller calls the inside of the stock market one of the best macro indicators he has seen, so it is important to take into consideration what the market internals are signaling along with the macro-based leading indicators of the growth cycle.

However, it is worth commenting on the clear outperformance of the pro-cyclical areas of the market over the past month, which we can see in all of the above three measures of market internals. This is clearly indicative of the ‘transitory goldilocks’ dynamic which has gripped markets of late. As I discussed here, through the dynamics of a China reopening, waning inflation, tight labour market and strong services sector of the economy, economic growth has slowed in its deceleration of late, leading many market participants to re-enter the market on the basis that a recession may be avoided until the second half of the year. This is certainly an outcome that must be respected and will probably prove true, meaning there remains upside potential for yields in the short-term, despite the fundamental suggest yields should head lower at some point this year.

Yields nearly always fall during tightening cycles… eventually

My base case however is that yields have peaked for this cycle, particularly as we are nearing the latter stages of the Fed’s tightening agenda. While the prevailing wisdom is that QE and easy monetary policy push yields down while QT and rate hikes cause yields to rise, this is in fact not the case over the entire course of an easing and tightening cycle. History tells us that during periods of quantitative tightening, we actually see bond term premia fall, not rise. It is important to remember that on the whole, demand for safe assets such as Treasuries is more a function of the level of yields on offer, along with the perceived level of systemic risk and recession risk that is present. Should liquidity deteriorate sufficiently as part of the Fed’s QT program such that the potential for systemic risk becomes elevated, the demand by investors for safe assets such as Treasuries should rise. This results in lower term premia, with the opposite being true during periods of QE, as we can see below.

Remember, the Fed tends to end its hiking cycles as the raising of interest rates and reduction in liquidity is itself a conduit for systemic risk and in most cases, some form of market crash or economic deterioration, so, as we approach the latter stages of this tightening cycle, much of the damage to the economy will have already been done. Barring a soft landing, this should serve to be a catalyst for significant flows into safe haven assets such as bonds, particularly when inflation turns from headwind to tailwind.

Peak inflation is historically bullish for bonds

A clear tailwind for bonds at present is the direction of inflation, which is clearly decelerating and is likely to continue to do so throughout the year. With inflation having peaked for this cycle, history suggests this is a favourable environment for bonds, so long as growth and thus term premia are also falling.

Source: 3Fourteen Research

Indeed, from a growth and inflation perspective, we are nearing the stage where allocating to Treasuries seems the logical choice, particularly on the short-end of the curve.

Positioning is still extremely bearish

What remains particularly bullish for bonds over the next 12 or so months are the positioning dynamics, which remain at levels indicative of excellent contrarian buying opportunities. Across the entire curve, speculators in the futures market are the most short-bonds as they have been at any point in years, highlighted below for the 10-year and 30-year contracts. Clearly, should a bond rally indeed ensue, there is a significant amount short-covering to be had. A material deceleration in growth and inflation that is likely later in 2023 could be this catalyst.

Likewise, sentiment remains very depressed toward bonds. If we look at the ratio of open interest of puts relative to calls as a gauge of whether investors are positioned for downside protection versus upside opportunity, investors remain the most bearish toward long-term bonds since the early stages of the 2000s.

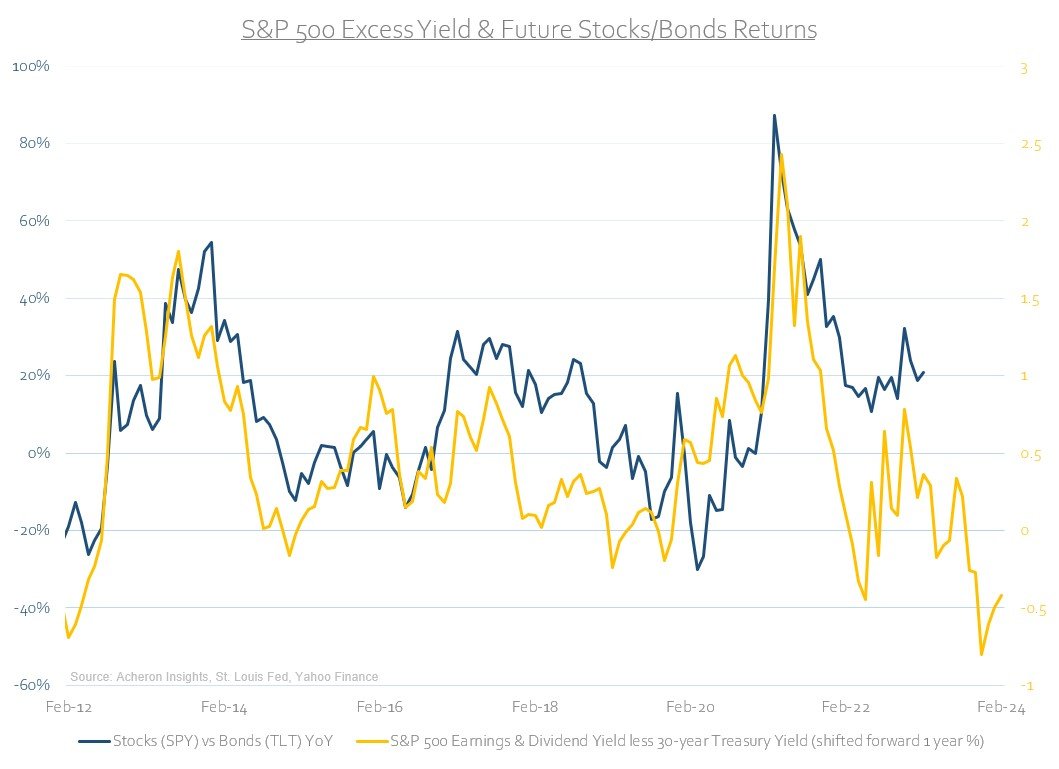

Bonds are poised to outperform stocks

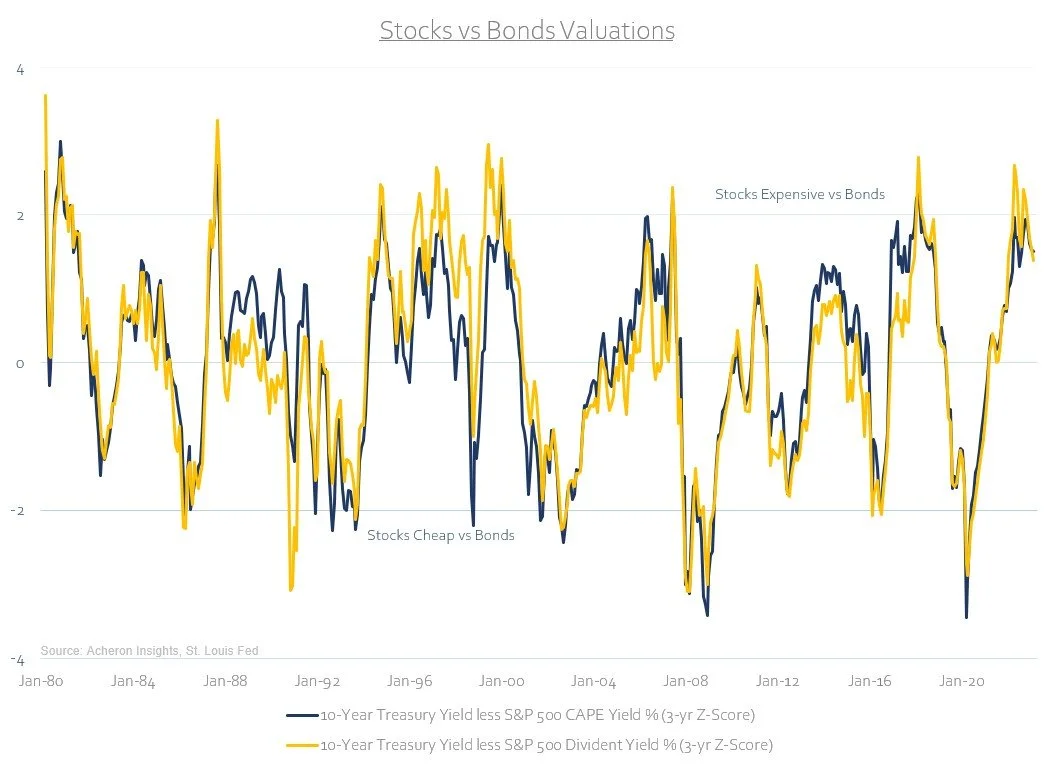

As I have opined recently, it is not just on an absolute basis that bonds seem attractive from a cyclical perspective, but also on a relative basis versus stocks. When we compare the relative yield on the 10-year Treasury Note to both the S&P 500’s dividend yield and cyclically-adjusted earnings yield on a 3-year Z-Score basis, stocks have reached overvalued territory versus bonds. The last two times these relative valuations measures reached such extremes were in 2007 and 2018, of which both times preceded a period of bond outperformance to the tune of 40-60% versus stocks.

Such valuation dispersions clearly tend to favour bond outperformance over the next year or so.

Whilst the same can be said of their relative performance based on the outlook for the business cycle.

The technical picture

From a technical perspective, the 10-year Treasury yield continues to flirt with the important support area of 3.4% while putting in a number of lower highs since the October peak. Whether we see a bounce in the coming months as part of the market pricing in ‘transitory goldilocks’ remains to be seen, but should we break below the 200-day moving average and lose the 3.4% area of support, that would seemingly be confirmation that the next leg lower in yields has begun.

In terms of bonds via the TLT ETF, the picture is of course very much the inverse of the above. A break above the 200-day moving average and out of the $107-$109 resistance area could see TLT move as high as $117 in short order. Until this happens however, the momentum is likely with the bears.

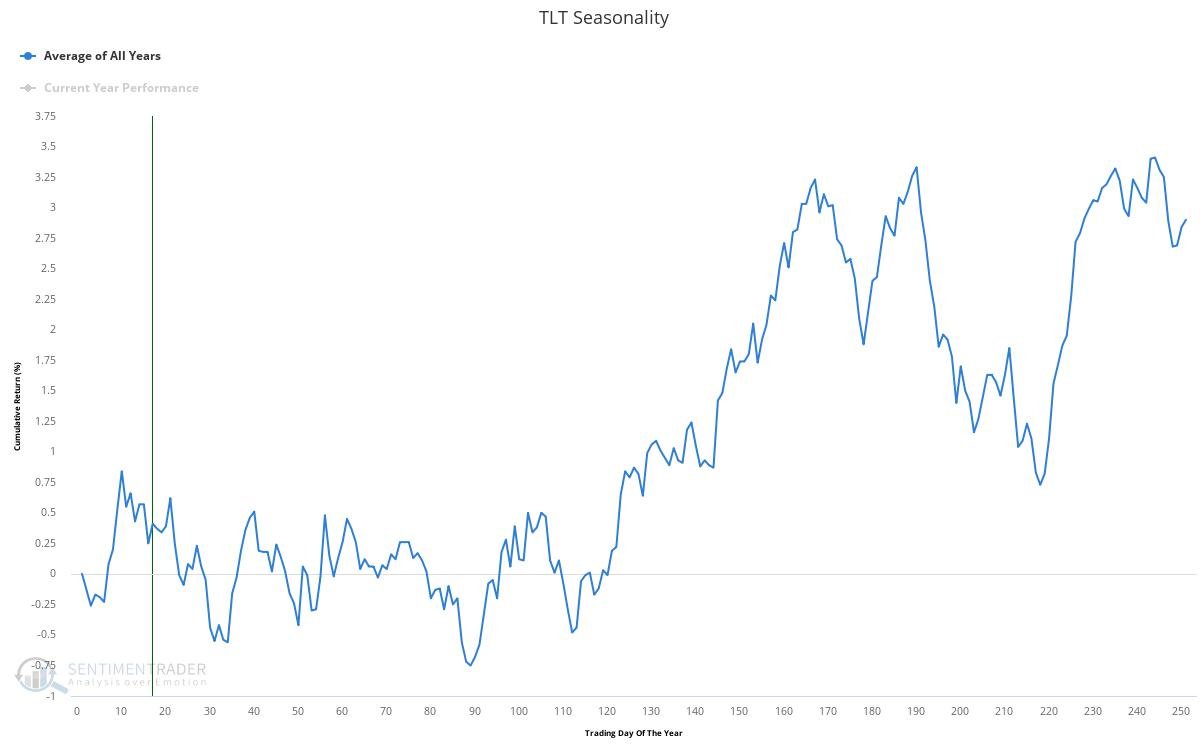

From a seasonality perspective, the outlook ties in nicely with my view that we may avoid recession until the second half of the year, with Q3 tending to be the best performing quarter for bonds. This suggests we may have further sideways action in both yields and bond prices over the next few months, or at least until the economy truly starts to slow as the leading indicators are suggesting.

For now, despite favourable fundamentals, it still appears too early to call an imminent rally in bonds. With a tight labour market, robust economy and China reopening all dynamics which may cause this business cycle to play out slower than expected, it appears as though some patience is still warranted for those bullish bonds.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated. .

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.