Further Upside For Stocks?

Summary & Key Takeaways

Driven by the China reopening, a strong services sector and consumer, a tight labour market, falling inflation and an economy more resilient than expected, the case for a continued rally for stocks is there.

These dynamics will likely keep a floor under economic growth for the next quarter or two.

Although the market is pricing in goldilocks, it is likely to be transitory. These bullish dynamics will likely absolve any chance of a dovish Fed pivot and ultimately give way to the impending economic slowdown.

Over the medium-term, the outlook for economic growth and risk-assets remains unfavourable.

The market is pricing in goldilocks, enjoy it while it lasts

A return of pro-cyclical leadership has been the main differentiating factor for this rally compared to the bear market rallies we have seen over the past year. Though the outlook for economic growth is poor and the economy does continue to slow, the market is taking these dynamics in stride and doing its utmost to price in a goldilocks regime. Thanks to the China reopening, resilient households, a robust services sector and tight labour market, we may be entering into a period where these bullish trends (or perhaps more accurately described as less bearish) help delay any recession until the second half of the year and put a floor under markets for the time being.

After a poor 2022 and the significant breadth of bearish positioning seen throughout, the markets are making the most of any goldilocks type data with the pro-cyclical areas of the stock market leading the way higher. Though not always correct, such measures of market internals are generally a good indicator of the health of the market and provide insight into future price action. As we can see below, investor risk appetites and the relative performance of the most cyclically sensitive stock market sectors are nearly all confirming the recent highs. This did not occur to such a degree during the July nor November rallies.

From a technical perspective, it is hard not to notice the changes in the underlying price action in recent months compared to the clear downtrend which has encompassed the past year. As discussed, the market is trying its hardest to rally in a sustainable manner, and for now, the pricing in of a China reopening and resilient economy has spurred an increased probability of a period of “transitory goldilocks”, of which nobody was positioned for, allowing the S&P 500 to go on to make a number higher lows since October. With a potential breakout of the downtrend line underway, 4,100 looms large as the next point of obvious overhead resistance, and seemingly an excellent area to reassess whether the market has overpriced these bullish developments.

With pro-cyclical leadership coming to the fore in recent weeks, we would expect to see small-caps and thus the Russell 2000 outperforming. This has certainly been the case through January, with the IWM ETF again testing an important overhead resistance level of around $187. A level which also coincidences with its recent downtrend line. If the breakout in momentum is any clue (as proxied via price vs. the 50-day moving average), then a bullish breakout is looming.

Also of note have been the number of bullish breadth-thrusts triggering during this rally. Admittedly, such measures have lost some of their efficacy in recent months as a number of false signals occurred during 2022, but alas, broad based breadth such as what we are seeing remain an important consideration as they signify healthy market internals. Most notably, the average of the 10 and 20-day number of up-versus-down stocks on the NYSE has triggered another bullish reading, as we can see below. The broad-based nature of this rally throughout the entirety of world’s various stock markets is also notable.

In terms of net liquidity, we may see continued short-term relief as the US Treasury moves to draw down their Treasury General Account, which the Treasury has signaled their intention to do so as the debt ceiling approaches. A reduction in the TGA would boost dollar liquidity as this would in effect be a transfer of reserves from the Fed’s balance sheet to bank balance sheets, temporarily offsetting Fed QT.

Source: Steno Research

What too could be viewed as bullish over the coming months is seasonality, with March and April in particular favourable months for stocks historically. However, when we view seasonality on a conditional basis through the lens of bear markets only, the appeal of seasonality becomes less enticing.

The bullish catalysts

A resilient consumer, a strong services sector, falling inflation, China stimulus and strong labour market are all material and impactful dynamics investors need to consider and understand when making their asset allocation decisions for the months ahead. Although the outlook for economic growth remains dreadful, these aforementioned dynamics have the potentially to continue to put a floor under growth for the next three to six months whilst also resulting in this cycle playing out slower than expected. Investors were not positioned for this outcome, and as we have seen, the market is beginning to only now price this in.

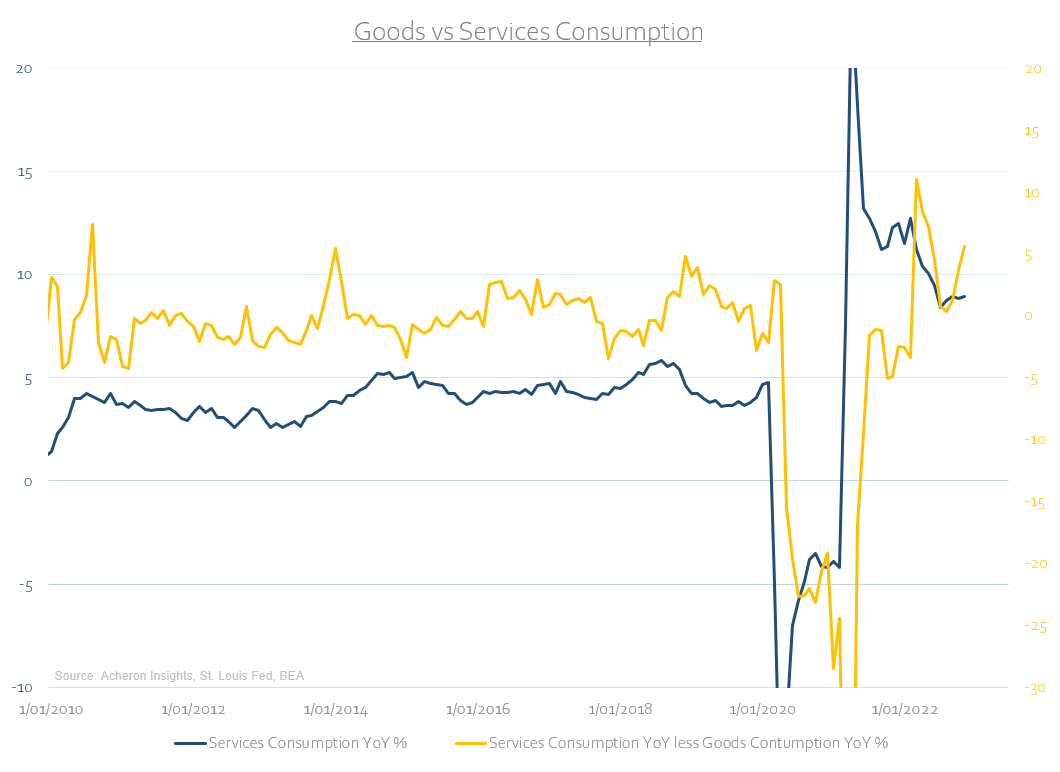

Nowhere is this economic resilience more notable than within the services side of the economy. Remember, the services sector is responsible for roughly 80% of all job creation and over 60% of GDP, compared to just 10% from the manufacturing sector. Yes, manufacturing is a large cyclical driver of the business cycle, but the services sector remains strong for now. Services related consumption is still growing materially above its pre-COVID trend and significantly outpacing the growth in goods consumption.

Most notably however is the China reopening and associated stimulus which will help support growth over the next quarter or two. The best measure of Chinese growth and liquidity is perhaps the China Credit Impulse, which measure the rate of change in credit creation within the economy. This metric tends to lead global growth, Chinese stocks as well as commodities by around six to 12 months. However, the magnitude of this Chinese growth impulse appears far smaller than what has occurred during recent cycles, at least for now.

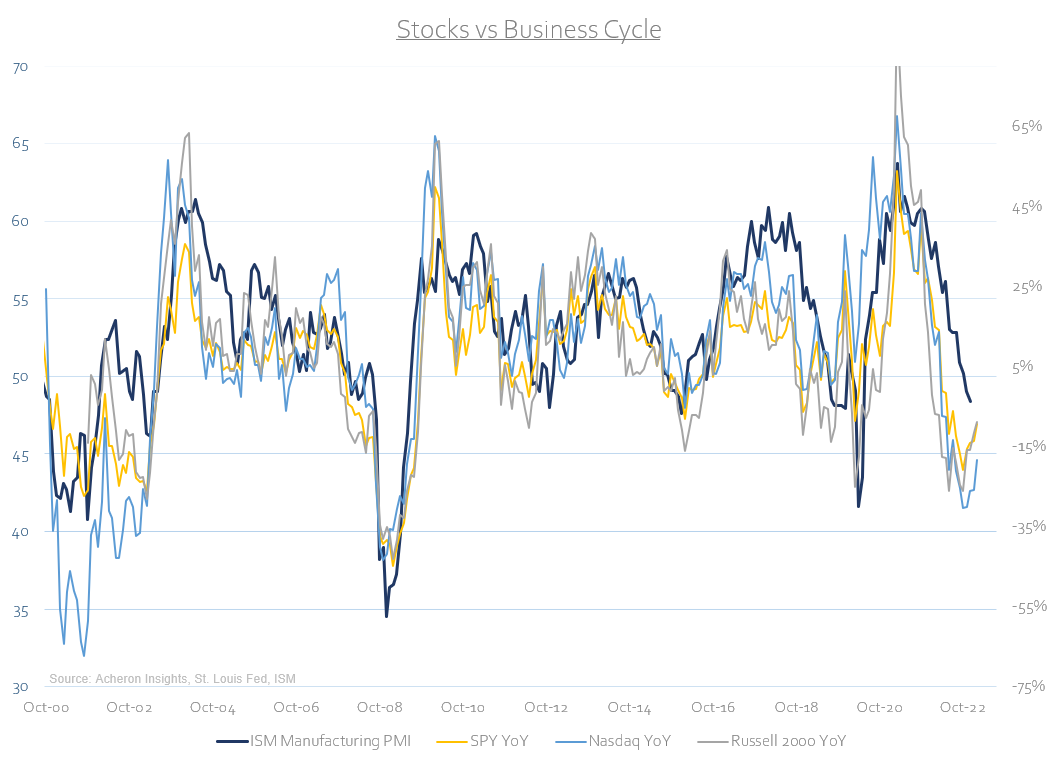

In terms of what the stock market is pricing in from a business cycle perspective, the broad indices continue to do a solid job in pricing in the cyclical slowdown. Stocks are pricing in a PMI of around 40-45, which is closer to where the leading indicators suggest the PMI may bottom during the latter stages of 2023.

Medium-term, the outlook for stocks remains poor

When making asset allocation decisions on a cyclical and medium-term basis, I try to always use a variety of different indicators to assess whether the market conditions favour risk taking. These signals range from measures of market internals, market excesses and speculative positioning, the business cycle, as well as the liquidity cycle and current monetary conditions. During difficult macro environments such as this, it pays to keep things simple. When we see these indicators turn neutral/favourable across the board, risk-seeking investment behaviour will likely be rewarded over the preceding six to 12 months, and vice versa. For now, while market internals have shifted bullish in recent weeks, it is important to remember the liquidity and business cycles in particular remain significant medium-term headwinds for now, regardless of how long the economy holds up or the China growth impulse lasts.

Indeed, until we see growth both bottom and accelerate, an underweight exposure to risk-assets on a medium-term basis remains prudent.

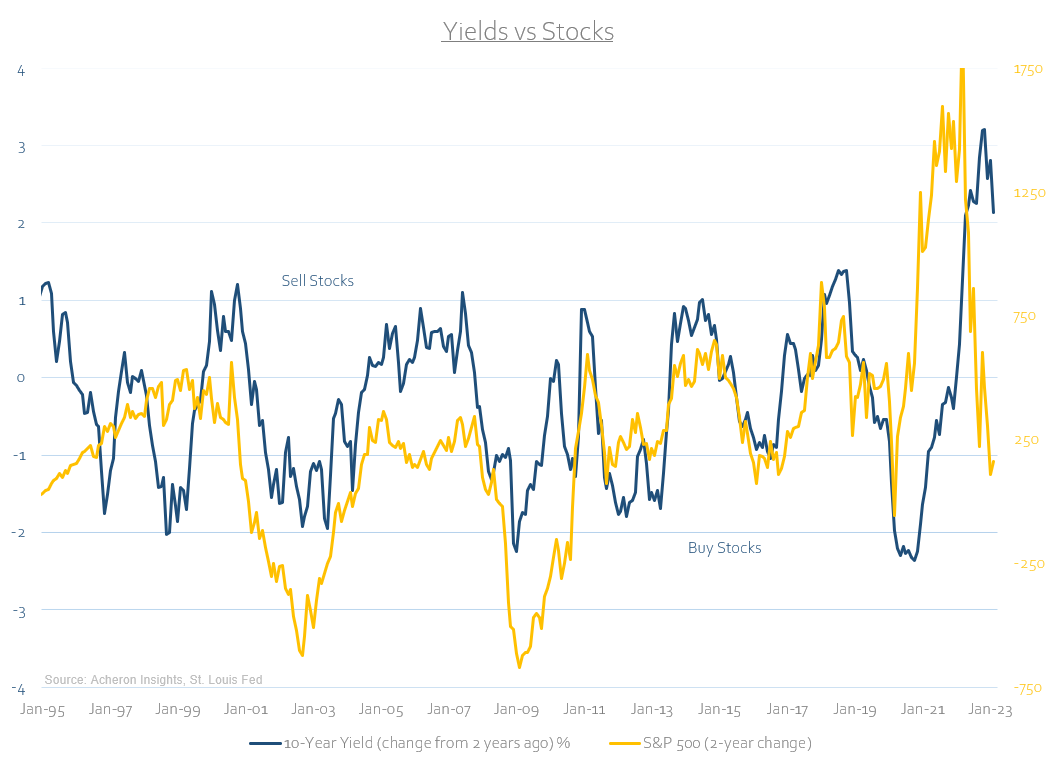

So long as yields remain elevated in both absolute terms and relative to recent history, the need for risk-taking is greatly reduced. This is true for both individual investors as well as institutions. This environment differs materially from what the entire investor landscape has become accustomed to during the era of easy monetary policy and will continue to be ever prescient in its influence over price action and market leadership. So long as monetary policy remains tight and appears set to remain tight for some time to come, investors can be paid to wait. This is an environment not suited to a simple buy-and-hold approach. Not only do higher yields beget lower stock prices, but, during periods where the real earnings yield for the S&P 500 is negative, stocks generally perform poorly.

Meanwhile, excess liquidity remains a headwind for stocks and should continue to be just that for the foreseeable future.

The same can be said of global central bank monetary policy conditions.

All of which will continue to suggest investors should be underweight high-beta risk assets.

What is most concerning is that if a recession does eventuate in the coming months, it has not been adequately priced in by a number of areas within the market. While the overall stock market indices have corrected in-line with the business cycle thus far, the same cannot be said of high-beta stocks or credit spreads. These areas of the market look particularly vulnerable, and whenever the slowdown does accelerate to the downside, a material re-pricing appears in order. Higher credit spreads do not bode well for volatility.

. . .

Thanks for reading!

If you enjoyed this article, would you be so kind as to share this around your network or to those who may be interested. Any and all exposure goes a long way to help promote Acheron Insights investment research and is very much appreciated. Thanks again.