Don’t Expect A Fed Pivot Just Yet

Rate cuts? Don’t hold your breath

Following this week’s banking crisis and the return of government bailouts, investors and traders alike are once again calling for a Fed pivot. While smooth market functioning and avoiding economic contagion are absolutely unspoken mandates of the Fed, for a true return of easy monetary policy the trends within the labour market, inflation and economic growth need to be supportive. As of now, they are not.

Inflation is stubbornly high

Whether we like it or not, stubborn inflation means higher rates for longer. Though we may be nearing a point where receding inflation momentum affords policy makers scope to cease hiking, the trends in inflation are not yet supportive of any kind of outright rate cuts by the Fed.

Obviously, inflation has peaked. However, although I expect it to continue to decelerate meaningfully this year, outside of headline inflation, the core and stickier measures remain persistently high for the time being.

In fact, if we delve into inflation momentum, both core CPI and services ex-shelter CPI have accelerated to the upside over the past two to three months. Likewise, the Fed’s preferred inflation gauge - the core personal consumption expenditure price index - has yet to show any real sign of downside momentum.

No wonder the effective Fed funds rate is now upward of 4.5%. Never has the Fed ended a tightening cycle when the Fed funds rate was below both headline CPI or core PCE. Right now, it is still below both. However, this will likely only be the case for another month or two, especially if we see a 25-bps hike next week.

Inflation is heading in the right direction and is coming ever closer to allowing a pause in this tightening cycle, but it is far from supportive of rate cuts. We are not there yet.

Unsurprisingly, the labour market is still hot

The other of the Fed’s explicit mandates is maximum employment. As it stands, the Fed has maximum employment, and some. Again, my leading indicators of both wages and employment suggest the labour market will cool later this year. But, as it stands, wage growth is still stubbornly high.

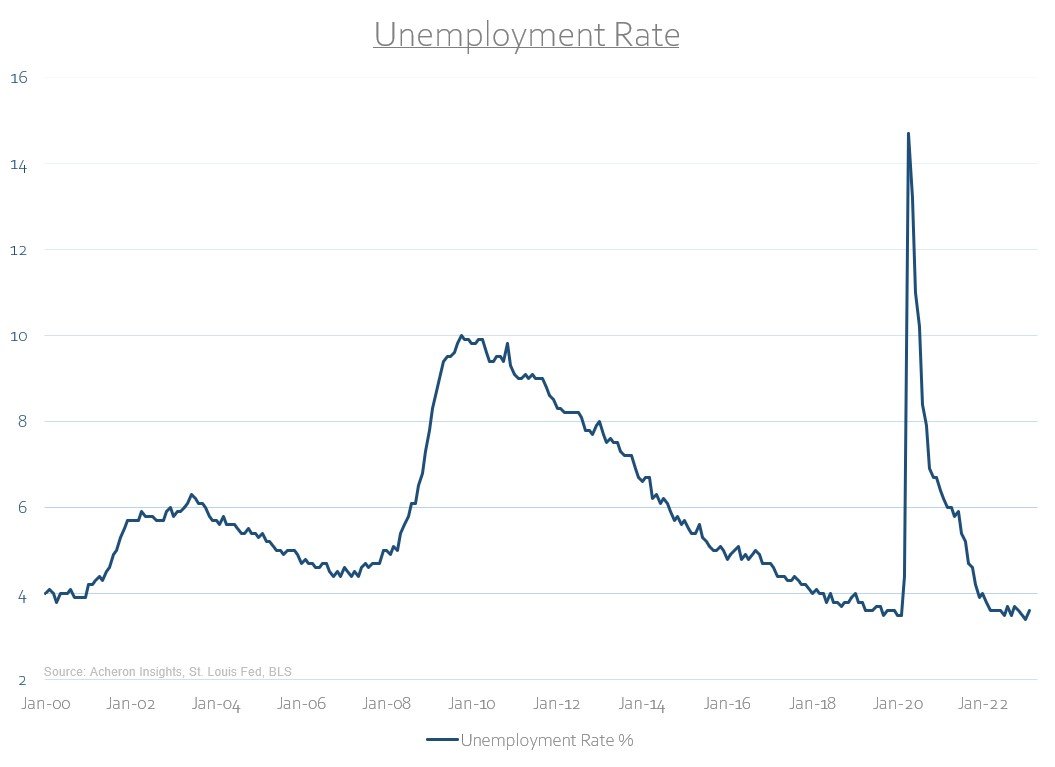

While unemployment remains near multi-decade lows.

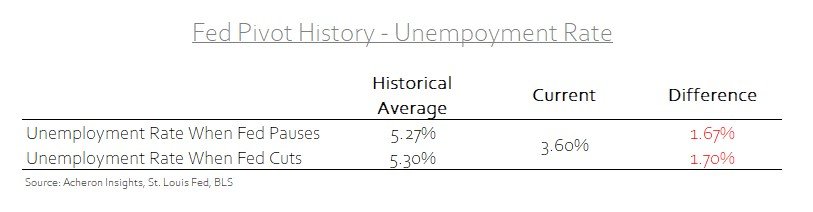

Comparing the current rate of unemployment to the historical averages when the Fed has either paused rate hikes or began rate cuts shows we are still around 1.6% to 1.7% below levels where we should expect dovish monetary policy. This does not mean the Fed cannot cease hiking, but it does not support that outcome.

Economic activity remains robust

As has been the case for some time now, the US economy continues to show resilience and robustness in the face of a vast array of bearish leading indicators. Although the general trend in coincident growth is drifting to the downside, particularly in the manufacturing sector (as we can see below via the rapid deterioration in industrial production), pockets of strength remain. Retail sales and real manufacturing and trade sales have picked up over the past few months, while real consumption and real personal incomes ex-government transfer payments are holding up.

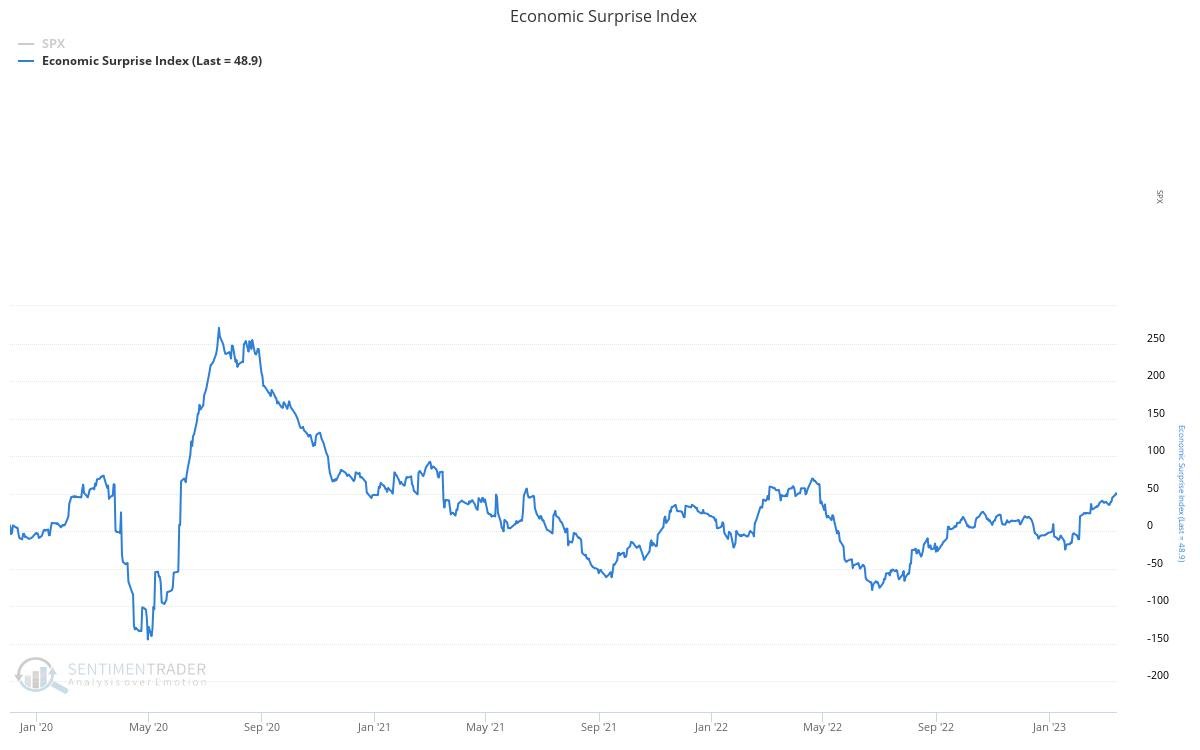

For the most part, economic data as a whole continues to surprise to the upside. The CitiBank Economic Surprise Index recently reached its highest levels in nearly 12 months. This is not the stuff rate cuts are made of.

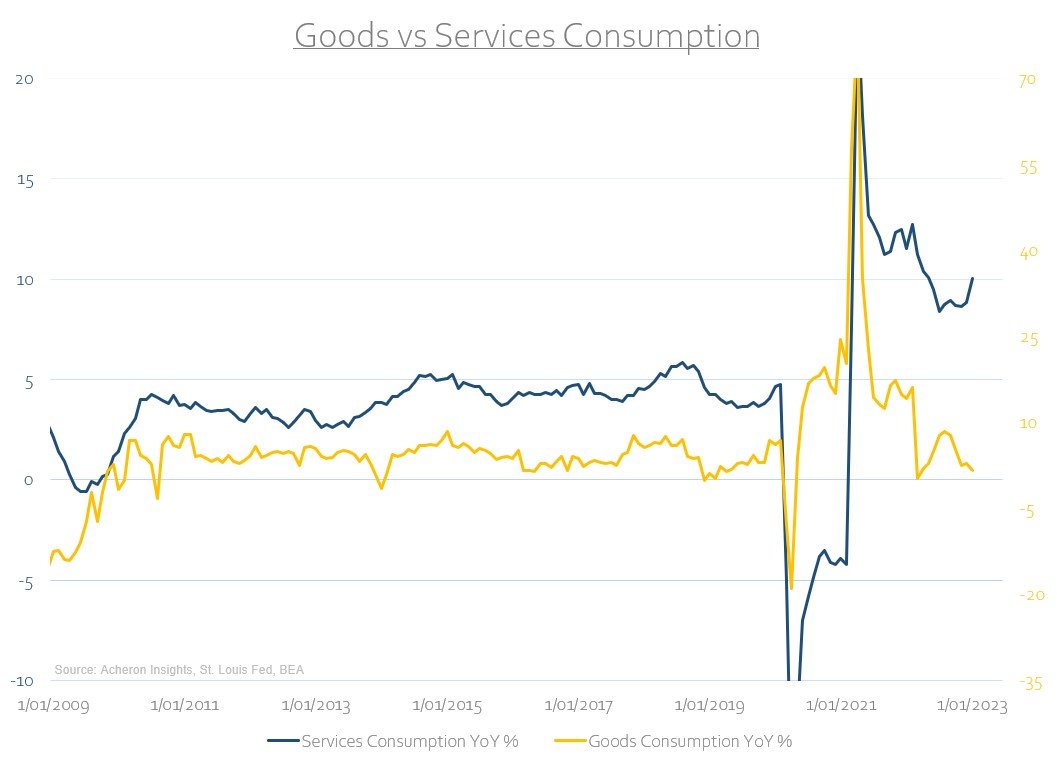

Much of this economic strength is being buoyed by the resilience in the services sector of the economy. Services consumption is still now growing at over 10% pa, while goods consumption seems to be rolling over. This is an important distinction to monitor as the US economy is largely a services-based economy, with the services sector being responsible for roughly 80% of all job creation and over 60% of GDP, compared to around 10-20% from the manufacturing sector. While the manufacturing sector is a large driver of the cyclicality of the business cycle, the dynamics within the services sector are what define the overall trend in economic activity. While not an explicit Fed mandate, resilience in the services sector and the economy as a whole is not really supportive of dovish monetary policy.

Financial instability

So then, what could cause the Fed to stop tightening monetary policy? A good old fashioned policy error. After four decades of easier and easier monetary policy, a reversal of this trend to such an extent was always going to break something.

Source: Bank Of America

Policy error and central banks go hand in hand. While economic growth is showing strength in the face of the largest tightening of financial conditions in decades (if ever), cracks are beginning to surface. Though Silicon Valley Bank and Signature Bank are likely outliers and are not representative of a systemic banking crisis, their demise is a cause for concern as it the tightening of monetary policy which ultimately tipped them over the edge.

The past 12 months have seen the swiftest decline in deposits at commercial banks in a long time.

Why? Because individuals and corporations can both receive a materially higher level of interest by moving their deposits from being an unsecured liability of a commercial bank, to a money market fund or a number of “risk-free” forms of short-term Treasury securities. An extra yield of ~4% on your idle cash is material.

Given deposits are liabilities of commercial banks, deposits leaving the banking system need to be met from the asset side of the banks’ balance sheet. For commercial banks, this largely consists of high-quality liquid assets (HQLA), which themselves are made up of securities such as Treasuries and mortgage backed securities, both of which have materially depreciated in value over the past year as yields have risen. So, for banks like SVB who did not properly hedge their assets for the scenario of rising interest rates and have thus been unable to fund their liabilities (deposits), such banks were always going to see issues arise should depositors move elsewhere.

What shouldn’t be a surprise is the Fed’s reaction to such a crisis. With scars from the GFC still raw, any signs of banking stress were always going to be met with immediate bailouts and both government and central bank support. The Fed does not want to be in a situation where they are required to respond dovishly to a financial contagion type event while trying to fight inflation. Unfortunately, this is exactly what they got. The Fed showed their hand.

For now, it is probably best to distinguish between the two. Unless this banking crisis evolves into something more systemic, if anything, the SVB bailouts may actually provide the Fed with scope to continue to keep monetary policy tight, just as we saw with the Bank of England following the LDI debacle in September last year (the BOE have since raised rates 175 bps).

Another area of concern worth noting in the financial stability spectrum is the rapid decline in central bank reserves seen as a result of the Fed’s QT program.

Why does the level of bank reserves within the commercial banking system matter? Well, bank reserves are effectively money for banks, and thus act as the lubricant of the financial system. Commercial banks use bank reserves to settle transactions with one another and engage in the repo or reverse repo funding, thus being an important form of liquidity required for smooth market functioning across the entire financial system. As reserves are drained via the Fed’s QT program, commercial banks will be stingier and more prudent with their actions, resulting in lower liquidity and increased market volatility. This is undoubtedly one of the reasons we are seeing bank lending standards rise to recession-type levels in recent months (a dynamic which does not bode well for the credit cycle).

In terms of specific levels to watch out for, liquidity experts Cross Border Capital have suggested the minimum level of reserves required within the system is around $2.6-2.7 trillion, while Fed official Christopher Waller has also recently suggested a minimum level of around $2.5 trillion. Given we currently sit around the $3 trillion level, we are approaching these levels whereby many financial plumbing experts much smarter than I suggest financial instability could ensue, putting a limit on how much further QT the Fed can undertake from here.

Policy makers are getting into a really tight spot where they need inflation, the labour market and economic weakness as cover to end their hiking cycle, given the damage this is causing in the banking sector. Unfortunately, none are overly supportive of easy monetary policy, as we have discussed.

So, how long until we see a Fed pause?

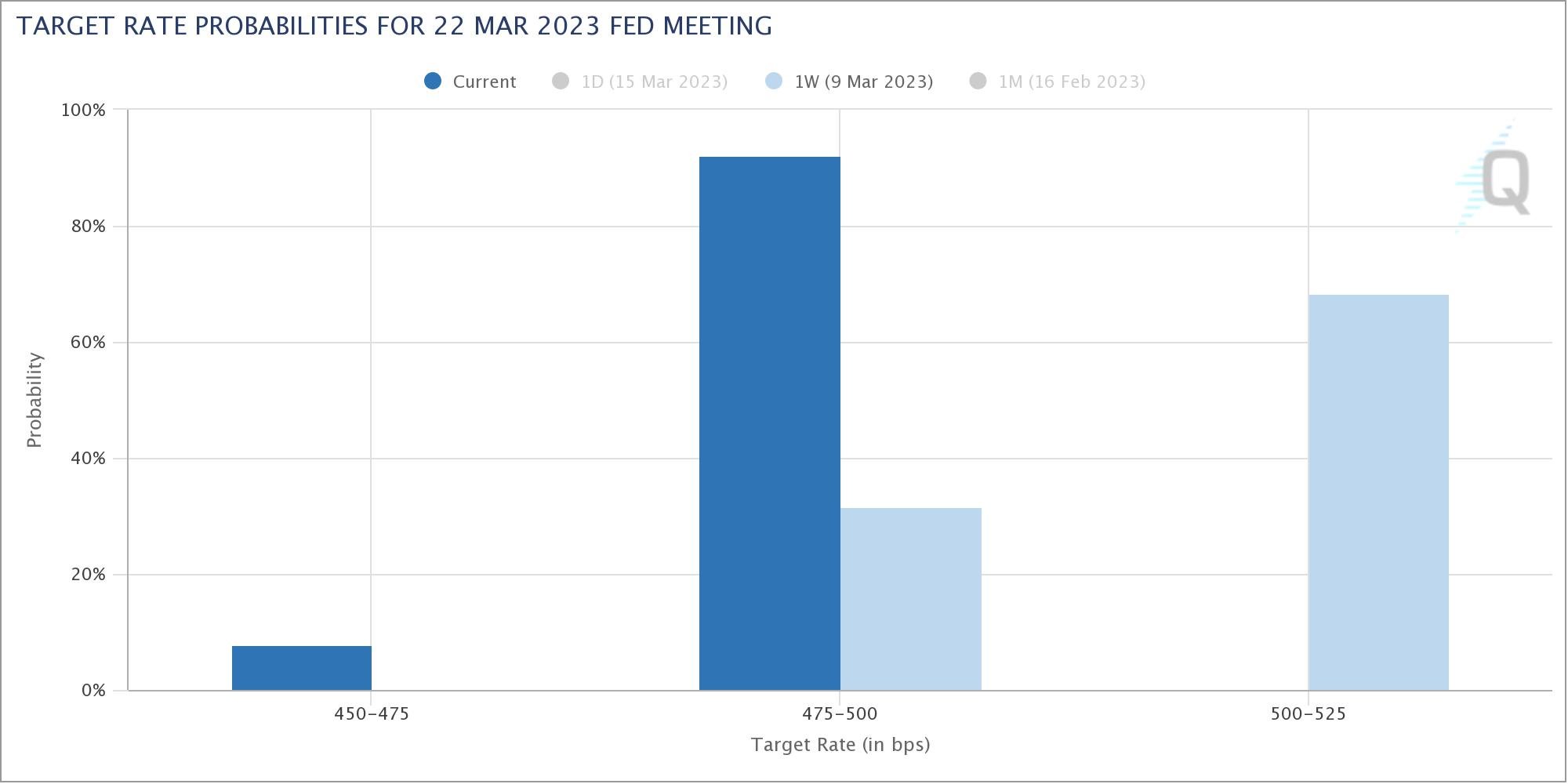

How quickly things can change. Only last week, the market was implying a 70% probability of a 50 bp hike at this month’s FOMC. Now, it is pricing a 92% chance of a 25 bp hike and an 8% chance of no hikes at all.

Source: CME Group

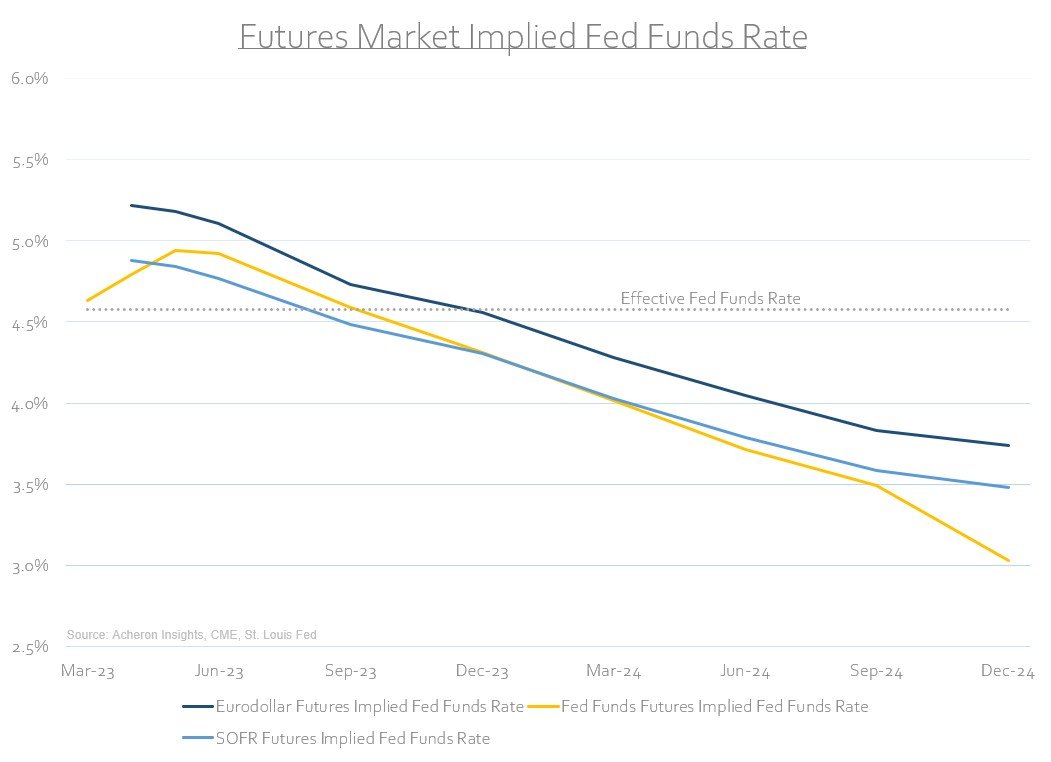

Further out, market participants are now almost unanimously agreeing the Fed will be cutting rates in the next couple of months after this month’s hike.

Many believe these banking issues will force the Fed’s hand. In fact, some sell-side firms such as Nomura are calling for rate cuts as early as next week. I don’t see it. The data simply does not support this type of dovishness. At least not yet. The Fed doesn’t want animal spirits back in the stock market with inflation still hot, wages hot and economic data continuing to surprise to the upside. Unless financial contagion sweeps markets over the next couple of months, I do not believe J-Powell will give the market what it wants.

Implications

What is often overlooked is the fact the Fed generally turns to cutting policy rates in times of crisis. And, times of crisis are usually not overly supportive of risk assets.

Source: Ned Davis Research

Source: Elliot Wave International

While a dovish turn by the Fed will likely spur risk assets higher initially, the lags of monetary policy are long and variable. It is highly unlikely we have fully felt the ill effects of the tightening seen worldwide over the past year. Dovish pivot or not, for long-term investors, now is not the time to be blindly buying risk.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.