Will We See An Earnings Recession In 2023?

Summary & Key Takeaways

The long-term leading indicators of growth and liquidity suggest corporate earnings and profit margins will continue to be pressured throughout 2023.

However, as the lags from leading indicators tend to be long and variable, we may not see a material impact in earnings growth until the second half of 2023.

Given that corporate balance sheets overall are also relatively strong and the economy continues to hold up nicely, this likely bodes well for earnings over the next quarter or two, particularly with analyst estimates seemingly becoming a little too pessimistic.

The stock market has done an excellent job pricing in the earnings slowdown, meaning EPS growth may no longer be a headwind for stocks for the time being.

Longer-term, earnings and profit margins remain artificially high, and the pressures of secular inflation along with a historically tight labour market suggest corporate earnings will eventually adjust downward to reflect this new state of events.

The macro-outlook suggests earnings growth will struggle in 2023

Corporate earnings are inheritably cyclical and tend to fluctuate in-line with the business cycle, thus having significant implications on stock price performance. Though we have seen earnings growth decelerate to a degree throughout 2022, whether we see a true earnings recession over the next 12-18 months remains key. The macro and liquidity indicators certainly suggest this is likely. First and foremost, the G5 credit impulse is foretelling earnings will roll over meaningfully at some point during 2023.

Source: @MacroAlf

Monetary policy and liquidity conditions worldwide also suggest a material slowdown in earnings is coming at some point. Increased borrowing costs should continue to materially impact profitability for over-leveraged corporates, while tighter financial conditions will pressure consumer spending. The latter dynamic has yet to materially translate into consumption trends (although signs of stress are rising in consumer credit card activity), and when it does, corporate earnings will likely take a hit.

The business cycle related leading indicators of growth seem to be corroborating this message. Both the ISM Manufacturing New Orders index and New Orders less Inventories spread lead EPS growth by around six to nine months, and both suggest earnings growth should decline materially in 2023.

Recent movements in the dollar, rates and energy costs also support this outlook. When we combine the movements of all three into a single composite, we tend to get a fairly accurate idea of where corporate earnings are headed over the following 12 months. Rising cost of capital, rising energy costs and reduced foreign income via a stronger dollar are all still headwinds for corporate profitability. While Q4 2022 and Q1 2023 EPS estimate may appear too pessimistic (particularly if this economic cycle continues to play out slower than many believe it will), the same is likely not true for 2023 estimates as a whole.

The movements in industrial commodities are also substantiating this message.

For now however, the credit cycle is yet to signal any cause for concern for corporates. Credit spreads suggest bottom-up Q4 earnings estimates of around -3.9% (the first quarter of negative year-over-year earnings growth since Q3 2020) may be a bit of an overreaction.

Again, although this economic cycle continues to play out slower than anticipated as consumer balance sheets and coincident economic growth trends are holding up well, the credit cycle is another area of the economy in which the forward looking indicators suggest will deteriorate as 2023 progresses (a dynamic I discussed here), which itself does not bode well for corporate earnings or stock market volatility.

And perhaps even more prescient for the viability of long-term earnings growth are the dynamics currently being played out in the labour market. Over the long-term, profit margins are highly correlated to labour costs (i.e. wage growth). With the labour market still secularly tight and wage grow strong, history suggests profit margins will eventually need to adjust downward to reflect these higher costs of labour. This will weigh on earnings, but again, is likely a story for the second half of 2023.

Source: John Hussman - Hussman Funds

Corporate balance sheets should support earnings for now, as should consumer spending

As I have touched upon, I suspect earnings growth may surprise to the upside over the first half of 2023. Why? Because corporate balance sheets and current economic growth trends should continue to be somewhat supportive of corporate profitability, while Q4 2022 and Q1 2023 estimates may be too pessimistic.

Although corporate leverage is still elevated relative to the pre-1990’s, it is important to remember that debt levels remain far from any extreme level of over-indebtedness seen during the 2010s (a period where earnings growth ex-FAANG was nearly non-existent), while inventory levels are also near secular lows.

Additionally, thanks to the abundance that was Covid related stimulus, corporates are still flushed with cash (as are households).

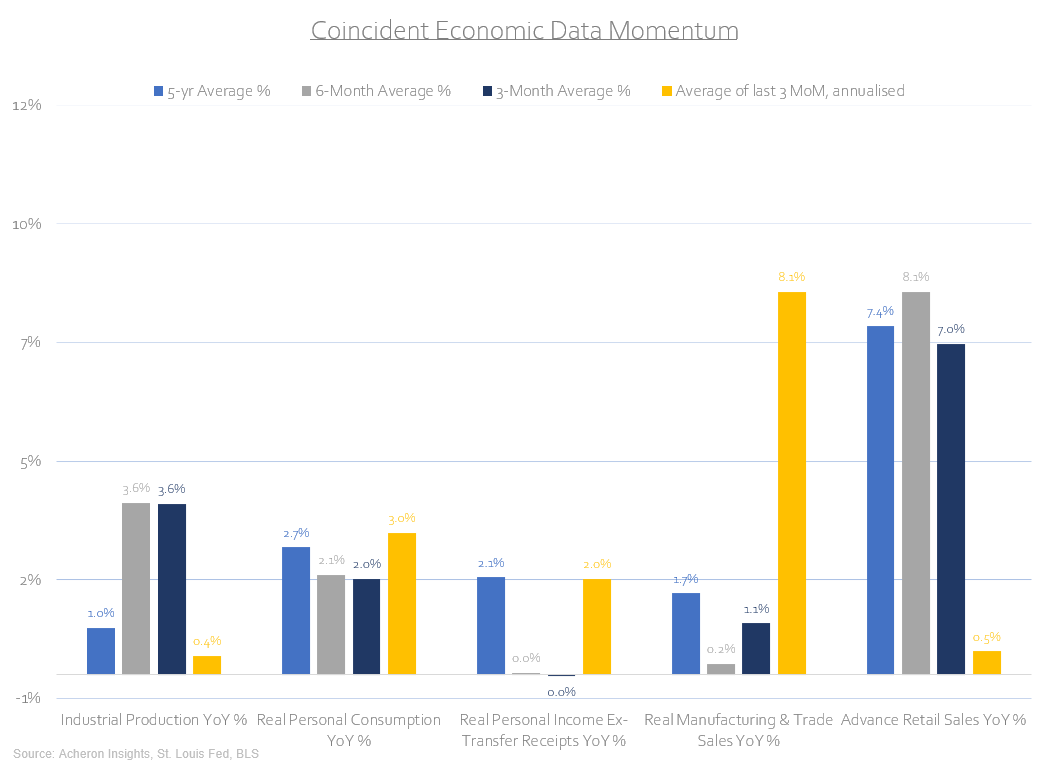

Meanwhile, coincident measures of economic growth momentum continue to suggest a robust economy, despite the poor outlook for the business cycle. Many people (myself included) have been surprised by the resilience of the US economy, and given the solid growth momentum in areas like real consumption and manufacturing and trade sales, this resilience should see the cycle play out slower than expected. Should we see an earnings recession or an economic recession in 2023, I suspect it will likely not be until the Q3 at the earliest. The ‘transitory goldilocks’ regime we may experience in the meantime could support earnings for the coming quarters as a result.

The stock market is already pricing in a significant earnings decline

In fact, when we couple this dynamic with the EPS outlook already being priced by the stock market, earnings appear to be far from any headwind for stocks at present. Similar to analysts’ expectations, perhaps investors have become a little too bearish on earnings too soon. For the time being, the pain trade appears to be to the upside for stocks.

When earnings do roll over, they may roll over hard

However, the problem with a ‘transitory goldilocks’ regime is that it is transitory. Should earnings growth indeed eventually roll over as the leading indicators suggest they will, this could happen hard and fast.

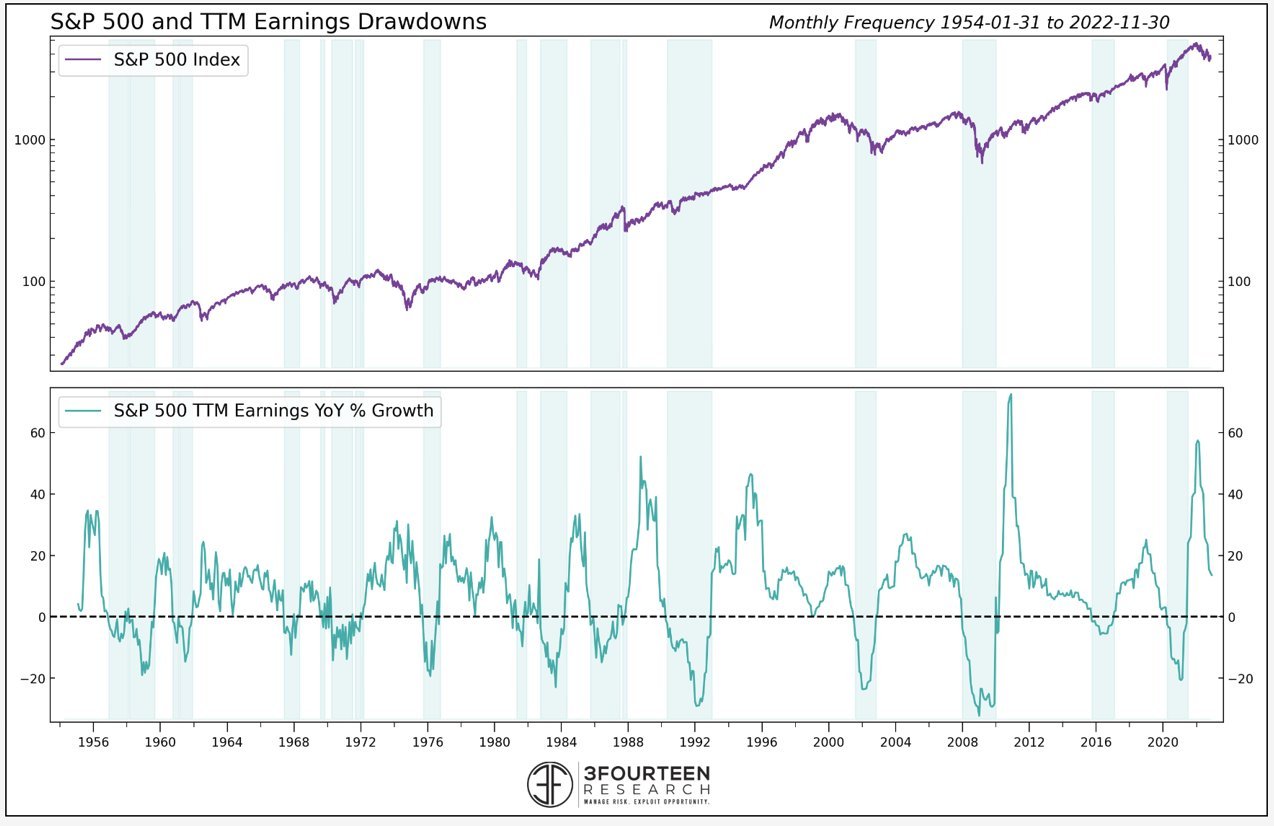

As we can see below per the work of 3Fourteen Research, when earnings growth turns negative it tends to materially decline thereafter.

Source: 3Fourteen Research

Source: 3Fourteen Research

What makes corporate earnings highly susceptible to a sustained material decline is the potential reversal of some of the long-term trends that have so supported profit margins in recent times. Through a period of secular stagnation where monetary policy and globalisation favoured capital at the expense of labour, low-to-no wage growth resulted. With stagnant wages came inflated profit margins, which remain significantly above their long-term trend.

The same can be said of the long-tern trend in EPS. Given the current state of the labour market and the pressures of secular inflation (peak-globalisation, geopolitical instability, green energy transition, and populism to name a few), one cannot help to think that over the next few years, earnings may have no choice but to reflect this new state of events. Only time will tell.

. . .

Thanks for reading!

If you enjoyed this article, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.