Time For Gold Bulls To Take Profits?

Summary & Key Takeaways

On a short-term basis, gold, silver and mining stocks are looking overbought and in need of the pull-back.

The divergence between gold and real yields has again become pronounced, suggesting precious metals markets may have gotten ahead of themselves for the time being.

Taking profits or adding downside protection appears prudent at present.

Longer-term however, the bull case for gold and precious metals remains strong as real rates should likely inflect lower as 2023 progresses, turning from headwind to tailwind, while speculative positioning and sentiment remain far from any levels indicative of extreme optimism.

Gold has decoupled from real yields

Back in November, I opined on how gold and precious metals were approaching an excellent contrarian buying opportunity. Since then, gold has rallied roughly 16%, silver 30% and gold miners around 35%. Driven by central bank gold purchases, tightness in the physical market, favourable seasonality and speculative buying, this has been an excellent run for the asset class by any measure. However, there are now a number of signs suggest precious metals have become overbought in the short-term and are in need of a well-earned pull-back.

Nowhere is this latter dynamic more apparent than in the relationship between gold and real yields. It is notable that this recent rally has not been confirmed by a move lower in real yields, as we can see below. Real yields (inverted in the below chart) have actually increased of late.

This dynamic can be proxied by observing the relative price action of Treasury Inflation Protected Securities (via the TIP ETF) and gold. Clearly, real rates remain a headwind for gold for the time being and such negative divergences generally result in weakness in the gold price, with the July/August rally being the most recent example.

In relation to the outlook for real yields, they have generally followed the business cycle in recent years. However, this relationship has broken down somewhat since the pandemic, likely indicative of how much the Fed suppressed interest rates as part of their monetary policy response to the Covid-induced lockdowns which resulted in too easy monetary policy for too long. Clearly, the opposite appears to be occurring now, with the Fed intent on keeping monetary policy tight despite the leading indicators of growth and inflation rolling over. Indeed, given this outlook for the business cycle (detailed in-depth here), there appears to be a decent probability that rates will eventually adjust lower throughout 2023. Should they do so at a faster pace than inflation expectations, real yields will too eventually follow the business cycle lower, a bullish outcome for gold and precious metals. This is likely a story for Q2 2023 at the earliest however. For now, real rates remain a headwind.

Outside of real yields, gold prices have historically also been influenced in-part by movements in the money supply (i.e. M2) and the dollar, though both tend to have a smaller impact than that of real yields. As we can see below, gold’s largest moves over the past couple of decades have occurred during periods of rapid growth in money supply (illustrating golds properties as a hedge against monetary debasement), while periods where the money supply growth decelerated have generally coincided with neutral or bearish price action in gold. This dynamic helps to explain why gold has trended sideways since late 2020. For now, money supply growth seems to be a headwind for precious metals, but not necessarily one that constrains positive price action entirely.

In terms of the dollar, the story is similar. Gold and the dollar have been highly negatively correlated of late, with the dollar’s rapid pull-back over the past couple of months being supportive of precious metals prices. Given my outlook for the dollar over the coming quarters, I suspect it is likely to remain bid, and this may have bearish implications for precious metals. However, it is worth noting the dollar and gold can trade with a positive correlation for prolonged periods of time. For example, if real yields collapse and the dollar remains strong, this is likely still net-bullish for precious metals.

Speculators have returned to the gold market

Only recently, sentiment and speculative positioning was at or near its most pessimistic and bearish levels in years. That is no longer the case as speculators have piled back into both gold and silver markets in abundance over the past couple of months, one of the main reasons why precious metals have had such a solid run.

This dynamic has been particularly notable in the gold futures market via the movements of managed money (i.e. hedge funds and CTA’s). While speculative positioning is far from the kind of overly bullish or optimistic levels seen at long-term turning points, it is also no longer at the contrarian buying levels seen in November. There remains plenty of fuel left in the tank to drive prices higher (or lower for that matter) throughout 2023.

Silver speculators in the futures market have too significantly increased their long positions in recent months. Right now, there is no clear signal from the futures market.

Gold ETF fund flows on the other hand continue to trend positively, whilst also being far from any overly optimistic level akin to those seen at major market tops. Again, this illustrates the potential upside still on offer for precious metals markets as 2023 progresses, but also the potential downside should these flows (or speculative long positions) reverse.

The options market is not buying the rally

Shifting gears, an interesting observation that can be gleaned from the gold options market is how there has been very little bid for upside call options during this recent rally. Put it another way, options traders remain skeptical and are not buying into this rally. This dynamic is particularly notable when viewed through the lens GLD options skew, which measures the implied volatility spread for 25-delta puts relative to calls. Generally, options skew tends to provide a solid read of where the spot price may be headed, and given that both skew and implied volatility remain neutral and calls have not been bid during this rally, the options market is suggesting the outlook for gold at present is somewhat neutral. Perhaps options traders believe this rally has been fueled by the unwinding of short-positions and tightness in the physical market as a result of central bank gold purchases, and are yet to be convinced the long-term sustainability of higher precious metals in the face of rising real yields, at least for now.

Source: Market Chameleon

The technical picture looks bearish short-term, but bullish long-term

Short-term, gold has just run into overhead resistance at the $1,875-$1,900 level, while also triggering a completed daily 9-13-9 DeMark sequential sell signal on the back of a negative divergence in momentum (RSI). All told, unless price action manages to break this key level and hold above (a very bullish outcome), these technical signs are suggestive of short-term trend exhaustion. Should we break down from the apparent bearish ascending wedge pattern, a pull-back to around the $1,800 area would appear constructive.

The technical picture for silver is nearly identical to that of gold, though the momentum divergences on the daily chart are more pronounced and the price looks to have already broken out of its own bearish ascending wedge pattern. Silver very much led gold upward during the recent rally, and appears to be potentially again leading gold to the downside here. A pull-back to the $21-$22 area for silver seems like a decent bet, and potentially a solid area for those bullish to add to their positions.

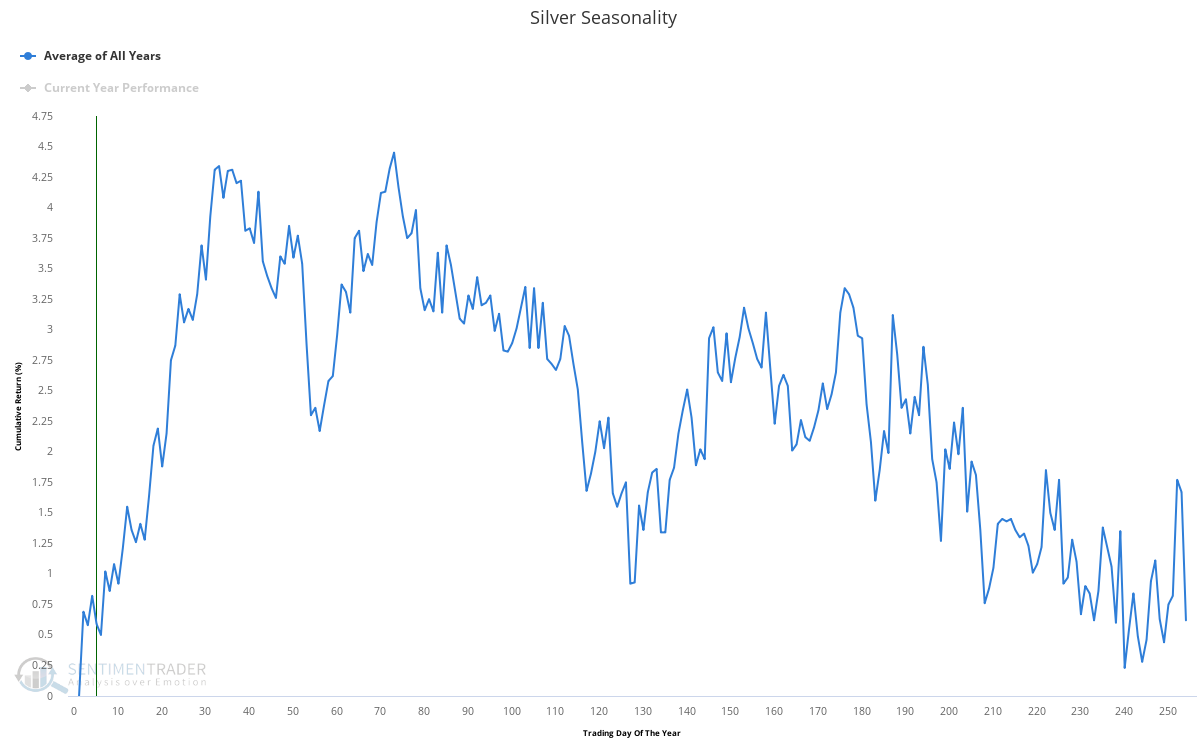

From a seasonality perspective, it is important to remember however that January is historically the most bullish month for precious metals, so it may well be that there is still room for gold, silver and the miners to run higher in the coming weeks. Though it could be the case that January’s usual positive price action has already largely taken place.

In summary, gold and precious metals are looking pretty stretched here and in need of a pull-back, or at least a consolidation. Given my contrarian nature, now appears a prudent opportunity to take profits, or alternatively, hedge downside exposure via put spreads, which look reasonably priced given implied volatility and skew are not overly expensive at current levels.

. . .

Thanks for reading!

If you enjoyed this article, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.