A Contrarian Buying Opportunity For Gold Bulls?

Summary & Key Takeaways

Rising and positive real yields continue to be a major headwind for gold over the short-term. However, this move in higher real yields is likely only temporary.

From a technical, positioning and sentiment standpoint, we appear to be nearing an excellent long-term contrarian buying opportunity for gold.

The long-term bull case for an allocation to gold remains as strong as ever.

Headwinds remain for precious metals but a long-term buying opportunity appears imminent

Precious metals have continued to frustrate bulls for much of 2022 despite what would appear to have been ideal conditions for gold in inflation and heightened geopolitical uncertainty. Unfortunately, gold has acted as a hedge to neither. Alas, what we can glean from this recent price action is a reaffirmation the primary driver of precious metals continues to be a combination of the monetary policy stance by central bankers and their implications on real yields.

It is through these channels that central banks either repress financial conditions and debase currency (bullish for gold), or over-tighten monetary policy and drive real yields positive (not so bullish for gold). Investors willingness to allocate to precious metals depends much on the real rates of return offered by the various available asset classes, and, given gold is a non-yielding asset whose supply trends bear little influence on short-term price action, should real-yields for safe haven alternatives such as Treasuries turn positive, the opportunity cost of holding precious metals increases.

This is the precise dynamic that bears much responsibility for the weakness in precious metals of late. The Fed has moved to tighten financial conditions in order to curb inflation thus forcing real rates positive, and in turn gold has repriced lower to reflect the increased opportunity cost of holding the yellow rock. Unfortunately, as we can see below, based on this relationship one could easily surmise precious metals have further repricing to do to the downside.

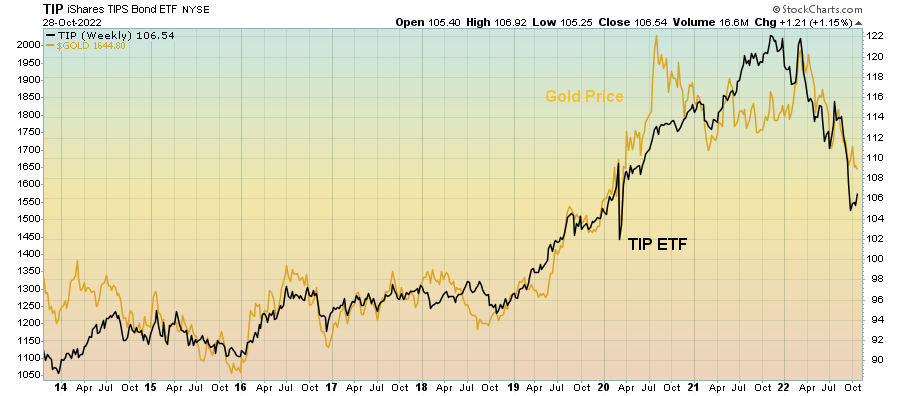

Indeed, this dynamic can be proxied by observing the relative price action of Treasury Inflation Protected Securities (via the TIP ETF) and gold, we the former again suggesting this sell-off may not be over for precious metals. Real rates remain the major headwind for gold for now.

We must remember however much of the long-term bull case in favour of an allocation to precious metals lies in the notion the economy cannot handle positive real yields for a sustained period of time. With the Fed trying to kill demand by forcing real yields positive to curb inflation, we have subsequently seen one of the largest tightening of financial conditions in recent history.

While rising and positive real yields are not a favourable environment for gold, it is notable how remarkably well gold prices have held up all things considered. Perhaps the gold market understands that a Fed pivot will eventually come (a likely story for Q1 2023). In a world of too much debt and a reliance on the suppression of interest rates to sustain economic activity due to decades of too easy monetary policy, positive real yields are only sustainable for a short period.

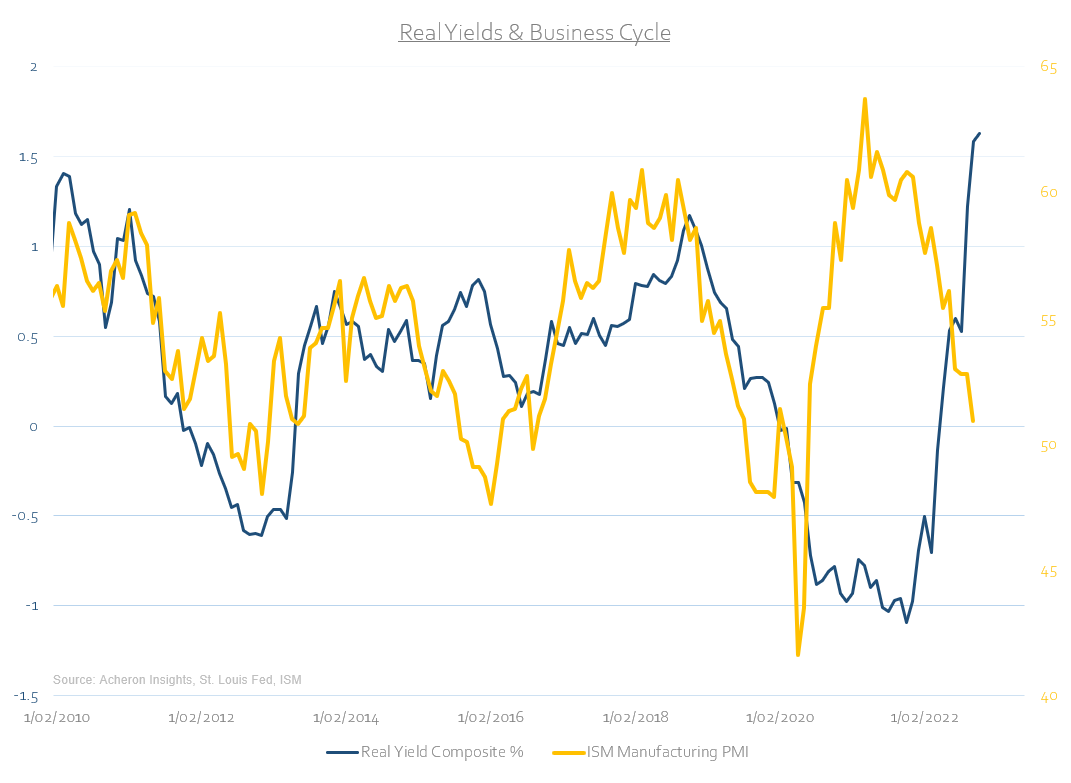

Fortunately, we can use the business cycle as a guide as to where real yields are headed. Tightening financial conditions generally lead to a growth slowdown, with a growth slowdown generally leading to lower real yields as policy makers stimulate, and vice versa, as we can see below.

Given this dynamic, real yields generally follow the cyclicality of the business cycle, and what is interesting when observing this relationship since early 2020 and the onset on the COVID-19 lockdown is how evident it is that policy makers kept financial conditions far too easy for too long. The business cycle peaked in the first half of 2021 and yet it took the Fed almost 12 months hence to begin tightening. Given the poor outlook for the economy (detailed in-depth here), we are likely seeing the opposite dynamic unfold; the Fed tightening too late and for too long. It appears only a matter of time before we see real yields follow the business cycle lower, an outcome that is very bullish gold. A Fed pivot (or pause) and a deceleration in inflation would be the catalyst for lower real yields, turning what is currently a headwind into a tailwind.

For investors looking to add to their precious metals positions in anticipation for such an outcome, we continue to see many signs from a positioning and sentiment perspective that an excellent contrarian buying opportunity for gold is nearing.

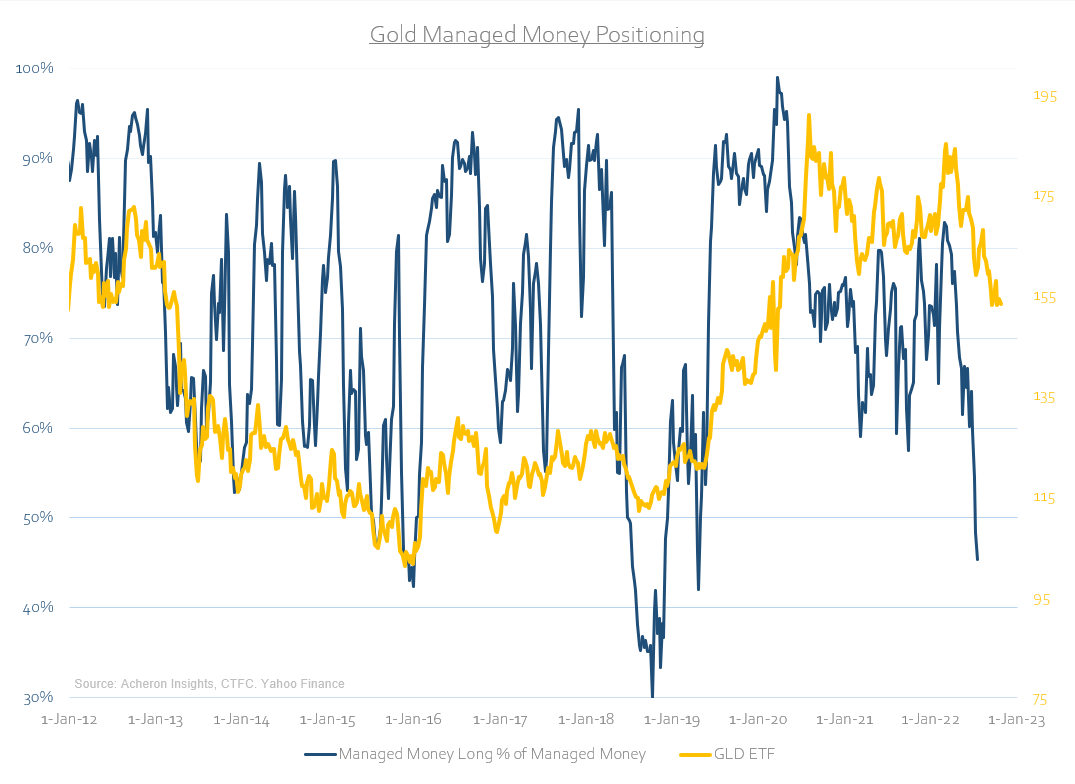

Firstly, if we look at speculative positioning in the futures market via Managed Money (consisting of CTA’s and hedge funds who tend to use trend-following strategies), we have seen a significant unwinding in their positioning amid this sell-off. Plummeting long positions of hedge funds and CTA’s tends to help both put a floor under the gold price and signal a contrarian buy signal, with their current long positions being close to excellent buying opportunities in recent years.

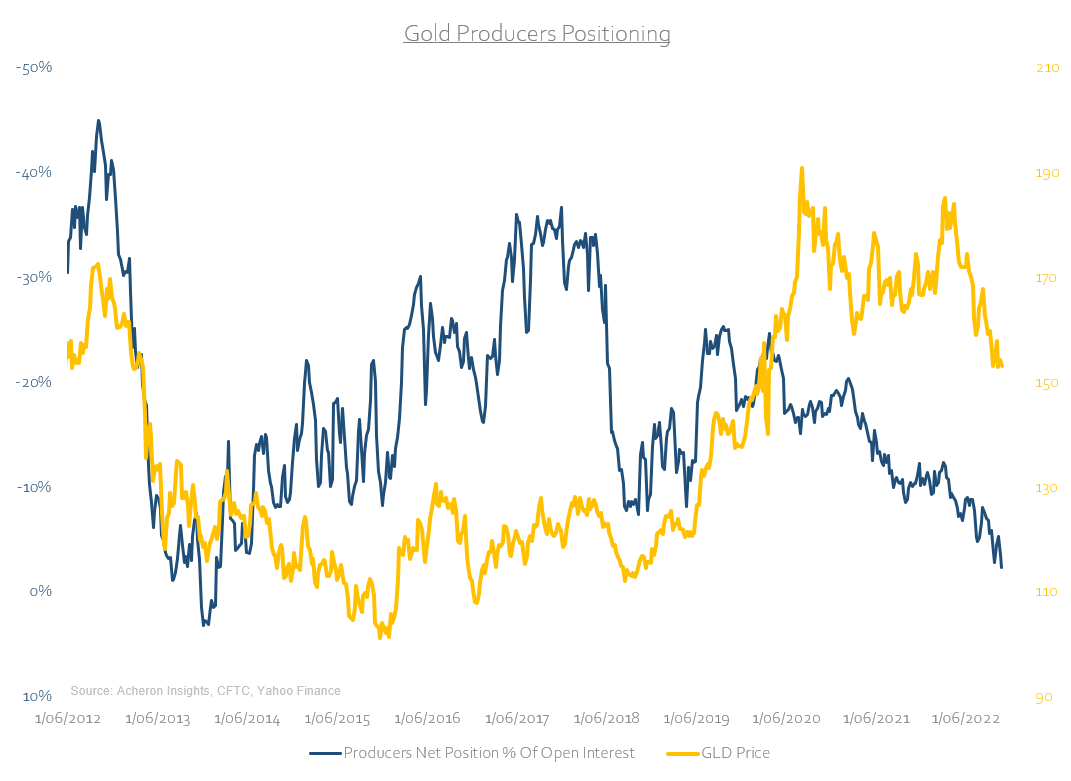

What is also encouraging is the positioning of Producers. Generally short the market as they sell forward their production and hedge their books, gold Producers are now essentially flat the market to a degree not seen in a decade. Again, this is the type of positioning that goes a long way to help put a floor under the gold price and mark decent long-term buying opportunities.

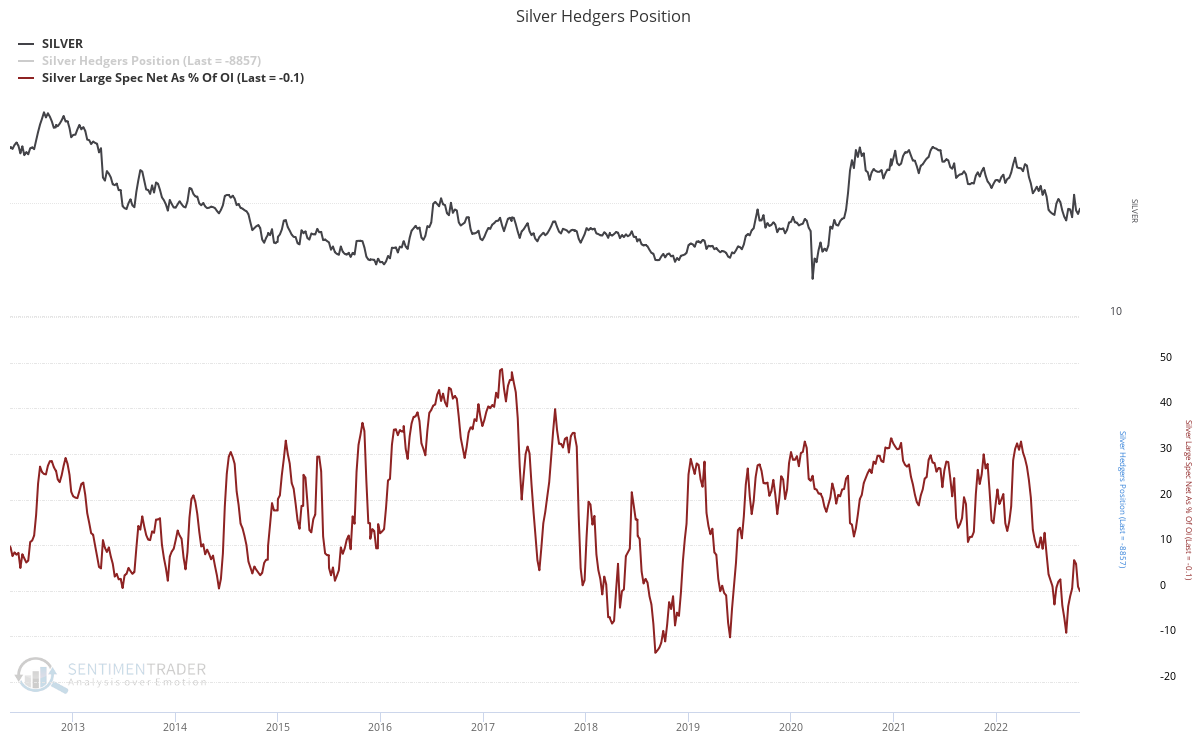

The situation is no different for silver, with speculators having on nearly their smallest long positions in the past decade.

In terms of investor sentiment, gold and precious metals are as hated now as they have been in years. If we proxy sentiment via the Bullish Percent Gold Miners Index (BPGDM), we are near levels that marked good buying opportunities over the past decade.

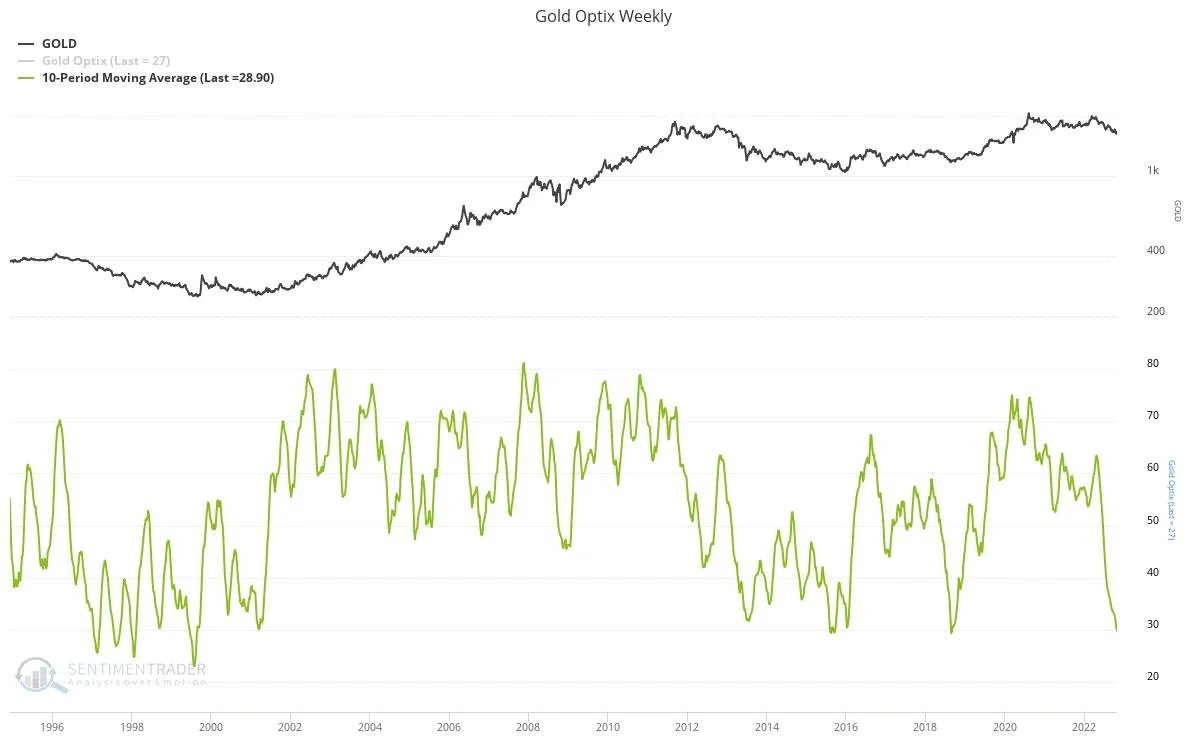

The pessimism toward precious metals is even more prevalent when measuring sentiment via SentimenTrader’s Optix index.

Although I must stress both sentiment and speculative positioning can remain depressed for long periods and are not much good in forecasting short-term price action (particularly when clear short-term risk is evident, as is the case presently), both do an excellent job of signaling buying opportunities for long-term investors. Rarely does sentiment for precious metals become this pessimistic, and as we can see below such levels have preceded excellent long-term returns in recent history.

Source: SentimenTrader

If we turn now to the technical picture, things continue to look encouraging. Although this sell-off has pushed prices below the important support/resistance level just below $1,700 for gold, the recent lows have been accompanied with bullish divergences in both the RSI and MACD. Likewise, gold looks to be readying to break out of a descending wedge pattern. An upward breakout from this technical pattern and price moving above $1,700 would likely be bullish and potentially go a long way in marking a reversal of this downtrend.

Another important sign this sell-off may be nearing a conclusion is the recent relative performance of the high-beta sectors of the precious metals market. As we can see below, all of gold miners (GDX), junior gold miners (GDXJ), silver and silver miners (SIL) have outperformed gold when making its recent low. Such positive divergences from the high-beta market internals are generally a positive sign of forthcoming price action.

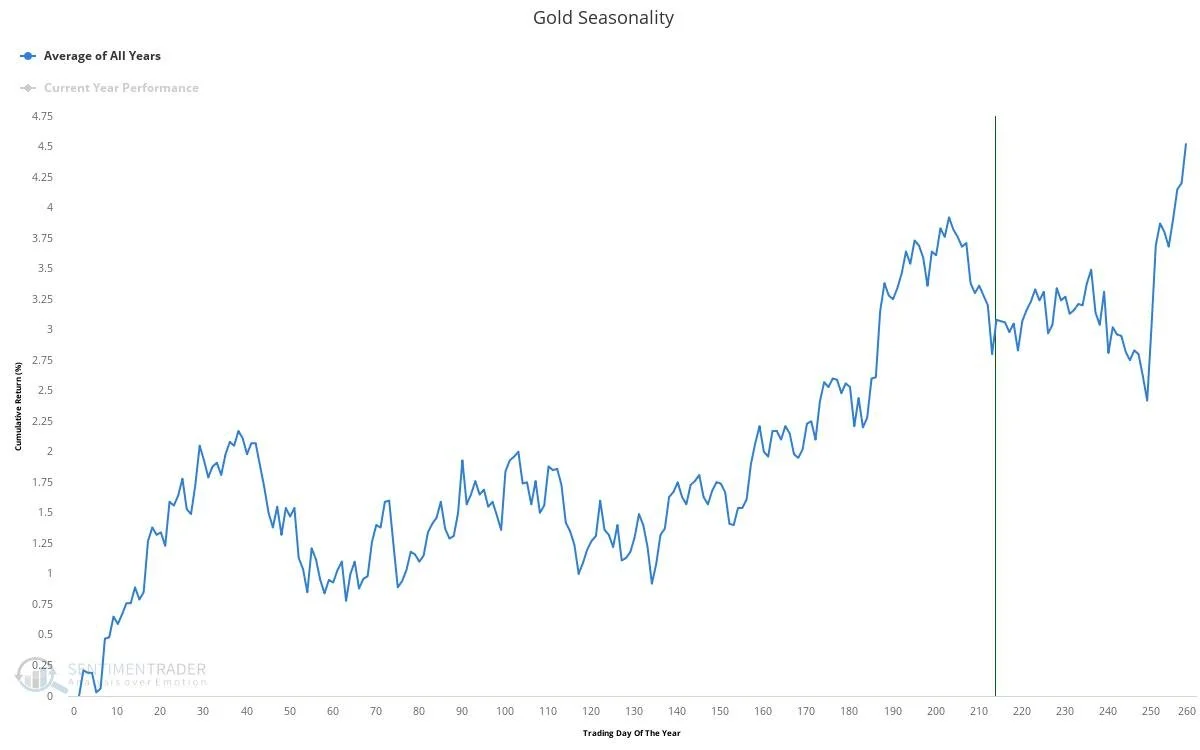

From a seasonality perspective, though the months of October through early December tend to be somewhat unfavourable for precious metals, the turn of the year generally coincides with one of the best times to be long gold. This seasonal trend seemingly confirming the idea of bearish to sideways price action over the near term remains the most likely outcome as precious metals continue to battle real yields.

A quick word on the physical gold market

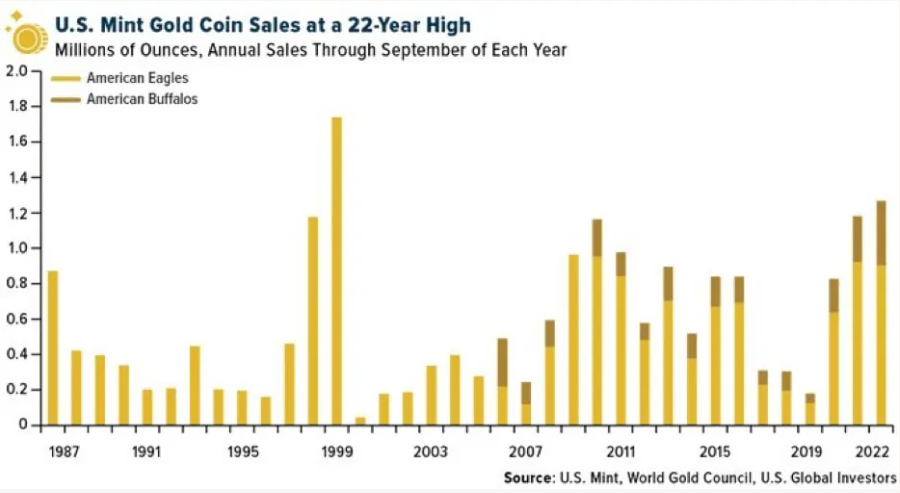

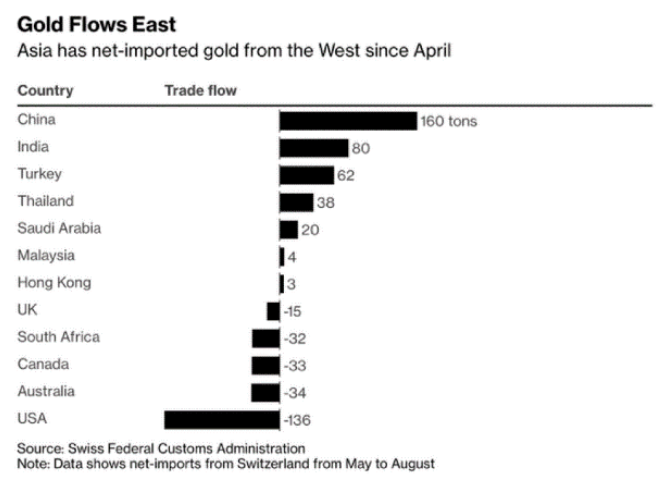

Supportive of the long-term case for precious metals are the recent developments in the physical gold market. Demand for physical gold has been surging of late, evident in the UK, Asia and the US:

Chart via Luke Gromen, FFTT

Chart via Luke Gromen, FFTT

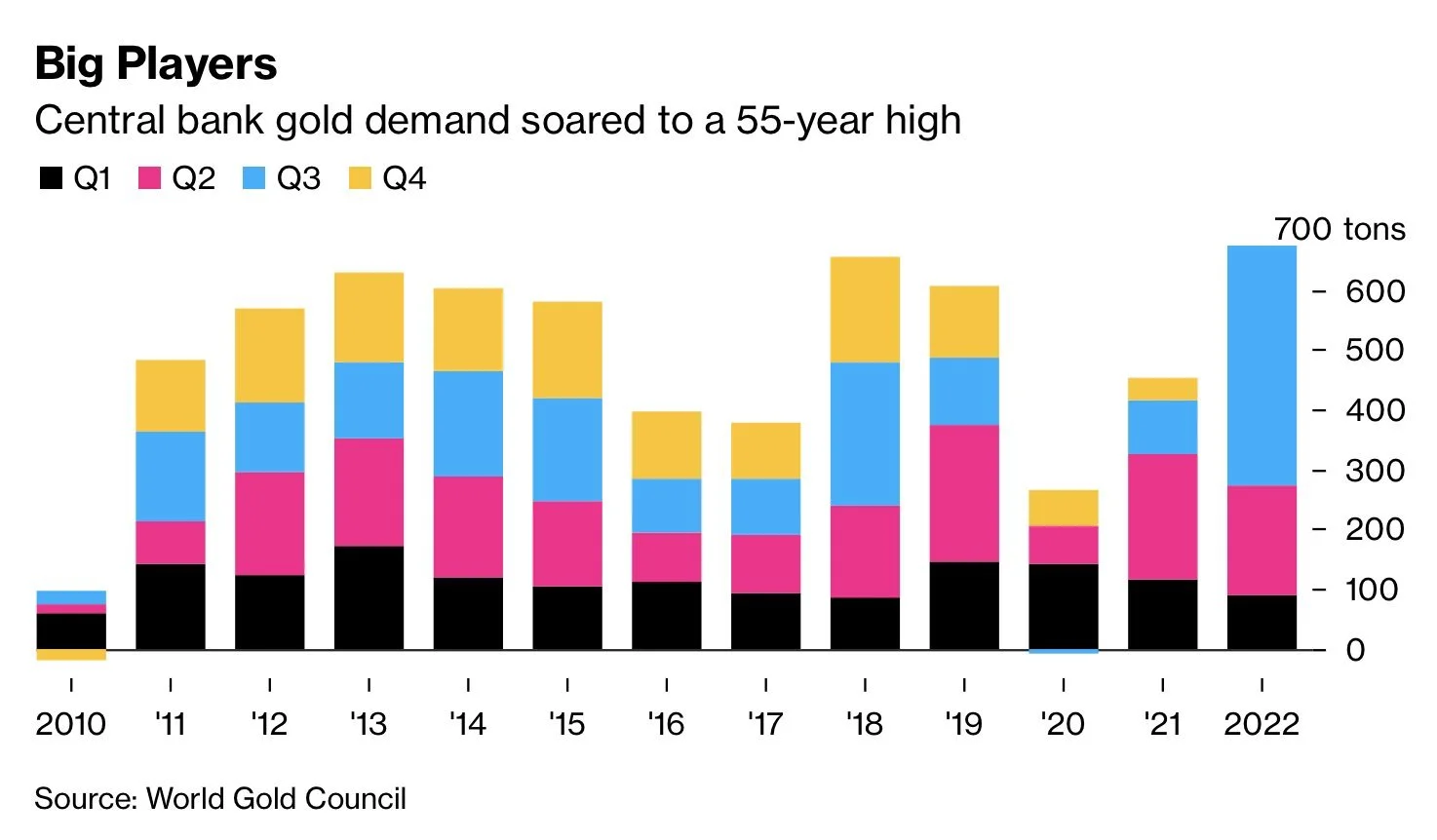

As well as by central banks worldwide, whose gold purchases thus far in 2022 are the highest in 55 years per Bloomberg.

Source: Bloomberg

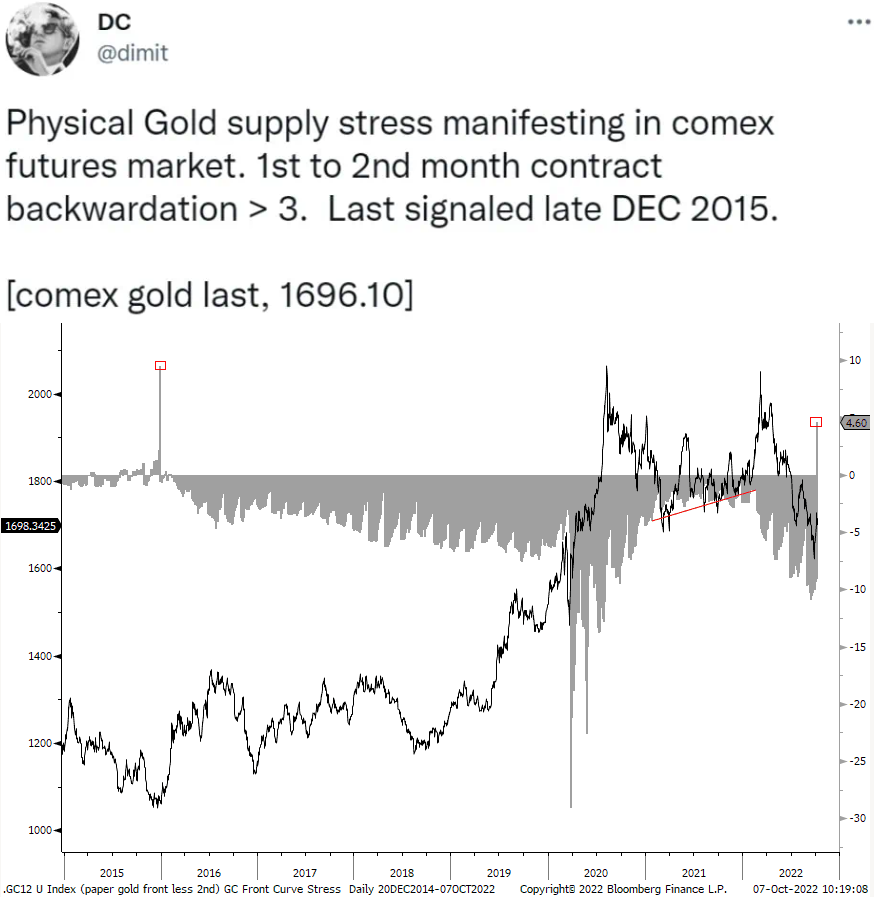

As a result, this rush toward physical gold is beginning to stress futures markets:

Source: @dimit via FFTT

Clearly, there remains an underlying demand for physical gold worldwide.

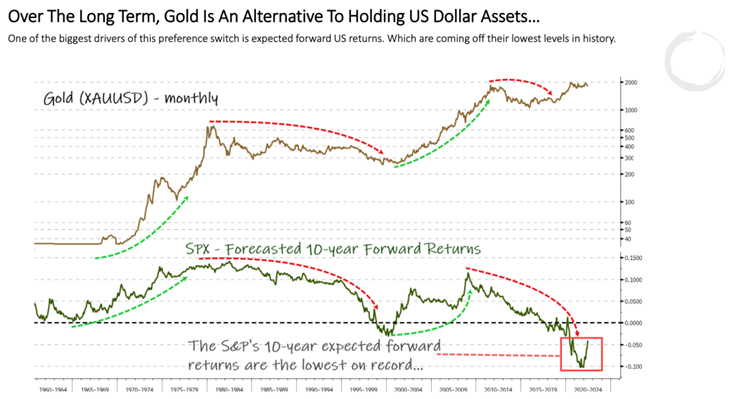

Long-term outperformance likely for precious metals

Based on the forward outlook for the stock market and golds attractiveness during such periods, this appears unsurprising.

Source: Macro-Ops

The technical picture of the S&P 500 relative to gold looks to be confirming to this outcome, with a near decade long bullish descending wedge pattern looking to be forming.

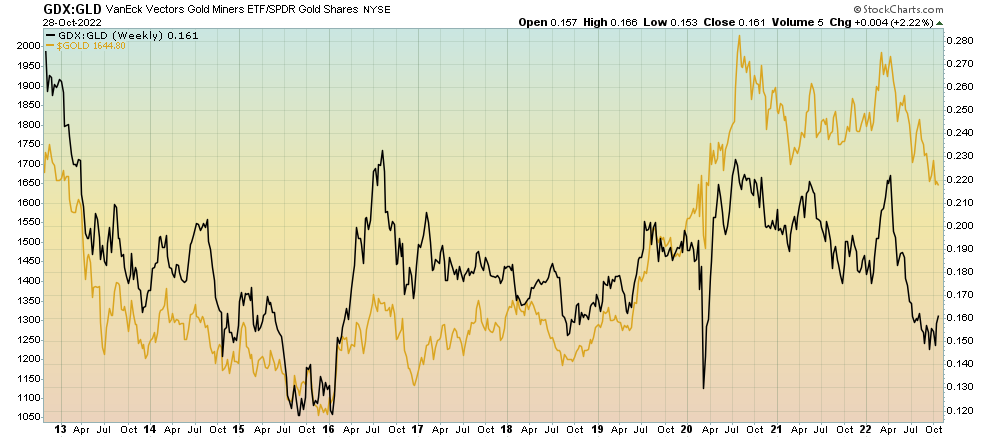

Gold mining stocks look set to benefit most from a resumption of the precious metals bull market, highlighted by the upside potential for outperformance of miners relative to gold, a ratio that has historically tracked the gold price itself.

Add to that the valuations of gold miners, which are once again are dirt cheap. This is true on an absolute basis, as illustrated below for the larges mining stocks in Newmont Corporation, Barrick Gold and Agnico Eagle Mines Ltd.

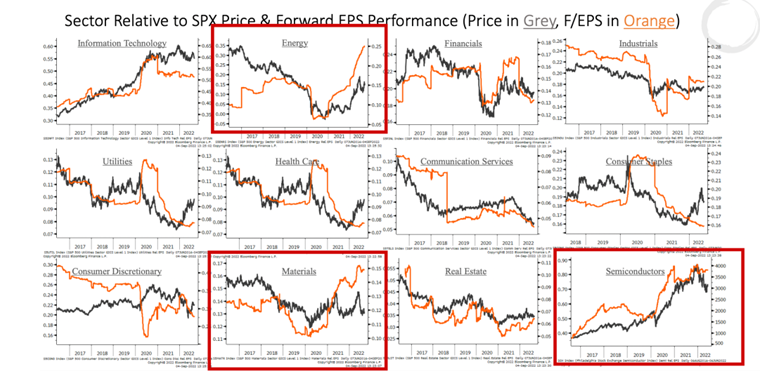

Whilst also being true an a relative basis, as highlighted below via Macro-Ops, with Energy and Basic Materials being nearly the only sectors of the market with positive forward earnings trends relative to the S&P 500, a situation which generally leads to outperformance versus the broad market.

Source: Macro-Ops

. . .

Thanks for reading!

If you enjoyed this article, would you be so kind as to share this around your network or to those who may be interested. Any and all exposure goes a long way to help promote Acheron Insights investment research and is very much appreciated. Thanks again.