Growth Cycle Outlook: Time Is Running Out For Risk Assets

For some months now I have been banging the drum on how economic growth has been slowing and is set to meaningfully deteriorate come the middle of 2022. Unsurprisingly, my growth outlook has not changed since I penned my most recent article detailing the subject.

Alas, we are coming ever closer to the inflection point whereby financial markets will succumb to the significant growth, liquidity and policy headwinds abound. Within this Growth Cycle Outlook I will rehash why I continue to believe a significant deceleration in growth is likely to rear its ugly head in the coming quarters, and whether we will see one last rally in risk assets before this change in trend.

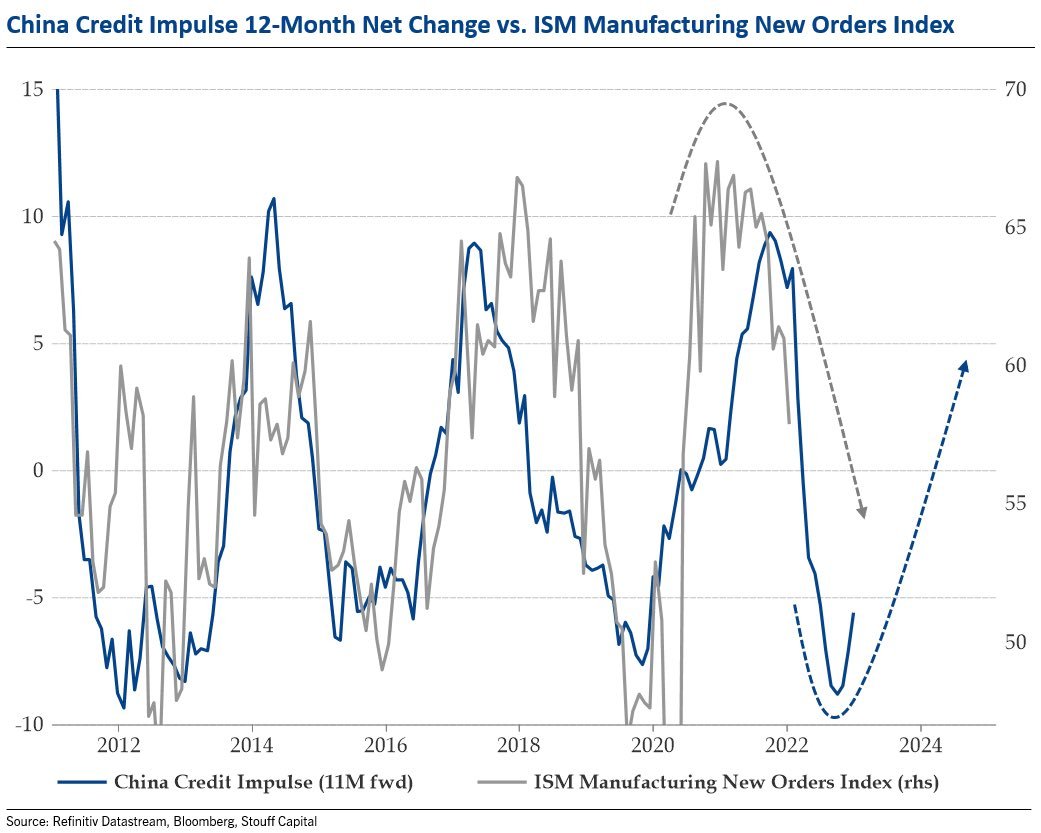

Checking in on the forward-looking leading indicators of economic growth, the Chinese credit impulse peaked back early to mid-2021 and its impact is clearly starting to be felt in developed markets.

Source: Julien Bittel

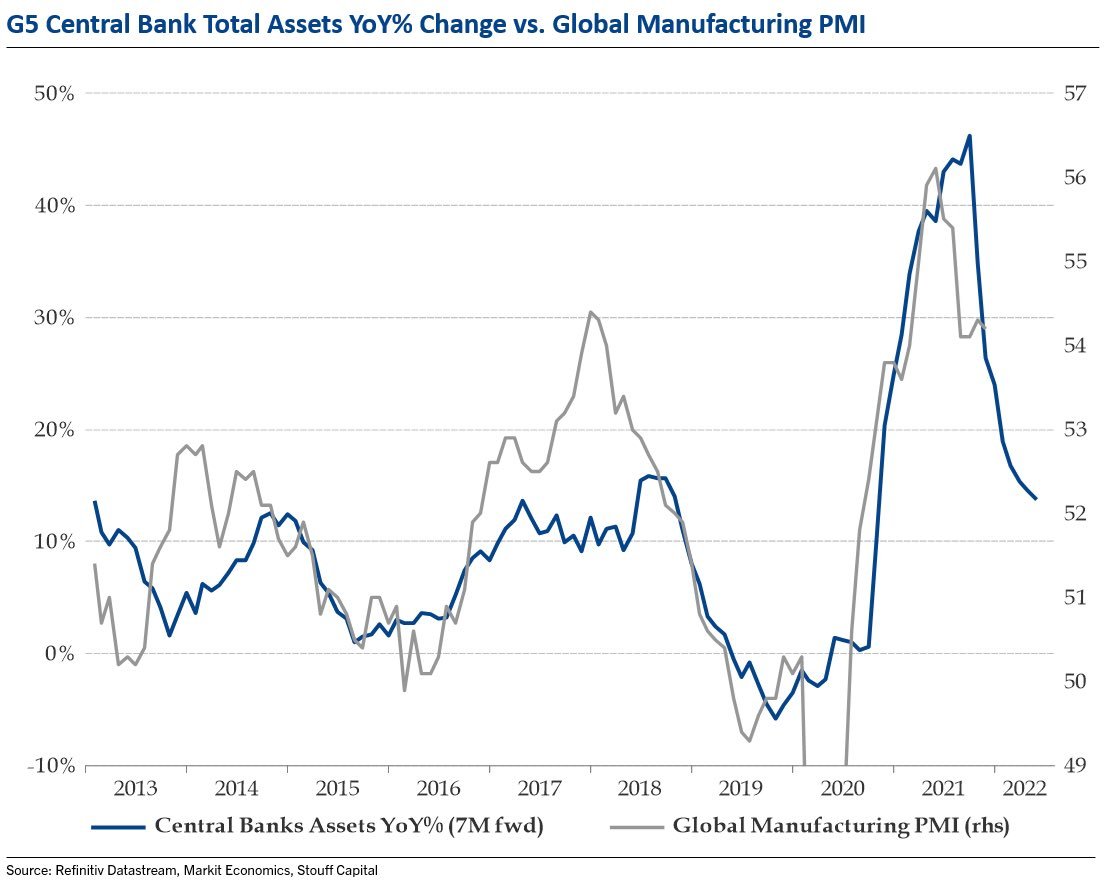

G5 central bank asset purchases are too signaling that global PMI’s are likely headed lower in the coming quarters.

Source: Julien Bittel

Whilst the Economic Cycle Research Institute (ECRI) Weekly Leading Index continues to trend lower since peaking nearly 12 months ago.

Source: Lakshman Achuthan

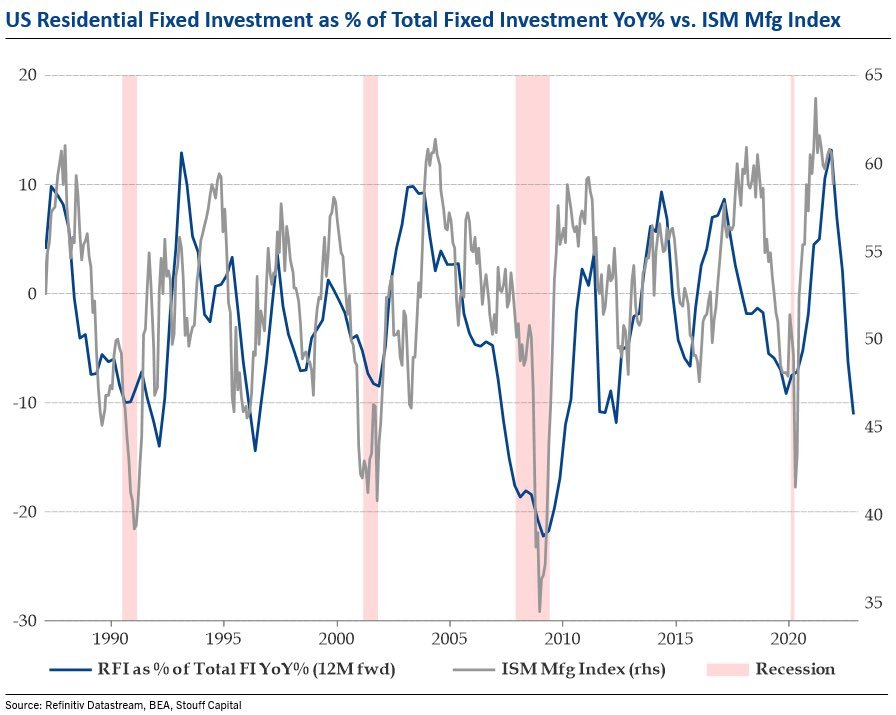

The housing market is all but confirming this message, pointing to a sub-50 ISM in the months ahead.

Source: Julien Bittel

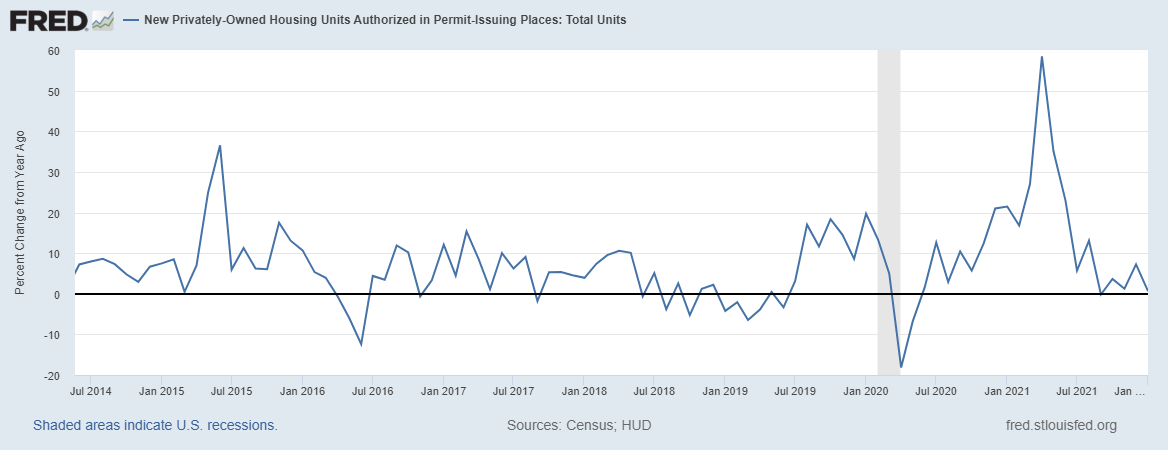

Accompanying the deceleration in fixed residential investment is building permits, which are flirting with near negative year-over-year growth.

Given the housing sectors importance to the economy, the implications here for economic growth are clear and obvious.

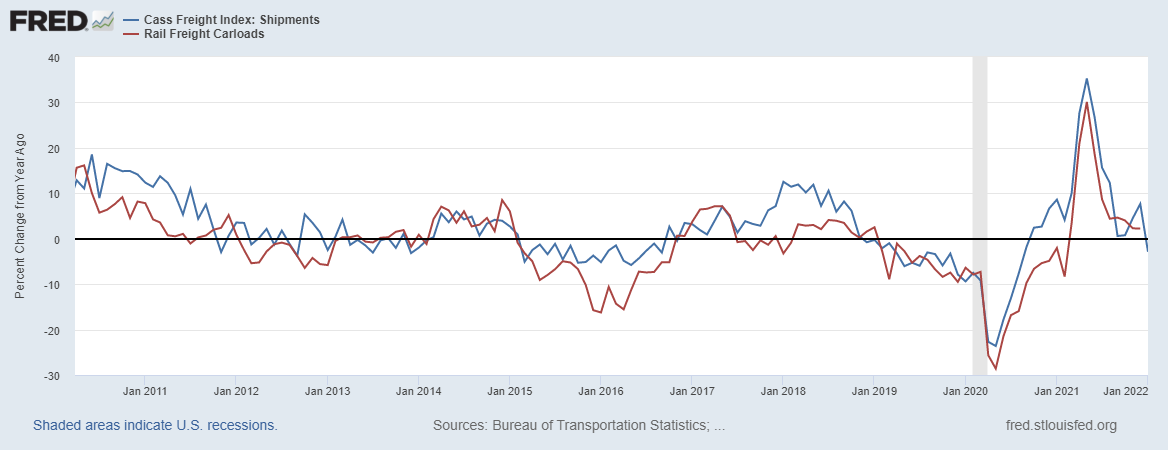

Turning to the consumption and demand side of things, both Rail Carloads and Freight Shipments are looking very weak.

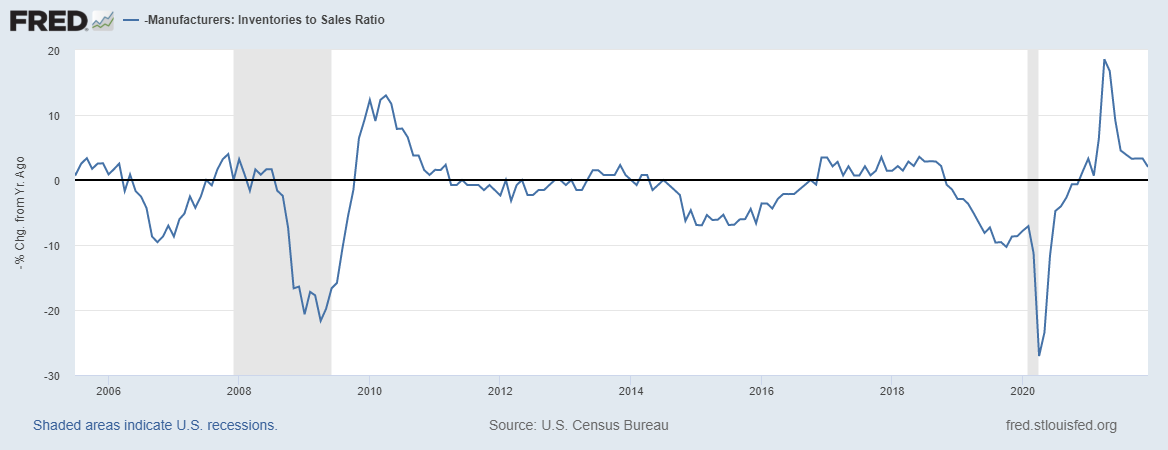

Whilst the manufacturing sales to inventory ratio continue to decline (inverted below). When sales are rising at a greater pace than inventories and the ratio rises, then more inventory needs to be produced, thus putting upward pressure on prices as well as an increased need for workers and hours worked, thus positive for growth. When inventories rise at a greater pace then sales and the ratio falls, the inverse occurs. Clearly, demand continues to falter.

If we source this ratio from the ISM Manufacturing Survey via the New Order to Inventory spread, the message is the same…

Source: Mr Blonde Macro

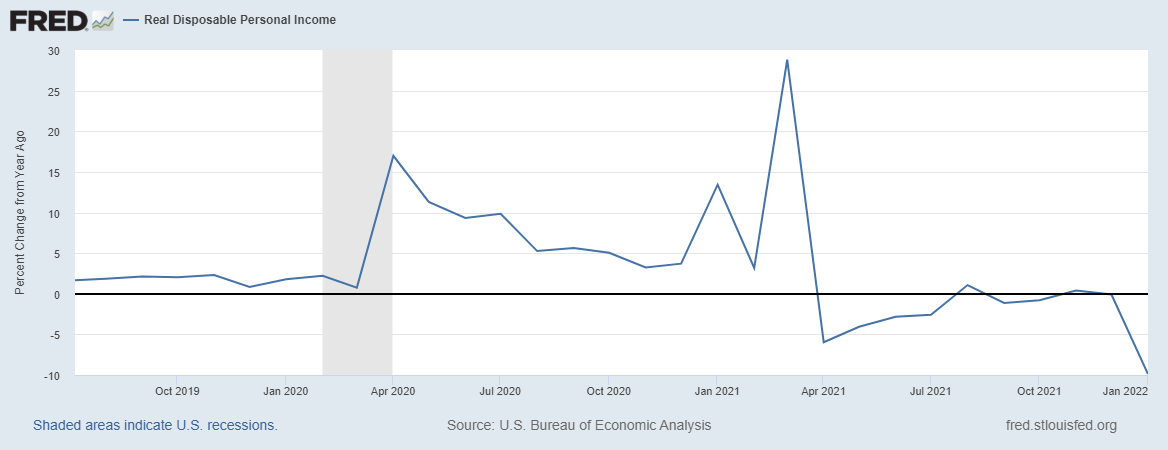

Clearly, demand is waning and the economy is slowing. Inflation has completely destroyed real income growth.

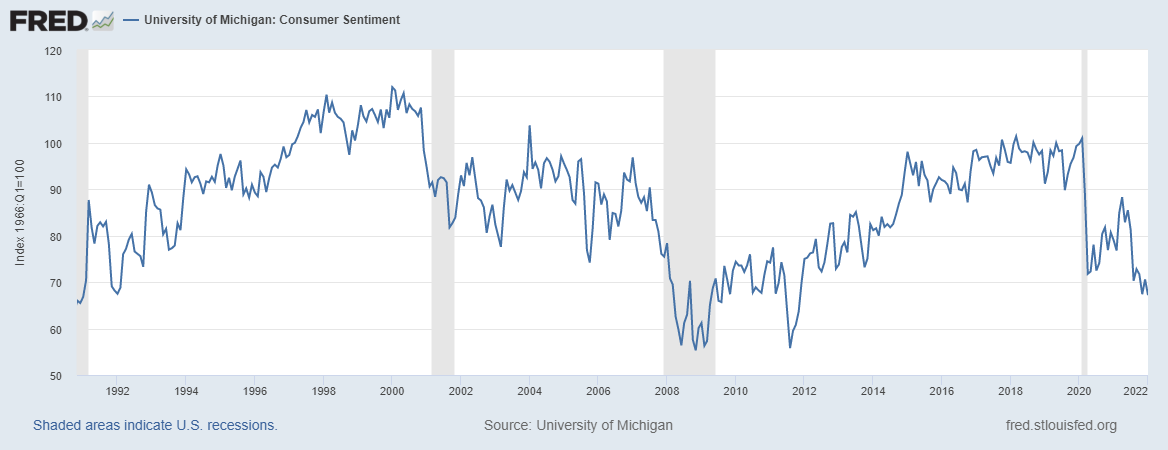

As a result, not only is consumer sentiment below where it was during the onset of the pandemic, but it is now at its lowest level in a decade.

Throw in the fact that every 50% rise in oil prices in the past has preceded a recession…

It is not hard to see how inflation is destroying incomes, demand and consumer sentiment. We are clearly at the latter stages of the business cycle.

So, what’s the solution? Tighten financial conditions into an economic slowdown by raising borrowing cost…

Source: Michael Kantrowitz, CFA

As we can see above, such actions will clearly reinforce the slowdown. The Fed of course have no choice in the matter as it is part of their mandate to achieve stable prices, and all they can do is use the tools available to them to attempt to achieve this. It just so happens the tools at their disposal have no ability to impact inflation. Such is the damage of inflation on the economy.

For risk assets, what matters in a large part to their performance is the direction of the rate-of-change in growth, as well as inflation. As I have discussed thus far, growth is slowing and looks set to materially decelerate throughout 2022.

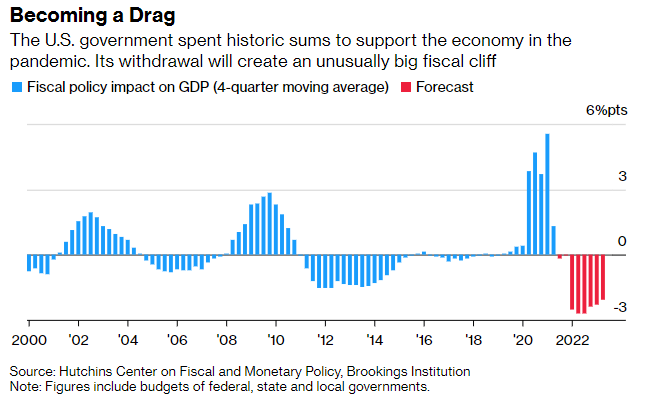

What is more concerning is that inflation also looks set to decelerate on a rate-of-change basis come the second half of 2022 (I discussed this dynamic and its implications in detail here). Should both growth and inflation indeed decelerate in tandem as the year progresses then we have a clear signal to be cautious of pro-cyclical risk assets during such times. Couple these dynamics with tightening monetary policy and a fiscal situation which has swung from stimulus to fiscal drag, investors will do well to position themselves appropriately for the year ahead.

These are the exact opposite dynamics that drove markets higher throughout the second half of 2020 and into 2021, during which we had accelerating growth and inflation, record quantitative easing, fiscal stimulus and excess liquidity. Expect the markets to behave accordingly as these factors now reverse course to the downside.

For further detailed discussion of the short and long leading indicators of economic growth and their implications going forward, please peruse my previous Growth Cycle Outlook musings of January and December.

Now, having said all this, the question then becomes at which point will this slowing growth environment truly show up in asset markets. It is important to remember when discussing macro and forecasting the business cycle that you are attempting to live in the future. Macro is slow moving and quite difficult to time to perfection. So, despite the recent weakness in equities, could we see one last rally into mid-year before we see the real growth deceleration take place? This looks to be a distinct possibility.

Indeed, there are a number of signs suggesting that the low may be in for equities for the time being.

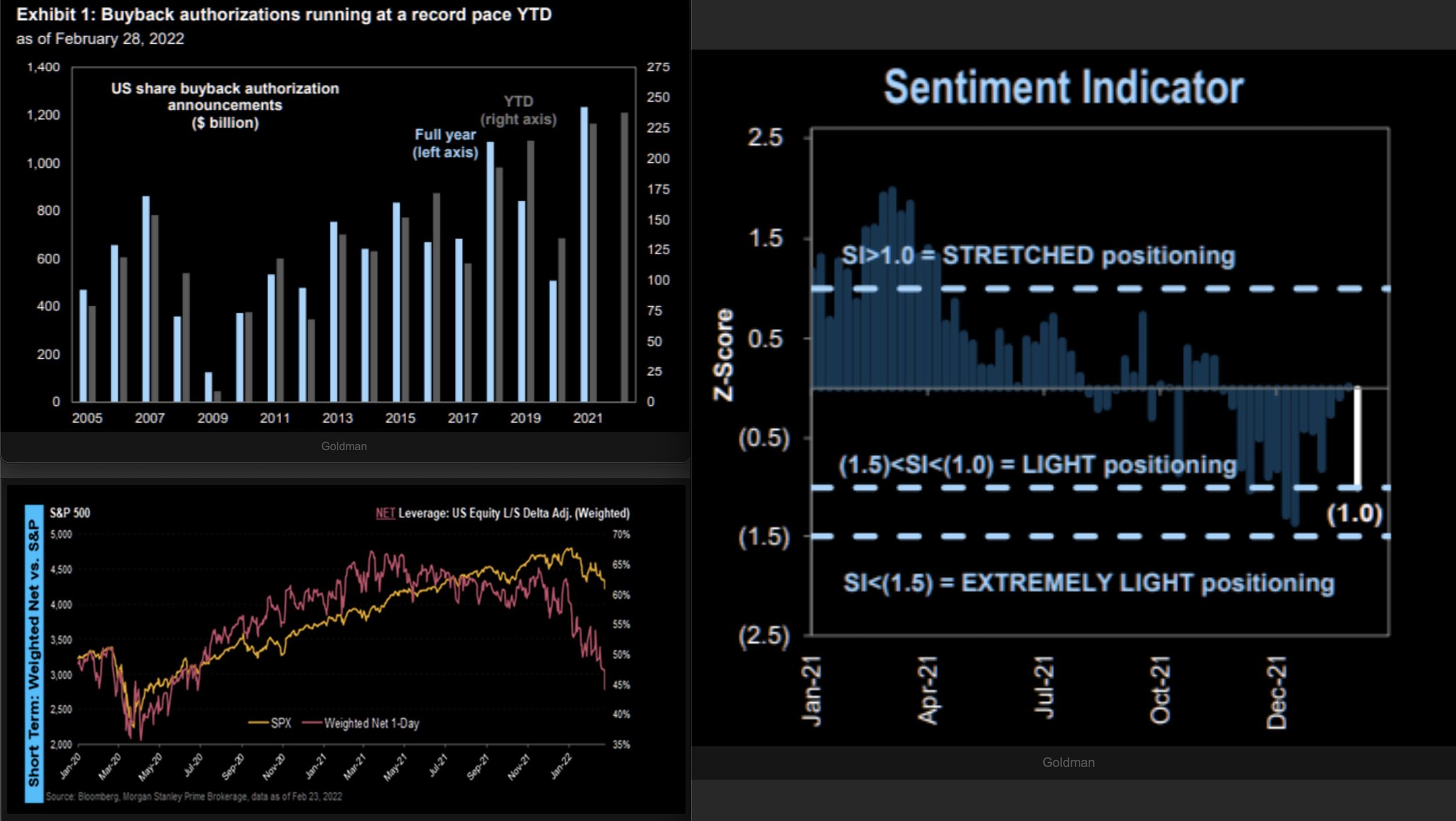

Firstly, as noted below, we can see that corporate buyback authorisations are running at a record high pace year to date, whilst sentiment has reached extreme levels of fear. Speculative leverage too has significantly reduced over the past couple of months.

Source: Imran Lakha - Options Insight

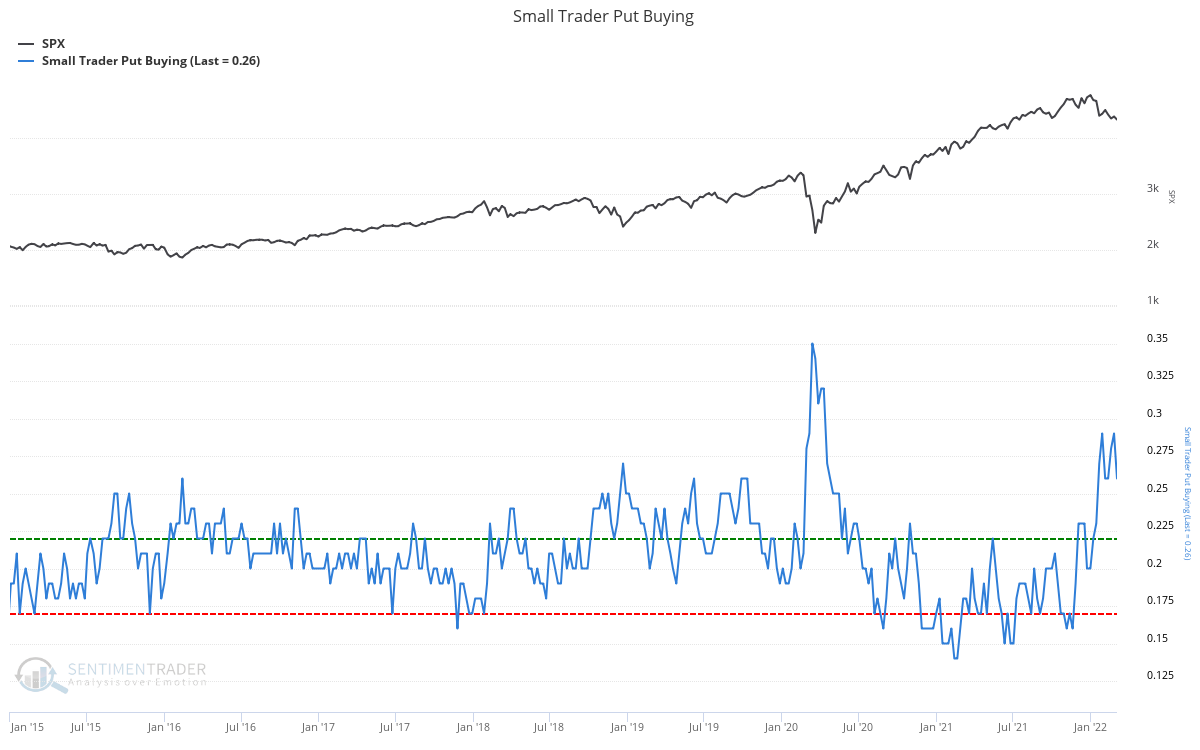

Investors have been piling into hedges via put options, again indicative of extreme fear.

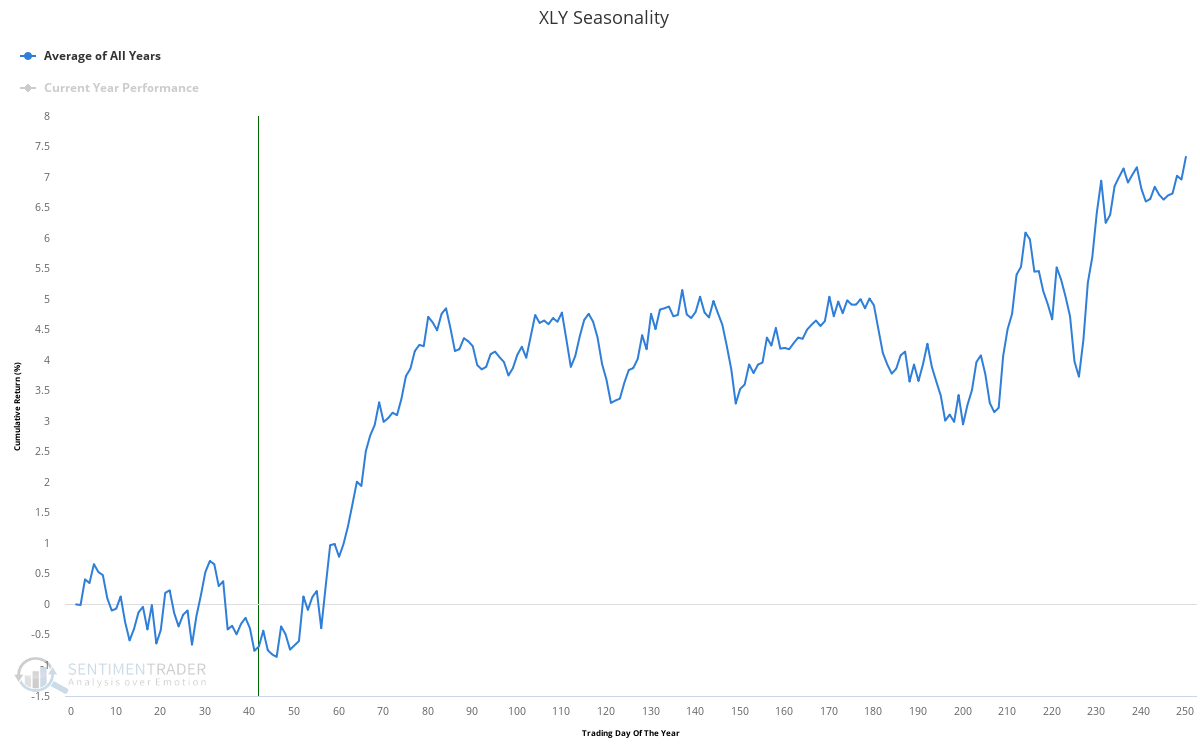

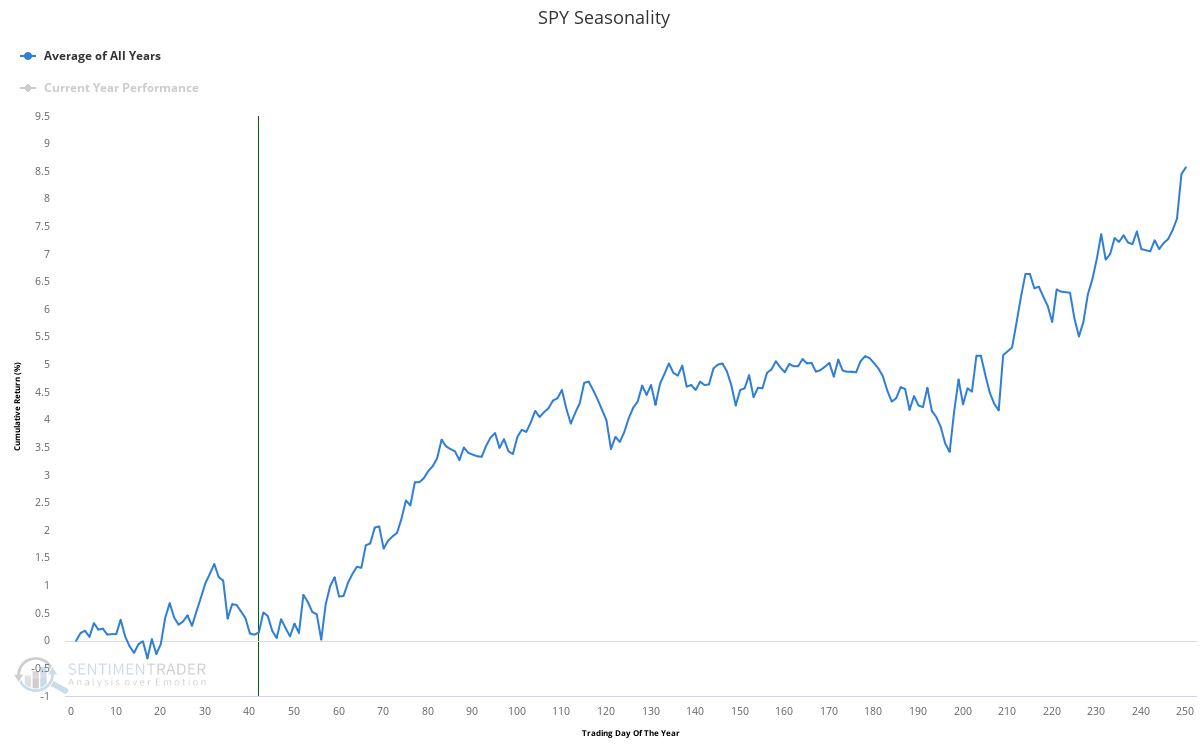

Meanwhile, seasonality for discretionary and most pro-cyclical stocks is about to enter the most favourable months of year in March and April.

As it is the stock market as a whole (and yes, due to market structure seasonality does matter).

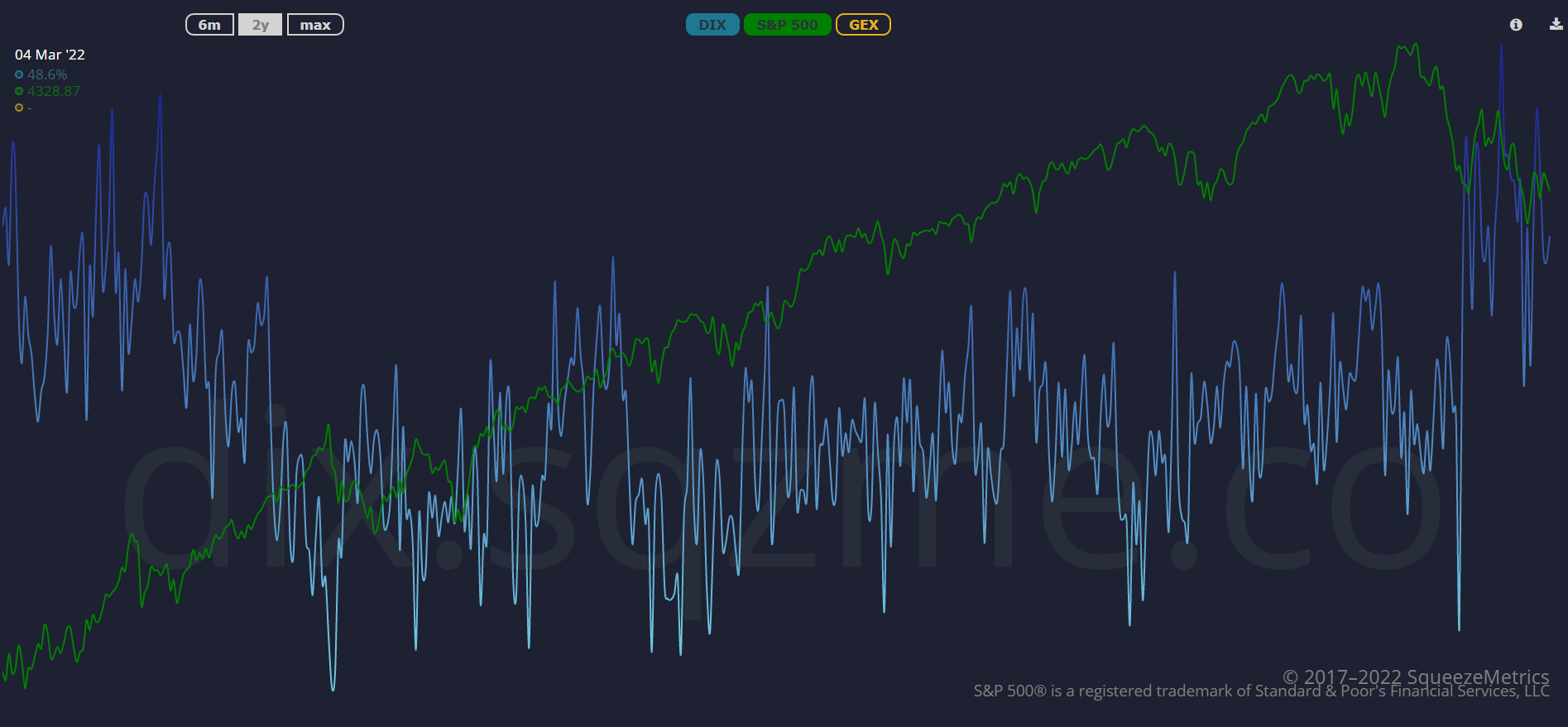

And finally, dark pools have seen a significant level of bullish activity of late, suggestive of positive market returns over the next one to two months.

Source: Squeeze Metrics

As we can see, although we are amid a growth cycle downturn there are reasons to believe we may see a rally in equity markets over the next two to three months. However, given the poor macro backdrop there are no guarantees and investors ought to be sellers into strength and take such an outcome as an opportunity to raise cash and position portfolios to a more defensive nature.

Summary and key takeaways

The leading indicators of economic growth point to a material slowdown as 2022 progresses. This is not a favourable environment for pro-cyclical equities and risk assets.

The Fed is in a difficult position whereby they have no choice but to tighten monetary conditions into an economic slowdown. Given that lagging hard economic data (via a tight labour market and low levels of unemployment) continues to point a robust economy, coupled with persistent inflation, this will likely keep the Fed on their tightening path for the foreseeable future. The Fed put will likely be struck lower that what we have seen in the past.

Additionally, better economic data coming out is not necessarily bullish for equities, as this keeps pressure on the Fed for more aggressive tightening, so too with high inflation readings in the next few months.

If we see an equity market rally into the middle of the year in the face of a severe slowdown in growth, this would appear an opportune time to take profits and position portfolios on a more defensive nature.

Investors will do well to focus on capital preservation as opposed to capital appreciation in the year ahead. A growth slowdown is not the time to be a trading hero.