An Oil Market In Healing

Summary & Key Takeaways:

The oil market is in a state of healing, after a disastrous month where a number of negative factors pushed prices down in unison.

These dynamics; seasonal weakness in demand, speculative selling, producer hedging, an oversupply of gasoline in addition to an increase in OPEC+ and US crude production, look to be running out of fuel, suggesting oil prices are probably in the process of bottoming.

With demand still holding up relatively well, any additional OPEC+ production cut could help shift the balance further toward deficits through Q1 of 2024, though any production increase by OPEC or Saudi Arabia would have me turn relatively bearish for the foreseeable future.

For now, patience is required, and for those looking to add to long-term equity holdings, it seems as good a time as any.

A story of speculators and supply

For the oil market, 2023 has been a story of the power of speculators and upside surprises in supply. Thus far, it has paid to fade speculative positioning, while those who have underestimated production have paid dearly.

On the supply side, as we can see below, Saudi Arabia’s production cuts didn’t really make much on an impact on total OPEC+ production (and subsequently on OPEC+ exports) until the July/August period of this year. It was this brief drop in production that saw the market tighten and in turn resulted in inventory draws which caused the bearishly positioned hedge funds and CTAs to start covering shorts and ultimately seeing WTI rally from the mid-$60s to mid-$90s.

Unfortunately, not only was this significant drop in Saudi/OPEC+ production and exports relatively short-lived (with OPEC+ production having increased by roughly ~700,000 bpd since August), but non-OPEC+ supply continues to surprise to the upside on the back on record US production despite several years of underinvestment. While the below chart is based on the EIA’s monthly US oil production statistics (which are far more reliable than the weekly production estimates they produce, but far less timely), all signs point to October and November production having exceeded expectations.

And of course, in addition to record US production helping to offset Saudi production cuts and Russian export cuts, Iranian crude oil production continues to increase on the back of lax sanctions enforcement to the tune of around 500,000 bpd above seasonal averages.

Meanwhile, it seems the Russians only briefly stuck to their 300,000 bpd exports cuts in July and August before returning to the 3.3-3.5 million bpd mark as prices rallied to their highs in October.

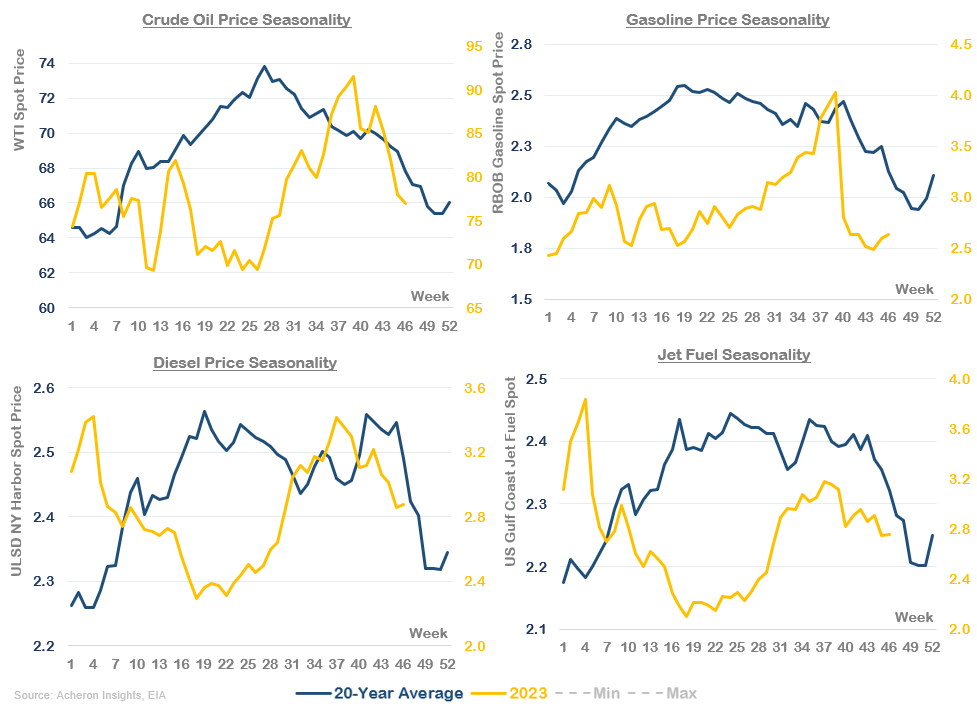

October and November are also generally bearish months for oil and energy prices as this period is post the northern hemisphere summer driving season and generally sees refinery runs drop as refinery maintenance picks up, as well as the annual Mexican oil producers Hacienda hedge.

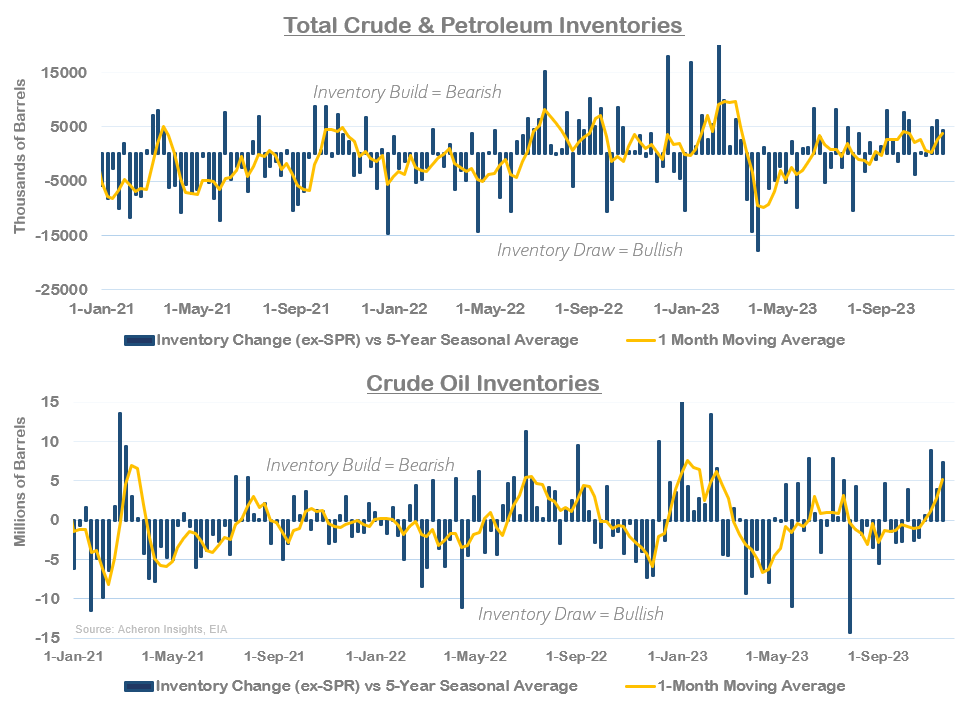

In all, the story of upside surprises in supply coupled with a period of weaker demand has seen seasonally adjusted inventory draws shift to inventory builds over recent weeks, coinciding with the recent drop in prices.

As it stands, the current inventory picture remains bearish. Not only are we seeing inventory builds higher than seasonal averages, but total crude and petroleum inventory levels are now no longer below their respective seasonal averages. In terms of refined product inventories, it is encouraging to see gasoline draws return to the market these past few weeks, while diesel stocks remain at worryingly low levels as the market remains tight due to a combination of reduced Russian diesel exports and reduced production of Saudi heavy/sour crudes (which are generally easier to refine into diesel as opposed to gasoline).

As a result of these bearish dynamics playing out over the past month or two, prompt futures spreads have been pushed into a state of slight contango for WTI and Brent, along with Brent CFDs and DFLs also shifting into contango. This is seemingly confirming the notion that the market is no longer as tight as it was, with a contango term structure also incentivising inventory builds as opposed to inventory draws

All these factors left oil vulnerable to a speculator driven sell-off. This is exactly what happened and why paying attention to hedge fund and CTA positioning in the market has paid handsomely this year. Managed money was caught near record short at the bottom in July, and subsequently near record long at the top in early October.

Historically, such extremes are almost always excellent opportunities to both take profits and enter longs. Fortunately, we are once again nearing extreme bearish levels in managed money positioning, meaning the downside is perhaps limited from here, barring exogenous shocks such as an OPEC+ production increase.

On the whole this is a very constructive development, with this week’s Commitment of Traders release likely to report further liquidations of speculative longs and/or an increase in shorts.

Another way I like to measure positioning is through the lens of managed money longs as a percentage of managed money open interest, which as we can see below, is reaching washout levels for WTI. Unfortunately, the same cannot be said of refined product positioning. Managed money is still neutral gasoline but very long diesel. This makes sense given the relative tightness of the diesel market, but also suggests the asymmetry in the diesel market is to the downside at present.

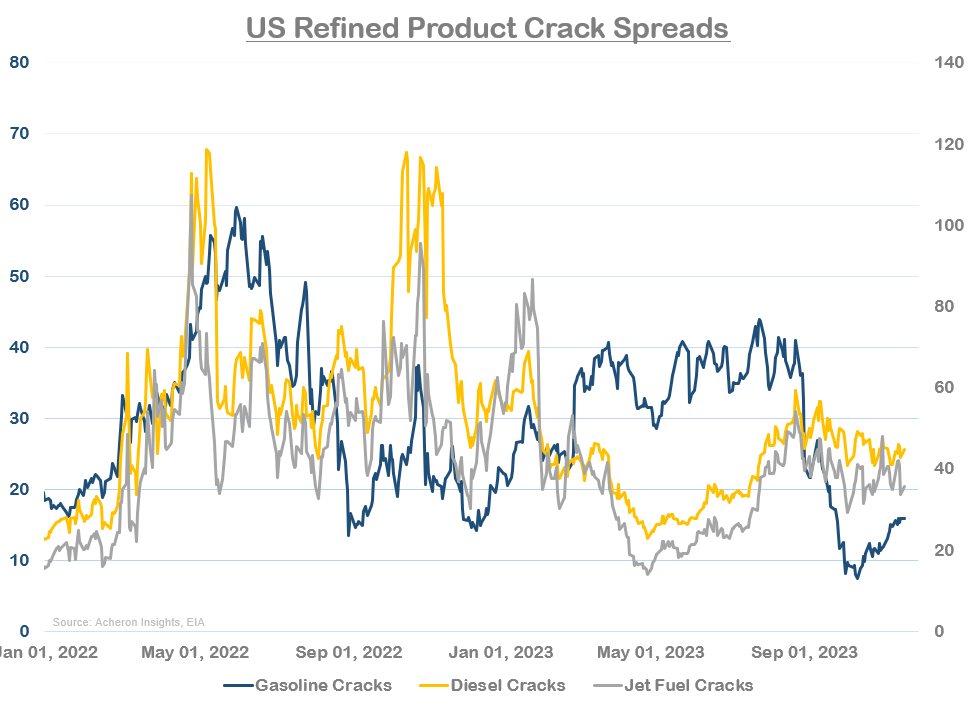

If we turn our attention now to some of the indicators of the physical market, we are seeing positive signs under the hood. Most notably, gasoline crack spreads are in the process of healing after collapsing throughout September and October. Falling gasoline cracks were always going to impact refinery runs to some degree (and thus crude demand), even if diesel/jet fuel margins have remained attractive.

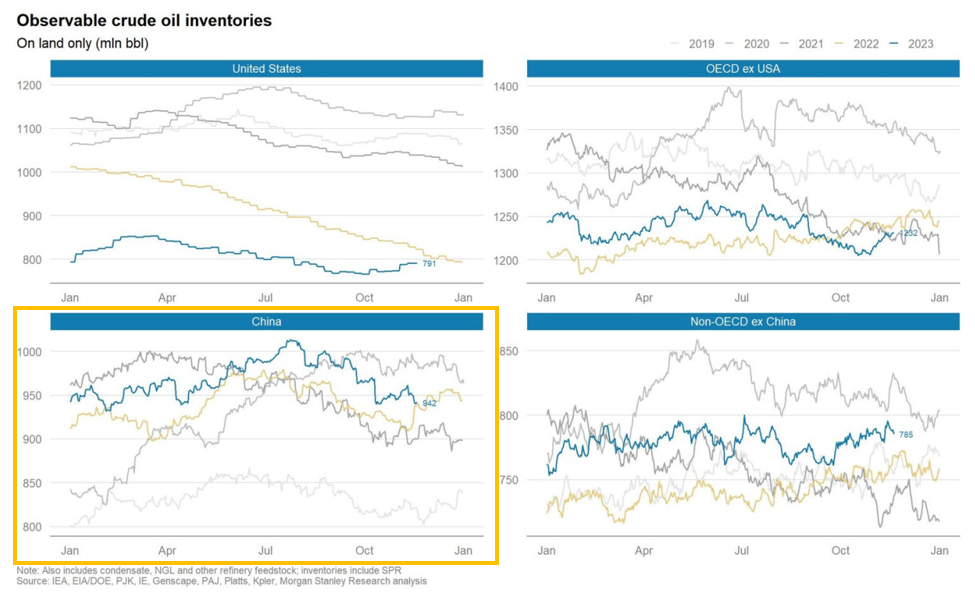

Meanwhile, the threat of Chinese inventories being released onto the market and thus capping prices has seemingly come and gone. This dynamic was central to my thesis as to why it seemed unlikely we would reach triple digit oil prices this year. Chinese on-land inventories look to have peaked around 1,000 million bbls mid-year, before being drawn down as prices rallied into October. Chinese inventories now sit more-or-less at seasonal averages for this time of year.

Source: Morgan Stanely

While Chinese demand certainly hasn’t been as high as some predicted following their reopening, I think it is fair to say Chinese demand is doing okay. And while Chinese imports are sitting at average levels for this time of year, the Singapore gasoil vs Dubai crack spread remains at fairly robust levels.

Source: Refintiv

While the Dubai/Brent EFS is near parity, suggesting Asian demand is proving robust (with Dubai crude relative to Brent often acting as a proxy for Asian demand given Asia is the marginal buyer of Dubai crude).

Source: Refinitiv

The elephant in the room

Having said all this, the arbiter for oil volatility at present is of course the OPEC+ meeting set for later this week.

OPEC+ first cut production in October 2022 to the tune of 2 million bpd, which was followed up by a voluntary 1 million bpd cut by Saudi Arabia this year in addition to a pledge by Russia to reduce exports by 300,000 bpd, both of which have been extended to the end of 2023. But as we discussed earlier, actual production has been inconsistent versus OPEC+ quota (with the UAE and Iraq being a couple of the other major culprits).

I should preface this section by first saying I am not in the business of trying to predict OPEC’s moves, however, were I to do such a thing my assessment is it seems likely OPEC will at the very least refrain from making any increases to production, and perhaps even propose further production cuts or enact better enforcement of current production quotas.

It is no secret Saudi Arabia wants prices higher and prompt spreads in backwardation such that we go back to seeing inventory draws. Backwardation also disincentivises selling of futures due to negative roll yield, as well as advantaging OPEC National Oil Companies which can’t/don’t hedge (i.e. sell forward) their production to the extent that US producers do.

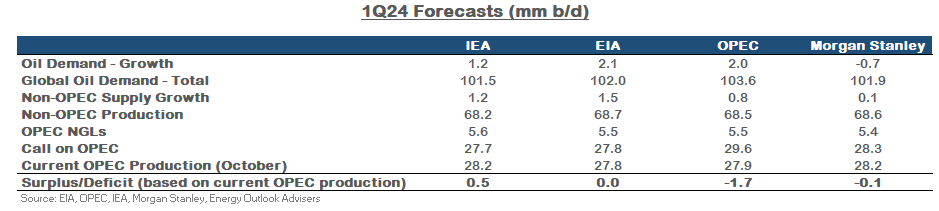

As to whether they need to cut, OPEC’s estimates of demand for the first quarter of 2024 are much more bullish than that of the IEA or EIA, as we can see below. Thus, for them to agree on further production cuts would seem to contradict their assessment of the current balance of the market and confirm the notion the market is not as tight as it was in Q3.

In addition, the cost OPEC+ will pay for further cuts will be in the form of the continued ceding of market share to US producers in the Permian, meaning there is a significant risk for Saudi Arabia in particular should any additional cuts or extensions to existing cuts not spur a market rally at some point in the coming months said cuts. This puts OPEC+ and Saudi in a tricky position given there are incentives for both cutting and increasing production, though I think the cuts will continue to win the day for now.

All in all, the oil market is in healing

Putting it all together, the state of the oil market is on solid footing. A number of negative forces have pushed prices lower since the early October peak, in the form of speculative selling, seasonally weak demand and an oversupply of gasoline (both of which resulted in reduced refinery runs), an increase in OPEC+ production/exports as well as market makers selling futures against the hedged of Mexican oil producers.

These forces are probably nearing their crescendo, and given we remain in a relatively neutral market (perhaps a slight deficit), things are looking brighter. Demand is still robust, and those interpreting this sell-off as a recession signal appear to be drawing a misinformed conclusion. Having said that, supply has been and will probably continue be sufficient to meet demand for the most part for the next year or so. Any additional OPEC+ production cut could help shift the balance further toward deficits through Q1 of 2024, though any production increase by OPEC or Saudi Arabia would have me turn relatively bearish for the foreseeable future.

Should we see crack spreads continue to heal themselves following gasoline’s significant post-driving season slump, this should help increase refiner throughput and thus slowly but surely put speculators in a position where they turn from seller to buyer. In addition, I would also like to see prompt spreads flip back into backwardation, a washout in refined product positioning and most importantly, persistent inventory draws for crude and petroleum products alike, a combination that would go a long way to fuelling another material rally in crude. For now, patience is required, and for those looking to add to long-term equity holdings, it seems as good a time as any.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.