The Red Flag Looming Over Markets

Summary & Key Takeaways:

The economy and financial markets have been resilient to the tightening of credit conditions we have seen so far this cycle.

This resilience has primarily been a result of the fantastic shape of household balance sheets, in addition to corporations terming out their debt at record low rates in 2020 and 2021.

But cracks are beginning to show, particularly surrounding credit card and consumer debt.

Meanwhile, the outlook for corporates is much more bleak as a wave of refinancing is set to begin this year.

And while households are well equipped to deal with tightening credit conditions, corporations have merely deferred the credit cycle, not escaped it.

Therefore, as corporate refinancing needs accelerate in 2024 and 2025, upside pressure on credit spreads should return, a material headwind for corporate earnings, volatility and the stock market.

Slowly by surely, the credit cycle is catching up

Although I have been viewing the credit cycle as a notable headwind facing the economy and stock market throughout 2023 and 2024, it’s fair to say deteriorating credit conditions for both households and corporates have had little discernible impact on financial markets or the real economy so far this cycle.

Slowly but surely however, we are seeing tighter credit conditions seep their way through the economy. Some things just take time. And, for reasons I shall reaffirm below, this credit cycle (and business cycle) is simply taking longer to play out than expected.

Central to the credit cycle is the ability for households, as well as small, medium and large corporations to access credit. There is no question that access to credit is the lifeblood of the US economy. This access to credit is perhaps best represented through commercial bank lending standards, which, as we can see below, the percentage of banks tightening lending standards reached their highest levels since the GFC and COVID-19 recession throughout 2023, and are only now starting to ease.

Meanwhile, credit spreads remain floored at cyclical lows. This is true for both high yield and investment grade credit.

Even though we are yet to see a commensurate rise in credit spreads that historically have accompanied stricter lending conditions, we are beginning to see signs of rising credit stress among small businesses. As we can see below, per the NFIB Small Business Survey, small business credit conditions are close to decade lows, while interest costs are close to multi-decade highs.

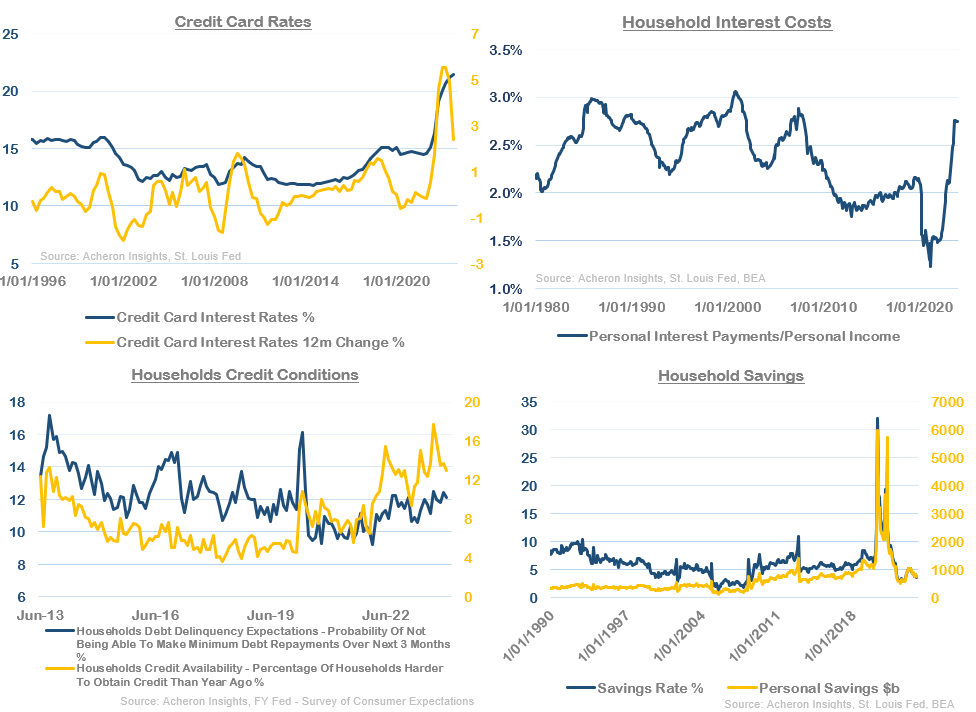

Similar signs of a slow but steady deteriorating credit cycle are showing up in household data too, particularly as it relates to credit card and consumer debt. As we can see below, credit card rates and personal interest payments as a percentage of personal income are both at decade-plus highs, while the percentage of households expecting debt delinquencies and those that are finding it increasingly more difficult to obtain credit are also on the rise.

Meanwhile, now that households have depleted much of their savings and are also saving at their lowest rate in over a decade suggests these cyclical pressures are like to becoming increasingly exacerbated, and in turn translate into a reduction in household consumption.

It is thus unsurprising to see credit card delinquencies continue to rise, particularly those issued by smaller banks.

But, outside of a small rise in delinquencies from credit cards and consumer credit, overall delinquencies so far this cycle have been mute. This is important to note as consumer and credit card debt only makes up a very small portion of overall household debt levels. Importantly, there is little credit stress for households surrounding mortgage debt, nor those for corporations.

Why hasn’t the credit cycle mattered so far this cycle?

Indeed, the final point above explains much of why the tightening of credit conditions have so far this cycle had little impact on economic growth, consumption, corporate defaults or credit spreads. Not only that, but as I have been stating for some time now, household balance sheets are the strongest they have been in decades. This is true from both an outright debt level, but also from a debt serviceability standpoint. As a result, households are in the best position to deal with tightening credit conditions that they have been in a long time.

While these dynamics do explain much of the economic resilience we have seen over the past 18 months, they do not automatically mean households are immune from the stresses of tightening credit conditions on a cyclical basis. Indeed, as we saw earlier, tightening credit conditions (particularly surrounding credit card and consumer debt) continue to suggest that on a cyclical basis, the credit cycle downturn that is yet to play out it is likely to eventually translate into some form of economic and financial market weakness. It just won’t be any kind of deep, GFC-style recession.

From the perspective of corporations however, the story of why tightening credit conditions hasn't translated into widening credit spreads is much different. I would argue corporations have simply deferred the credit cycle, not avoided it.

There is no question that one of the main reasons why the economy has been so resilient to higher interest rates (other than strong household balance sheets), has been the fact that over the past three or so years, corporations largely deferred the need to refinance by terming out their debt at record low interest rates in 2020 and 2021. Not only is the duration of outstanding high yield corporate debt the lowest in decades, but the need to begin refinancing that debt commences in 2024, with around a fifth of total US corporate debt in need of refinancing over the next three years at much higher interest rates.

Indeed, according to S&P Global, approximately $438 million and $360 million in investment grade and high yield debt respectively will need to be refinanced throughout 2024 in the United States.

While the large and mega-cap companies that dominate the Nasdaq and S&P 500 will be able to deal with such refinancing needs with ease, those small-to-medium enterprises with lower credit quality who do not have the level of cashflow and cash on hand compared to the mega-cap behemoths will struggle. There is no doubt corporate balance sheet health is being skewed to the upside by the top companies.

Source: BofA

The overall picture is much less rosy. Indeed, according to Fathom Consulting, financial strength across the entire US corporate world is the lowest in decades.

These dynamics suggest the upcoming refinancing wave is likely to have significant implications on credit spreads, particularly those of a high-yield variety.

So, where are we now in the credit cycle?

In terms of the outlook for the credit cycle itself, almost all the leading indicators suggest the trend of tightening credit conditions will continue throughout 2024, with the aforementioned refinancing cycle likely the catalyst.

Though it is true we have probably seen the cycle peak in the banks tightening of lending standards, it is important to remember these trends take time to filter through the system. Indeed, lending standards continue to suggest loan growth for commercial and industrial loans could continue to contract for some months still.

While the same can be said of consumer credit growth, right at a time when households are beginning to feel the pinch around rising consumer credit costs.

Thus, as loan growth continues to decelerate and refinancing needs rise, we ought to expect delinquency rates to follow credit conditions higher.

As the corporate refinancing cycle accelerates through 2024 and into 2025, credit spreads should ultimately move higher. This is something lending standards have been pointing to for some time.

In addition to interest rates.

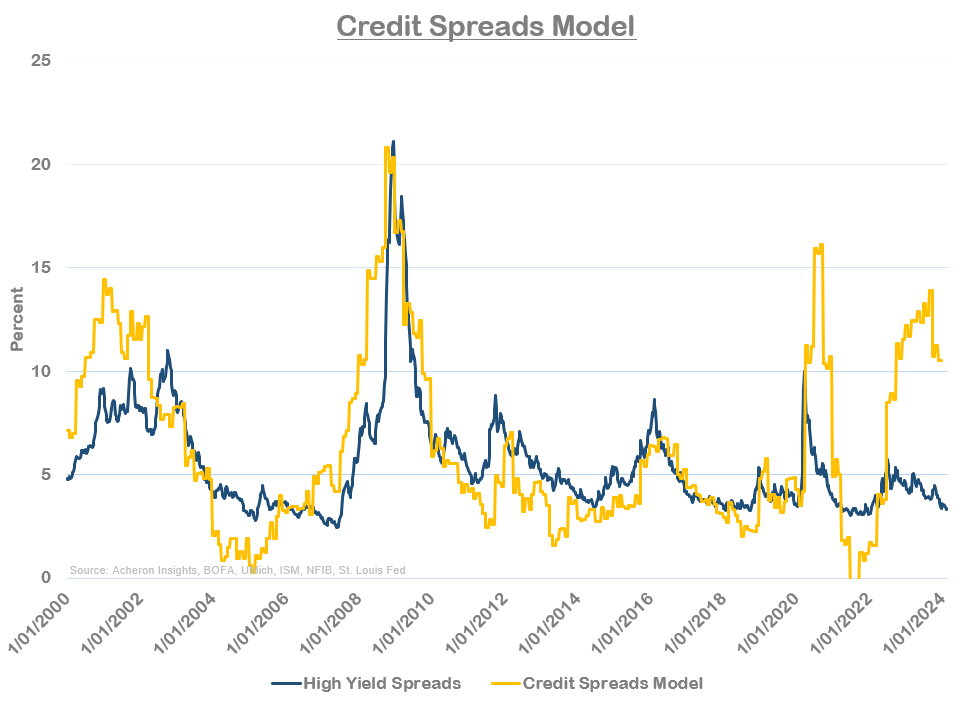

While my composite credit spreads model has also been suggesting spreads are too low. It is notable the last time we saw such a divergence between credit spreads and my model was just prior to the GFC. But, as I have discussed, don’t expect a blowout in credit spreads to such a degree that we saw in 2008 and 2009, given household balance sheets are in much stronger position now compared to back then. Nonetheless, the divergence is clear.

Consequences of the credit cycle

Regardless, I do expect at some point in the near future, the implications of tightening credit conditions will rear their ugly head, even if it is to a lesser extent than we have seen historically.

Given how small businesses in particular are heavily reliant on credit availability, and their important role in job creation, it is only natural that tighter credit conditions eventually lead to a rise in unemployment.

And of course, credit spreads are highly correlated with equity returns.

As well as volatility. In fact, when it comes to volatility, the credit cycle is perhaps the move important driver of the volatility cycle.

Especially when you consider the relationship between credit spreads and corporate earnings. A solid case can be made that the recent strength in S&P 500 EPS growth has been a result of benign credit spreads. If my analysis is correct and we do see spreads widen at some point over the next 12-18 months, then earnings growth is likely to suffer, and with it the stock market.

It is for this reason as to why I view the credit cycle as one of the major headwinds facing stocks and risk assets moving forward. Given how equites and credit have now almost entirely priced in any type of economic recovery we could see in 2024, the credit cycle downturn may be about to rear its ugly head.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.