Stock Market Vulnerability On The Rise

Rising risks for stocks

The continued rally in equity markets seems to be slowly reaching its crescendo. While the fundamentals have been screaming bearishly for some time now, there have been a number of structural factors at play driving markets higher in spite of these headwinds.

Namely, increased short-term liquidity, underweight positioning, dealer flows and falling implied volatility have all been supportive of equities since late 2022. But, as this market continues to move higher and these bullish dynamics lose their steam, signs are again beginning to pop up suggesting we may be edging nearer to the point whereby the fundamental reality facing markets comes to the fore.

Indeed, on a tactical basis (that is, over the next few weeks to months), an increasing number of bearish signals are emerging. First and foremost, net liquidity has been unsupportive of higher equities since April.

Likewise, the developments underway within the bond market could too be troublesome. Bond yields look to be breaking out to the upside of what appears to be a bull-flag continuation pattern that has developed over recent quarters.

While this breakout in yields could prove to be a false dawn, should this move in rates to the upside continue we will likely see a renewed rise in interest rate volatility (inverted below). Similar to what we saw during 2022, this is likely a bad outcome for equities.

And of course, no market is more vulnerable to this dynamic than the mega-tech Nasdaq, with the recent divergence between itself and yields (inverted below) becoming more and more extended by the day.

Meanwhile, investor sentiment is again reaching levels of extreme bullishness, triggering a bearish reading on Morgan Stanley’s Market Sentiment Indicator.

Elsewhere, I am also noticing a number of binary short-term buy/sell signals trigger. Firstly, the relative strength of stocks vs bonds just triggered its second sell signal in as many weeks.

While we have also seen a volatility sell signal trigger on both the S&P 500 and the Nasdaq. This occurs when both stocks and implied volatility rise in tandem, a move that is generally unsustainable. It is worth pointing out that we last saw a number of these sell signals trigger toward the market top in late 2021.

We can also view this volatility dynamic through the lens of the implied volatility term structure versus price. As we can see below, a number of measures of longer-dated implied volatility relative to shorter-dated implied volatility have diverged bearishly from price. This suggests that near-term uncertainty is rising, with such divergences often presaging price action.

Perhaps the most important development of all in recent months has been the changes in positioning. Following the culmination of the sell-off in mid-2022, investors were underweight risk assets to a historic degree. When everyone is bearish and have positioned their portfolios as such, it is difficult for equities to go lower regardless of whether the macro conditions or fundamentals say they should. Now, as stocks have rallied, positioning has too slowly but surely shifted bullishly.

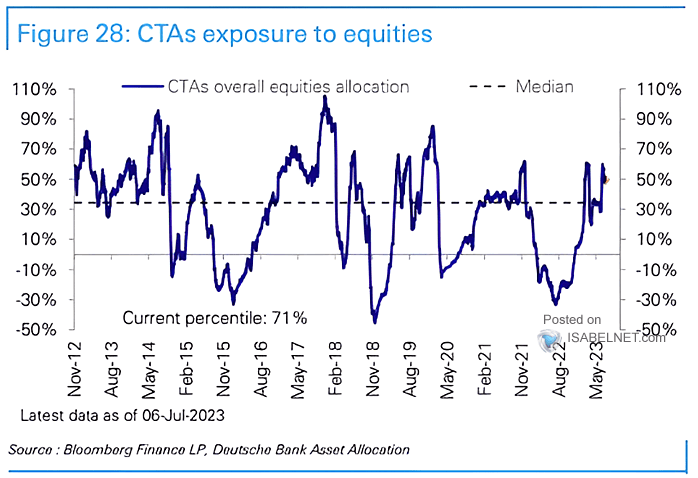

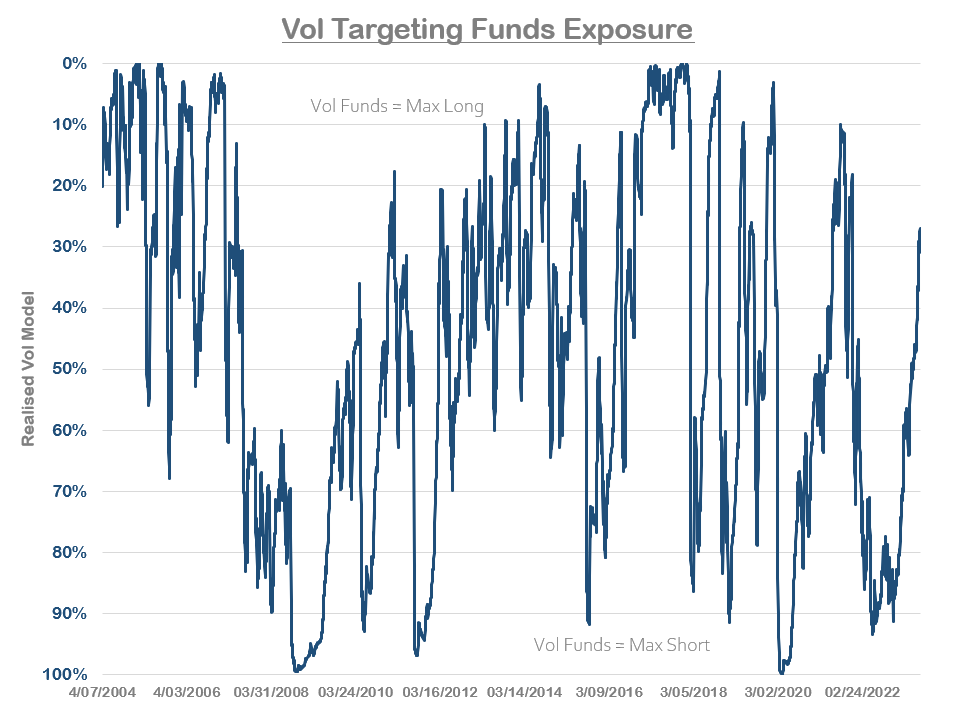

This is true of discretionary, trend following and systematic strategies…

As well as volatility targeting funds. Simply put, sentiment and positioning are no longer wholly supportive of risk assets.

It is also important to remember we are amidst a seasonally lackluster period for stocks.

Turning to the technicals, the chart of the Nasdaq is striking. What we have seen over the past couple of months is akin to parabolic price action. However, we have recently triggered a 9-13 DeMark sequential sell signal. As such, it seems the odds are favouring at the very least a minor pull-back/consolidation in the near-term.

However, it is difficult to be too bearish as yet when the market continues to make higher highs and higher lows amidst a clear uptrend. Indeed, the thing about blow-off tops and parabolic price action is that such moves can go on far longer than one would expect. The old adage is that “markets can stay irrational much longer than you can stay solvent”, and with passive, systematic strategies and dealer hedging flows dominating markets in recent years, never has this statement been more true.

We must recognise that, despite the mounting headwinds facing markets at present, this market could go higher still.

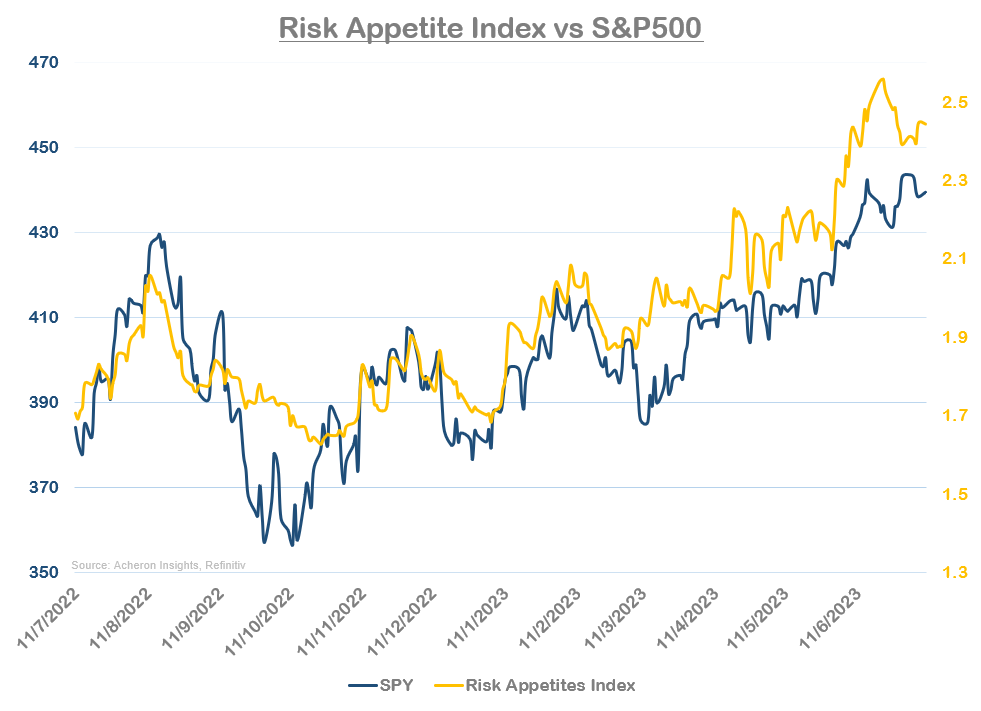

Indeed, both my measures of market internals - pro-cyclical stocks vs S&P 500 and composite measure of investor risk appetites - are generally pretty favourable of higher prices for now.

Meanwhile, the spike in short-dated implied volatility we have just seen in anticipation of this week’s CPI release is also likely to provide short-term fuel to markets as it normalises lower.

And of course, although positioning is slowly becoming stretched, it can easily go higher still. We must respect the upside risk but remain cautious.

Longer-term, investors will do well to remain cautious

In assessing the longer-term outlook for stocks - that is, buying and holding risk assets for a 12-36 month period - I will again refer to my indicator dashboard.

While market internals remain on the supportive side, economic, liquidity and financial conditions do not. What’s more, as discussed earlier, positioning is now shifting from tailwind to headwind.

Perhaps most important from a buy and hold approach to equities is my preferred long-term measure of liquidity. Excess liquidity tends to lead risk assets by around 12 months and is yet to inflect higher. It is not uncommon for stocks to diverge from excess liquidity one way or another for a period of time, but the latter tends to be right over the long-term.

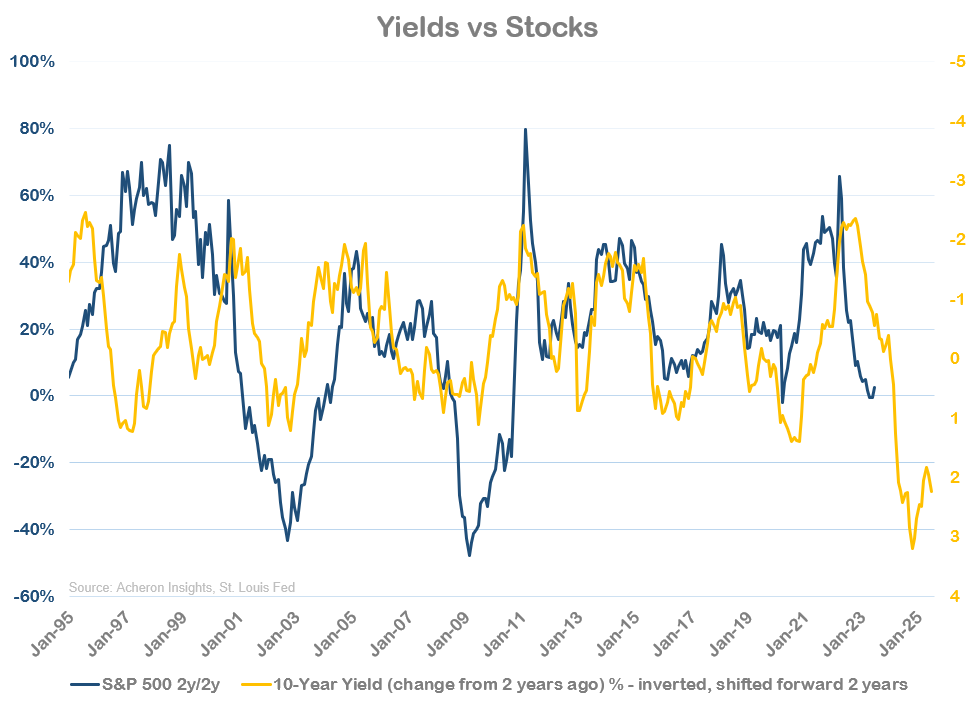

It is also worth highlighting how a higher rate environment tends to be unfavourable for stocks, with long-term movements in yields historically leading long-term changes in stocks by around 18-24 months.

Another significant headwind facing equities are the outlook for earnings. Although the market has priced in much of this expected negative EPS growth, it seems consensus EPS forecasts still remain a little too optimistic.

Source: Morgan Stanley

Speaking of market pricing, from a growth perspective I would say stocks are now well and truly pricing in a soft landing.

And let’s now forget, the market is still very, very expensive, particularly on an interest rate adjusted basis. Now is not the time to buy and hold. Beta is not your friend.

. . .

Thanks for reading!

If you would like to support my work and continue to allow me to do what I love, feel free to buy me a coffee, which you can do here. It would be truly appreciated.

Regardless, feel free to share this with friends and around your network. Any and all exposure goes a long way and is very much appreciated. Thanks again.