The Greenback

A trend I have been keeping a close eye on lately is the direction of the US dollar. To me, the dollar may be the single most important determinant in the direction of the majority of asset classes and markets.

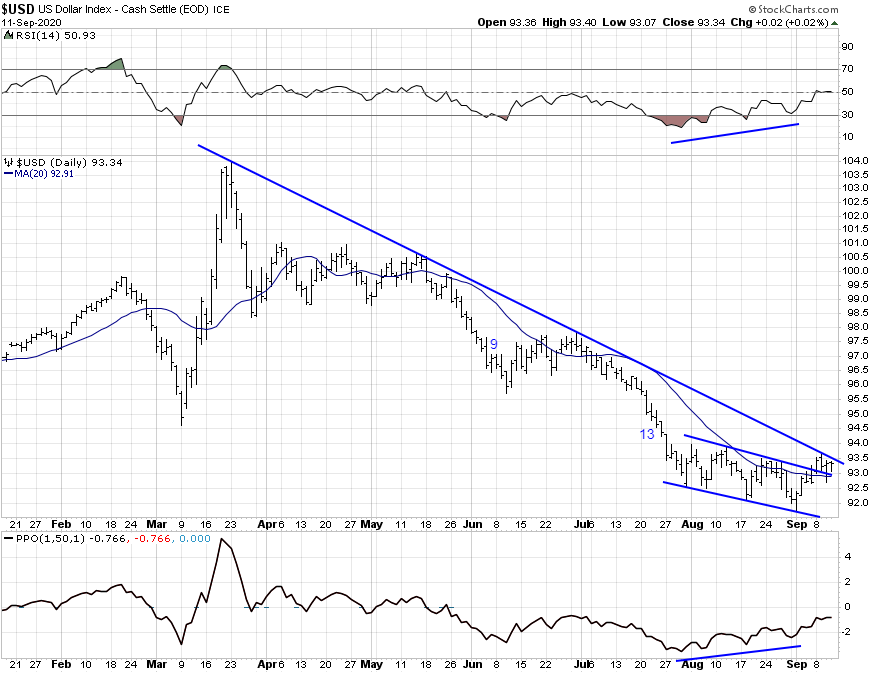

The dollar index (DXY) peaked at around 104 during the height of the risk-off rally in mid March, it has has steadily trended downwards since. However, there are signs the dollar may now be finding a short-term bottom. From a technical perspective, the new lows of around 94-92 have been accompanied by bullish divergences in RSI and momentum (measured as price relative to its 50 day MA). Indeed, we can see the dollar has bullishly broken out of its August trading range whilst finding resistance at its downtrend line that dates back to the March highs.

Source: StockCharts.com

Whether these developments represent a consolidation period prior to another move lower or trend reversal, at this stage I am unsure. What is prescient at the moment is the narrative that the the days of dollar dominance are coming to an end with inflation likely to rear its ugly head. Indeed, the net short futures positioning of large and small speculators attests to this belief.

Source: BarChart.com

Whilst my (very) long-term opinion of the dollar probably resides in the bearish camp, such negative sentiment towards the dollar (as illustrated above) appeals to my contrarian nature and leads me to believe we may be a while away from this narrative fulfilling itself. Historically, whenever speculators have been net short, we have seen the dollar rise over the ensuing months.

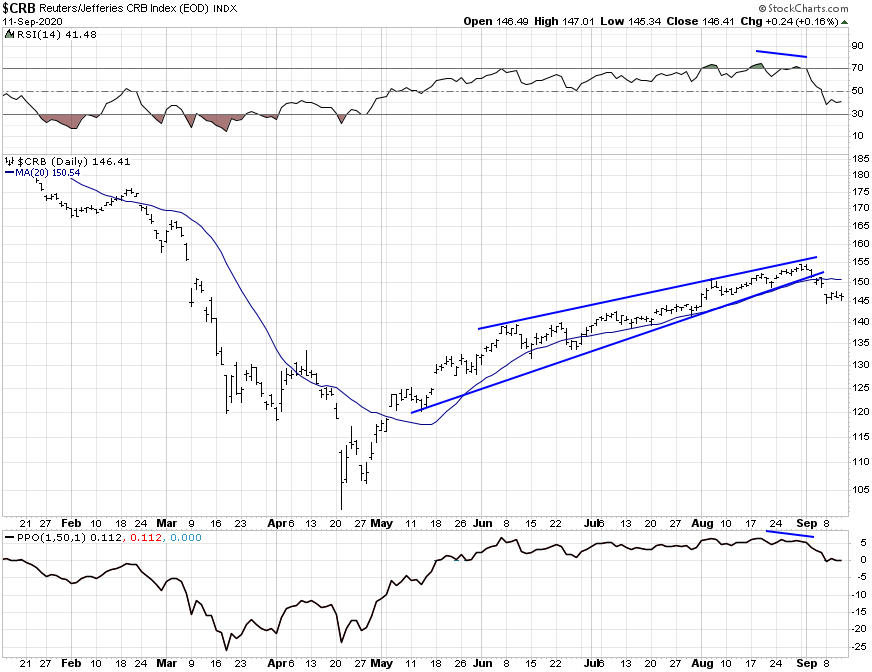

From a shorter-term fundamental perspective, particularly on the inflation front, there a signs the weakness in the dollar may be premature. If we look at commodities (as measured by the CRB commodity index), whose price is largely an inverse of the dollar, appear to have bearishly broken out of its rising wedge pattern.

Source: StockCharts.com

Likewise, the recent parabolic rise in lumber looks to be reversing in dramatic fashion, copper and oil too appear to be putting in short term tops on waning momentum (not pictured). I would argue the reflation phase of the recovery is still yet to commence, and perhaps what’s every more likely in the near future is a continuation of the deflationary pressures that accompany a recession.

A relationship which I have mentioned previously is GDP’s leading ability to predict core-CPI by around 12-18 months, which tells me that the deflationary trend in CPI may indeed still have some life left.

Source: St. Louis Fed

Likewise, when banks tighten their lending standards during recessionary conditions, restricting credit for both businesses and individuals, this has historically been associated with a stronger dollar in the short-term. Until banks ease their access to credit, such a dynamic is certainly a tailwind for the dollar.

Source: St. Louis Fed

There are also a number of markets whose outperformance has historically been tied to that of a falling dollar who are yet to confirm the dollar weakness. Firstly, weakness in the dollar relative to the Euro should be confirmed by outperformance in the Eurozone equities relative to the S&P 500. As indicated in the chart below, this has not been the case since over the past couple of months.

Source: StockCharts.com

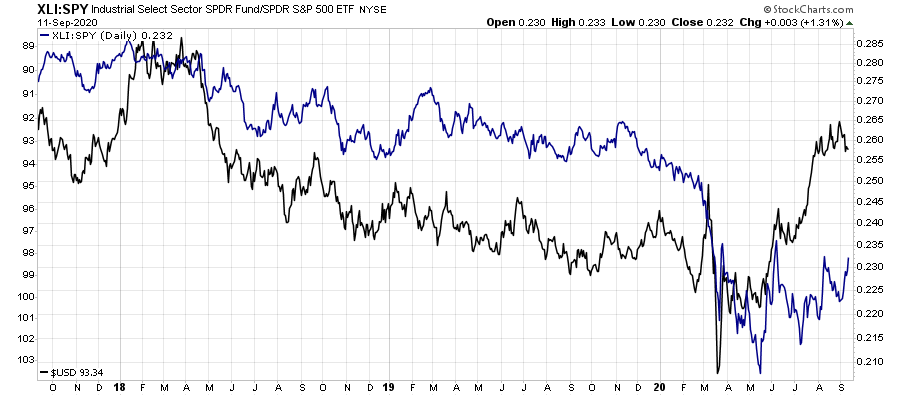

Furthermore, several sectors whose relative performance to the broad market is largely a function of the direction of the dollar are also giving non-confirmation signals.. During periods of dollar weakness and thus rising inflation expectations, companies with greater levels of operating leverage (ie a greater level of fixed costs relative to variable costs) would usually see increases in their profit margins during such times as they able to increase their revenues without the need to dramatically increase their costs. The materials and industrials sectors are the prime examples of this, whilst the tech sector is on the opposite end of the spectrum. These relationships have all diverged to some degree over the past couple of months.

The energy sector, emerging markets and small caps are all sending a similar message (not pictured).

However, there is a caveat I must point out regarding how much of a reliable signal the relative performance of these sectors actually provides. Firstly, I am of the opinion that we are amidst a speculative bubble that is perhaps the largest in history, which to me, is primarily been driven by market structure forces (excessive call option buying by retail, volatility selling strategies, monetary policy and passive investing) that act in the self-reflexive manner on the way up and the way down, massively distorting market prices from fundamentals.

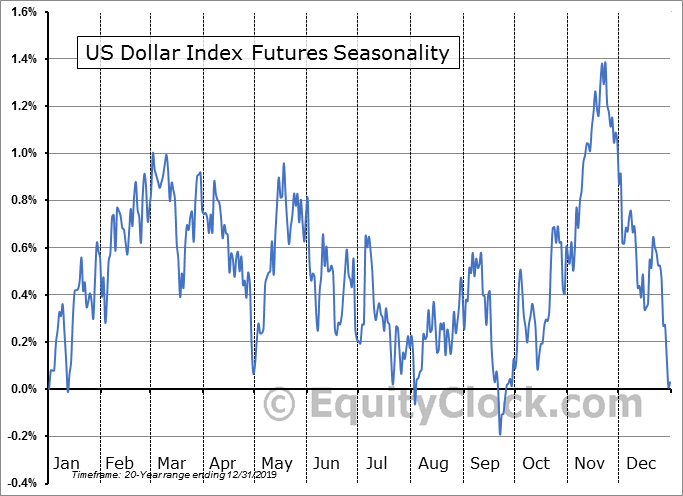

Nonetheless, there are various technical and fundamentals indicators pointing to the dollar being due for a bounce. Futures seasonality confirms this, which as we can see, shows us historically that the dollar has performed well during the October to November period.

Source: EquityClock.com

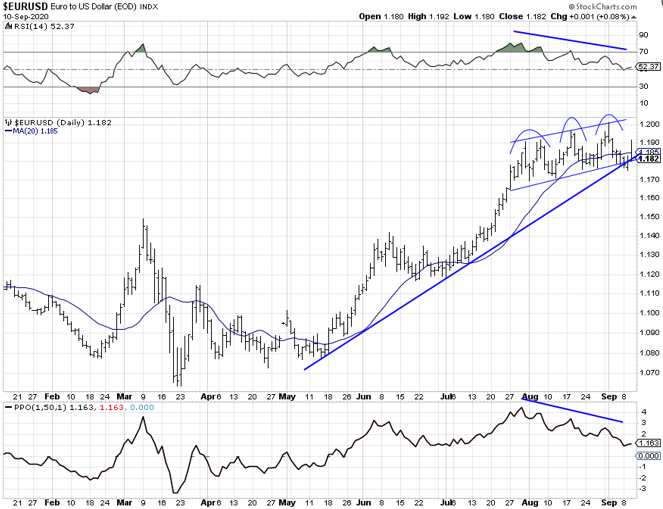

Whilst a period of dollar strength may be imminent, for this to be the case the dollar itself must strengthen relative to other currencies. The dollar index itself (DXY) is most heavily weighted towards the euro (approx. 57%), the Japanese yen (approx. 14%), the pound (approx. 12%), the Canadian dollar (approx. 9%), with nominal weightings in the Swedish krona and Swiss franc making up the balance. Technically, the euro looks to be potentially forming a short-term top/consolidation on waning RSI and momentum. It recently broke out of its trading range and had a false breakout of its uptrend line dating back to early May. A sustained break below the uptrend line would certainly have a negative impact of the DXY.

Source: StockCharts.com

The yen looks to have formed a pennant patter, of which a breakdown below the lower rising trendline would be bearish.

Source: StockCharts.com

And finally, the pound has already broken down from its rising wedge pattern.

Source: StockCharts.com

Similar to the dollar, these are important technical junctures for all these currencies. If the euro, yen and pound all breakdown bearishly and the dollar breaks its downtrend line, we may see an aggressive bound in the dollar.

If the correction we have seen over the past week or so were to morph into a total risk-off event, this would no doubt be bullish for the dollar given its flight to safety characteristics. Such an outcome would have implications for equities, gold and the precious metals market, as well as Bitcoin., As the institutions are required to meet their margins calls during a risk-off period, selling becomes indiscriminate.

As such, I will be watching the dollar closely over the coming days and weeks, and if were to see the price action of the dollar, euro and yen confirm this thesis, I will likely look to add a small allocation to the dollar index to act as a hedge against my open positions.